- Shiba Inu consumption rate plummeted amid price fights.

- Whale transactions continued to influence SHIB price, adding to both volatility and liquidity concerns.

shiba inu [SHIB] has seen fluctuations in its burn rate recently, with a dramatic 90.69% drop in burns in the last 24 hours.

While token burning is a deflationary mechanism designed to reduce supply and increase scarcity, the impact on SHIB price has been limited so far.

As we approach 2025, many are wondering whether flaring efforts, combined with whale activity, can generate long-term value or whether broader market conditions will continue to overshadow these efforts.

Understanding Burn Rate and Recent SHIB Price Movement

For context, burn rate refers to the rate at which tokens are permanently removed from circulation, reducing the overall supply. In theory, this mechanism increases demand. However, recent data has raised concerns.

In the last 24 hours, 506,465 SHIB tokens were burned, reflecting a sharp drop of 90.69% from previous levels.

This significant drop suggested a sudden slowdown in burn activity, especially with the massive 578% increase just 10 hours earlier.

Despite this, weekly burns presented a different story, showing a modest 4.5% increase with 65.19 million SHIB tokens burned over the past week.

This indicated that community efforts to reduce supply remain active, even though the short-term flaring rate has decreased.

Price action and market sentiment.

Meanwhile, on the price front, SHIB has struggled to maintain its November highs. At press time, the memecoin was trading at $0.00002167.

Despite a slight rally of 1.69% over the past day, the overall market sentiment remained subdued. The token’s RSI decline indicated bearish momentum.

Furthermore, the OBV showed stagnant demand, while reduced trade volumes indicated a decline in retail participation.

Source: TradingView

Shiba Inu whale activity

Here it is worth noting that whale transactions have been instrumental in shaping Shiba Inu market activity.

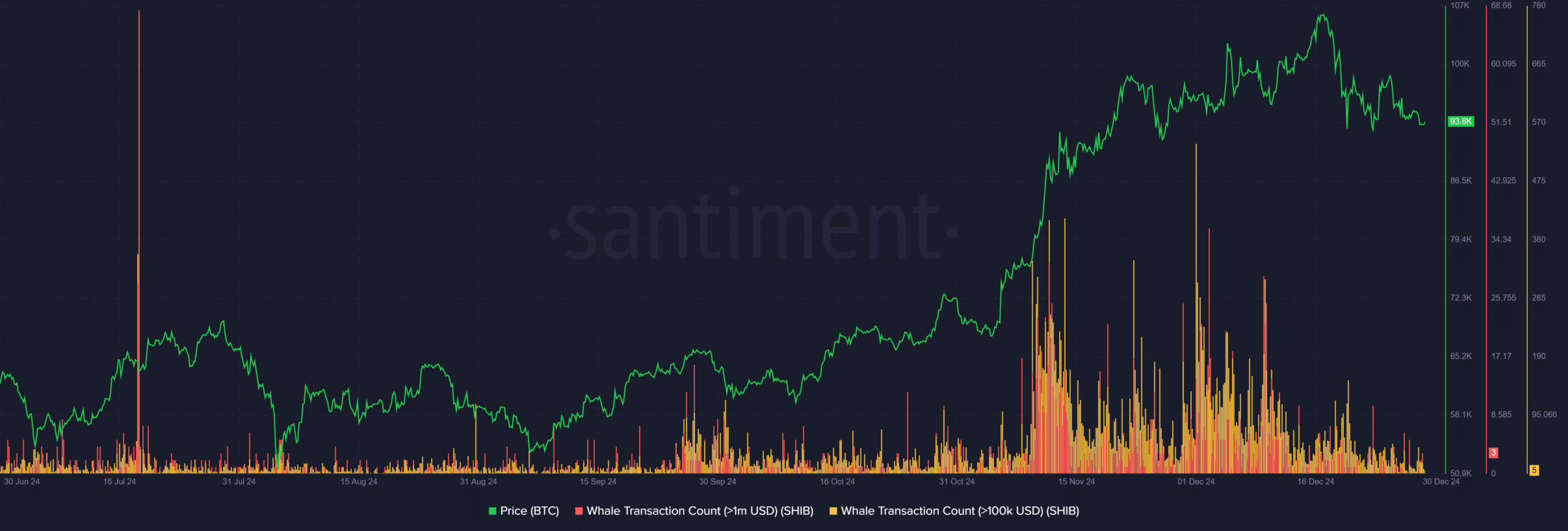

AMBCrypto’s analysis of Santiment data revealed a notable increase in whale activity during key price rallies in October and November 2024. This suggested a direct correlation between high-volume transactions and SHIB momentum.

Source: Sentiment

Interestingly, the latest data showed that whale transactions remained elevated. Counts stabilized at about 93.8K for transactions over $100K, highlighting sustained interest from deep-pocketed investors.

This increased activity bolsters liquidity but also adds volatility, as significant sell-offs could slow price recovery efforts.

When combined with burn rate mechanics, whale activity works as a double-edged sword: intensifying speculative price increases and exacerbating corrections.

This dynamic remains critical to SHIB’s near-term trajectory heading into 2025.

Despite this intense activity, neither whale trading nor flaring initiatives have led to substantial price rallies. Because? Because macroeconomic uncertainty continues to weigh on investor sentiment.

SHIB’s reliance on burns and whale-driven liquidity, without the foundation of broader utility, limits its upside potential.

Read Shiba Inu [SHIB] Price prediction 2025-2026

Looking ahead to 2025, the token’s trajectory continues to be influenced by this dynamic.

For SHIB to reverse its bearish trend and foster sustainable growth over the next year, network development and greater adoption will be critical.

Fountain: