The data in the chain show that a large part of the CAP made XRP is in the hands of the investors who entered during the last six months. This is what this could mean for the asset.

XRP investors under six months have significantly increased CAP participation

In a new one mail In X, the Glassnode chain analysis firm has discussed how XRP’s limit has recently changed. The “limit made” here refers to an indicator that, in summary, it monitors the total amount of capital that the holders of the asset as a whole have invested in it.

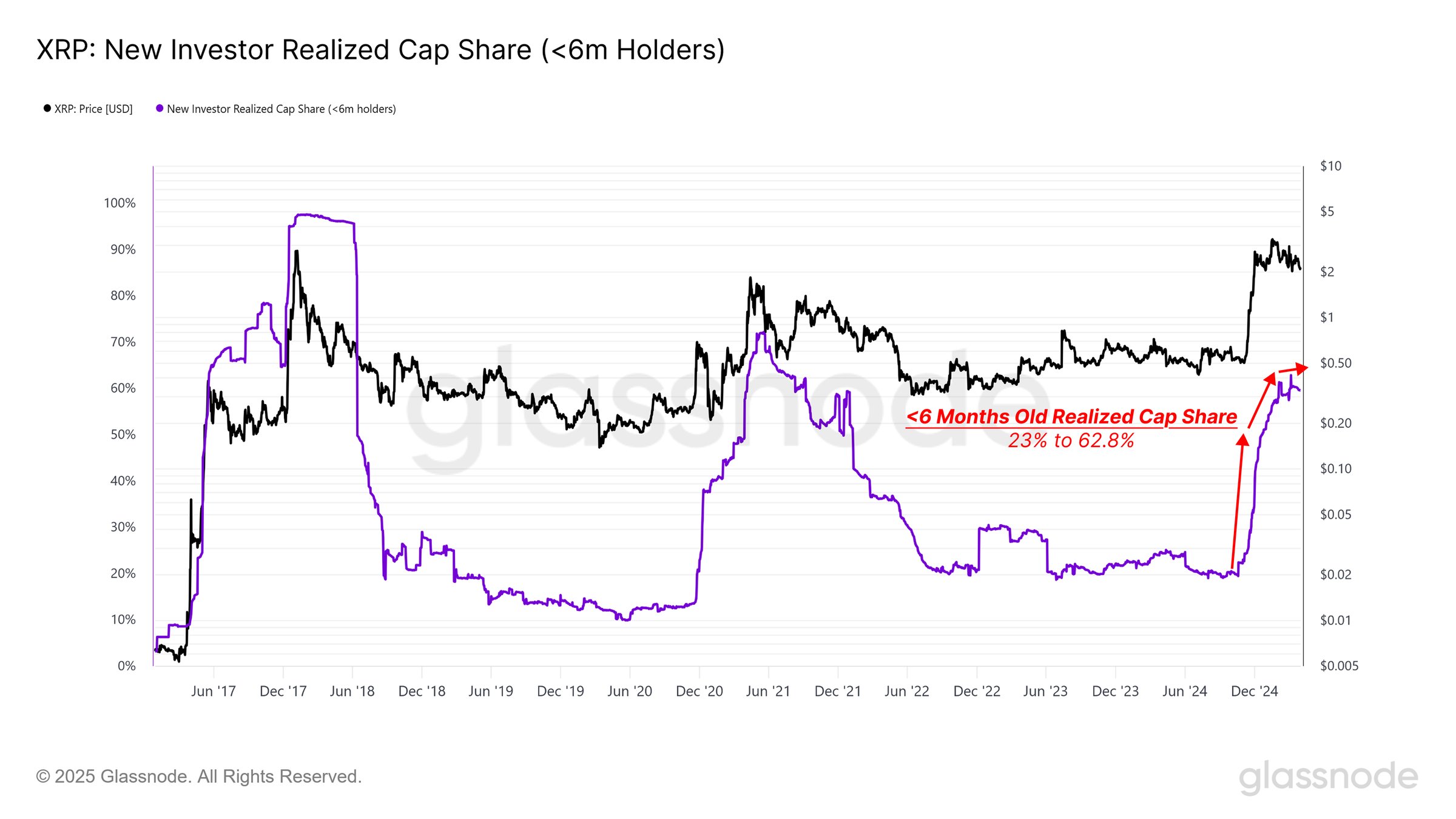

The changes in this metric, therefore, correspond to inputs and exits that the cryptocurrency is observing. Below is the shared table by the analysis firm that shows the trend in the limit made for XRP in recent years.

As shown in the previous graph, the XRP made the CAP has shot in recent months, which implies that a large amount of capital has flipped to cryptocurrency. More specifically, the asset has seen the metric duplicate from around $ 30.1 billion to $ 64.2 billion.

In the same graph, Glassnode has also connected the indicator data of the age groups of young investors. It seems that the capital held by cohorts as 1 month to 3 months and from 3 months to 6 months has recently fired, which makes sense taking into account the growth in the limit made added during these windows.

According to the analysis firm, this short -term capital peak is a sign of impulse led by retail trade. However, the impulse seems to have cooled, since the metric has not been growing so well recently.

A consequence of all fresh capital tickets is that XRP has seen a shake in the domain of investors. As another table shared by Glassnode, the new investors, which comprise all age bands under 6 months, have witnessed their exploration of the participation in the limit made.

Before the new entries, this cohort controlled only 23% of the cryptocurrency limit, but today that value has grown to 62.8%. This means that 62.8% of the entire capital invested in the currency has reached the price levels of the last six months.

Since XRP is currently quoted under the prices that have been in most of this window, many of these headlines would be underwater. “This rapid concentration in the new headlines reflects a strong retail participation, but also increases the risk of fragility, since many have high cost bases,” says the analysis firm.

From the table, it is evident that these are the same conditions that led to a Top during the last two upward markets. With decreased tickets as the price decreases, it is possible that the same pattern is forming once again for XRP.

XRP price

With a fall of more than 8% in the last 24 hours, XRP has survived its last recovery, since its price has returned to $ 1.78.