Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

Ethereum (ETH) has recovered 10% in the last 24 hours, driven by the 90 -day break of the US administration on commercial tariffs for more than 75 nations. The second largest cryptography for market capitalization is now aimed at the resistance of $ 1,800 as the next key level to claim for a continuation of rally.

Related reading

Ethereum jumps at $ 1,600

The price of Ethereum reached a minimum of 2 years of $ 1,385 during this week’s correction, feeding a bassist feeling among many investors. The cryptocurrency lost the lower area of its macro range of $ 2,100- $ 3,900 on March 9 and has turned over 16% in the last month.

Since then, Ethereum looked at a new test of the historical demand areas, falling below the $ 1,640 area to reach this week’s minimum. As a result, many analysts have noticed that ETH bleeding may not have finished, and a new test rank of $ 1,000-1,200 pricing is likely if the king of Altcoins does not claim the key levels.

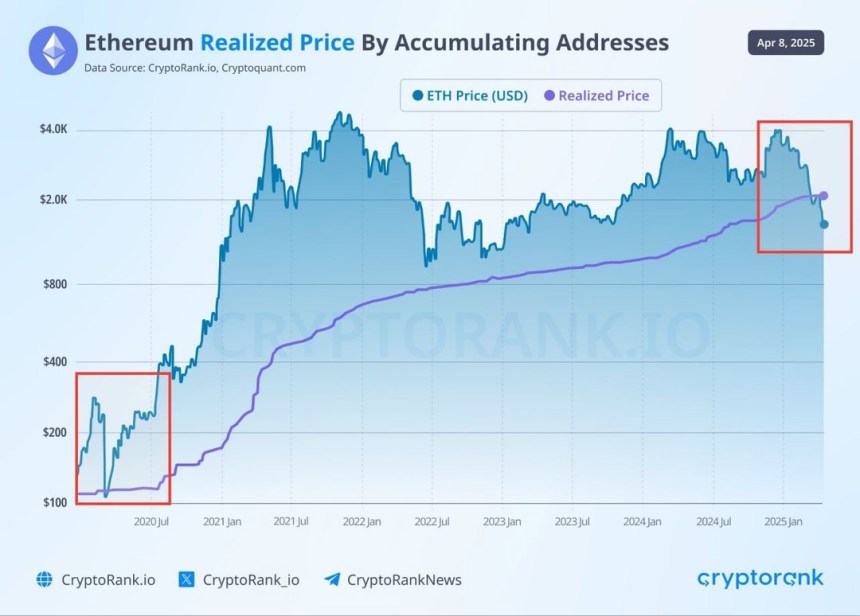

Amid its recent performance, ETH fell below its price made by accumulating a $ 2,000 address, which some market observers consider a possible background signal.

According to the Crypto Rank research and analysis platform, the last time Ethereum fell below this level was in March 2020, when the price fell from $ 283 to $ 109 before recovering significantly in the coming months.

In particular, the 90 -day pause of the president of the United States, Donald Trump, on rates for multiple nations, except China, saw the cryptographic market and the actions shoot, with Ethereum recovering 10% in one hour.

Is it a break in the horizon?

Crypto Titan Analyst noted That Ethereum could be on the verge of a return based on the ETH/BTC trade pair. In the ETH/BTC graph, the “RSI shows a family pattern. One that previously pointed out a potential change at the time.”

In particular, the several -year table shows that the couple tested the trend line three times before the impulse changed and the ETH price increased towards its AT 2021. Similarly, the torque has tested the line of trend three times since 2022, which suggests that cryptocurrency could go to a return.

Analyst Crypto Bullet considers a weekly closure above $ 1,550, a key level of historical support, necessary for the ETH uphill impulse. Meanwhile, the pseudonym Trader Lluciano said that Ethereum “is showing signs of a break after keeping strong in key support.”

Related reading

Yesterday, ETH, which was testing again the levels of historical maximum (AH) 2018, increased from $ 1,480 to $ 1,600, near the $ 1,700 resistance before stabilizing between the price range of $ 1,580- $ 1,640.

He pointed Over that “the market could be ready for a bull reversal,” since the cryptocurrency has formed a wedge pattern that falls. According to the publication, if ETH breaks above the higher trend line of the pattern, in around the $ 1,840 brand, ETH could see “significant profits” and meet at higher levels.

At the time of writing this article, Ethereum lies at $ 1,566, an 11% decrease in the weekly term.

Prominent image of Unspash.com, TrainingView.com box