- Over the past 24 hours, the market recorded its largest sell-off in a single day, with traders experiencing major setbacks.

- ETH and DOGE holders were among the hardest hit as prices fell during the sell-off.

The global cryptocurrency market capitalization fell by 4.11%, falling to $3.47 trillion. However, trading volume increased by 114.40%, reaching $352.9 billion, as investors reacted to the volatility.

Market analysts note that the long-awaited rally in altcoins may face delays, given the current change in sentiment and uncertain market conditions.

Market sweep: $1.71 billion settled

The latest cryptocurrency market slowdown has led to unprecedented losses, leaving traders in chaos.

Insights from Coinglass reveal that the past 24 hours marked the highest single-period liquidation and the highest number of traders affected since the start of the current market cycle.

Coinglass reported:

“In the last 24 hours, 569,214 traders were liquidated, with total liquidations reaching $1.71 billion.”

Source: X

This aggressive market reaction indicates a potential for continued declines, especially among altcoins. Widespread panic selling has eroded market confidence as traders rush to preserve profits amid rising volatility.

Analysts warn that altcoins may take time to regain momentum as sentiment indicates the market is not yet ready for a recovery.

Altcoins Weaken as Bitcoin Dominance Increases

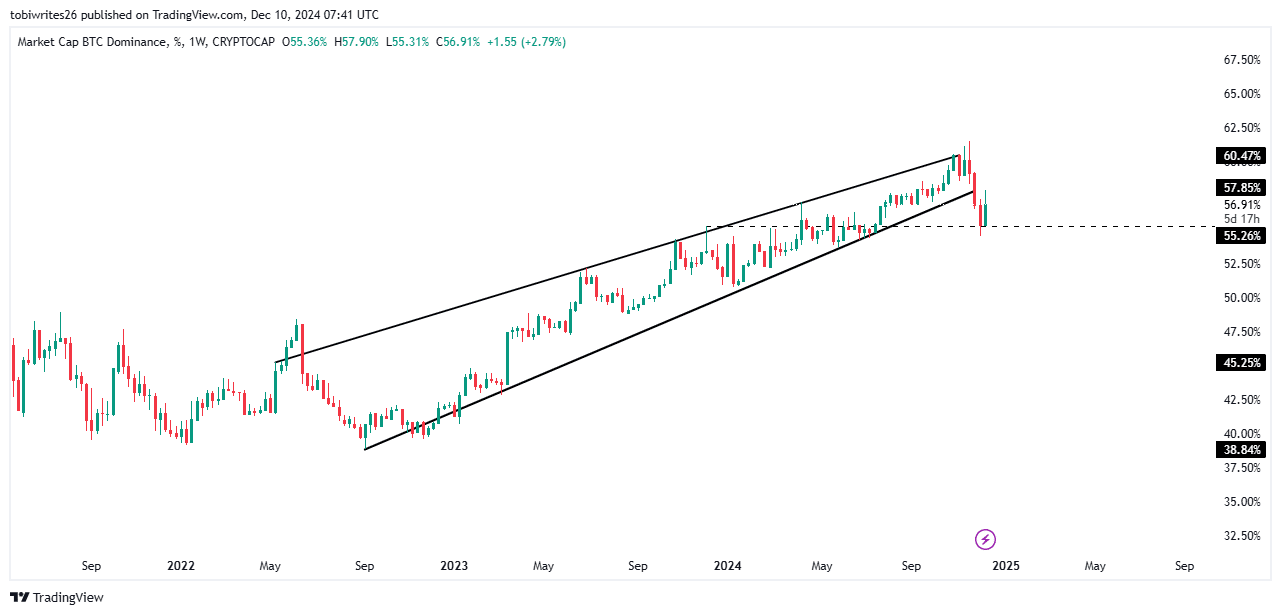

bitcoin [BTC] Dominance (BTC.D) has increased in the last 24 hours, reaching a high of 57.90%, up from 56.86%. This rise reflects a change in market dynamics, with Bitcoin exerting greater control over the cryptocurrency market.

The rise in Bitcoin dominance was sparked by a bounce from the 55.26% support level, which held firm and acted as a catalyst for Bitcoin’s renewed strength.

Source: TradingView

Typically, a drop in BTC.D indicates strength in altcoins, which often leads to rallies. In contrast, a rising dominance chart indicates capital returning to Bitcoin, leaving altcoins struggling to maintain momentum.

If Bitcoin dominance continues its upward trend, altcoins are likely to face further losses, widening the current bearish outlook.

ETH and DOGE lead with $350 million liquidated

Ethereum [ETH] and dogecoin [DOGE] It bore the brunt of the recent market decline, posting the largest liquidation losses among altcoins, according to data from Coinglass.

Combined, the two assets saw $350.56 million disappear, of which ETH accounted for $249.48 million and DOGE contributed $101.08 million. These liquidations occurred when the market moved sharply against traders’ expectations, forcing positions to be closed.

Read Dogecoin [DOGE] Price prediction 2024-2025

Long traders were hit the hardest, losing $213.28 million in ETH and $83.13 million in DOGE. This highlights a market heavily skewed in favor of bearish sentiment.

A possible recovery would require renewed demand for these assets, possibly driven by large investors (whales) taking advantage of the opportunity to accumulate at lower prices. If such activity materializes, a rebound could occur sooner than expected.

Fountain: