Last night, President Trump signed the “digital assets” executive order (EO), and let’s just say bitcoiners are feeling… sour. Initially, rumors made a spin that this could be the long-awaited Bitcoin Reserve (SBR) strategic legislation. But no, not even close. Bitcoin Reserve did not receive a single mention.

Instead, the EO said:

“The task force will evaluate the potential creation and maintenance of a national reserve of digital assets and propose criteria for establishing such a reserve, potentially derived from cryptocurrencies lawfully seized by the federal government through its law enforcement efforts.”

Translation: This EO seems like a vague “Let’s study Shitcoins” roadmap rather than a bold step toward a strategic bitcoin reserve. If you were hoping for an orange pill moment from the state of the nation, this isn’t it.

But before you go to the tweet, take a deep breath. There is a positive side. The EO bans CBDCs, a big victory for Freedom Money and a more aligned future for Bitcoin.

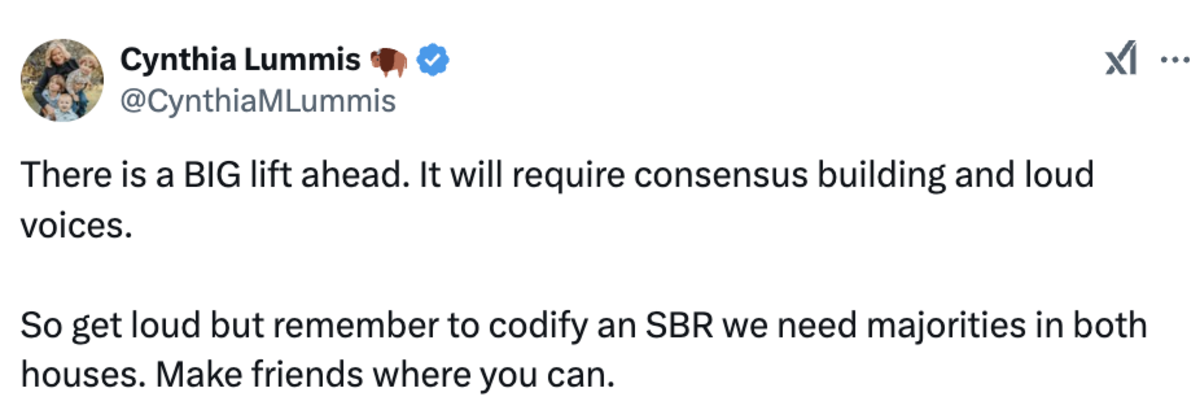

And, as Senator Cynthia Lummis reminded us yesterday, her strategic bitcoin reserve bill is “a big elevator“:

Why is this good news? Let’s break it down:

- Executive orders are fragile: EOS is implemented quickly, but can easily be reversed by the next administration. They are political post-it notes, not permanent solutions.

- Legislation is durable: Laws passed by both houses of Congress are much more difficult to repeal. Lummis’ long-term strategy aims to cement Bitcoin’s role in the American economy for generations, not just in the next election cycle. She’s taking the low time preference route, and I salute her for that.

Senator Lummis said it herself in an X DM, she allowed me to share:

“Even if the EO had been a strategic reserve of Bitcoin, the next administration (after Trump) could undo it (what is done administratively can usually be undone administratively). So, to get the minimum 20-year HODL, which my project law requires, and significantly the US debt, we have to go through the legislative process (go through the House and Senate) to get it to the president’s desk for signature.

It’s really important that we have momentum for a marathon, not a sprint. I don’t want people to get discouraged. The trajectory is to the moon, but we have to continue with it and work on the process. A lot to do, but the EO was a great starting point to get us there.”

So, yes, the EO feels like a quick win for crypto executives eager to pump their purses. But the real fight for the future of Bitcoin is just beginning.

An SBR passed by Congress is better than an SBR through executive order. From the end!

Bitcoin has always thrived in adversity. Whether it’s bans, restrictions, or now the “national digital asset existence” nonsense, Bitcoin’s resilience is unmatched. As Senator Lummis works to push the strategic bitcoin reserve bill through Congress, individual states are already leading the charge. States introduce bitcoin-specific reserve legislation, not vague “digital asset” plans.

Meanwhile, Global Momentum is building. Putin didn’t say: “No one can control digital assets,” he said: “No one can control Bitcoin”. Nation states are not about to fomo on $Trump or Fartcoin. They are looking, learning and getting closer to Bitcoin.

Bitcoin wins because it is superior money. Every piece of news, even setbacks, is ultimately bullish for Bitcoin because it exposes the weaknesses in Fiat and strengthens the Bitcoin narrative. So stay patient. The slow burn will be worth it.

See you in Las Vegas, and remember: the best money wins.

This article is a Carry. The opinions expressed are entirely those of the author and do not necessarily reflect those of BTC Inc or Bitcoin magazine.