Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

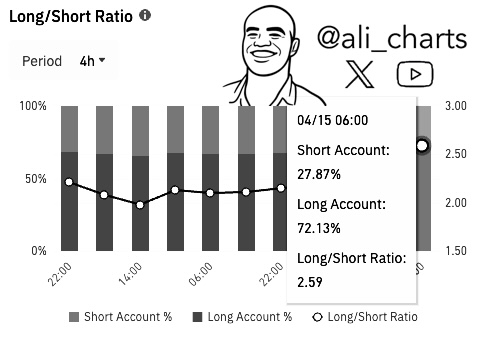

A new snapshot of Binance futures market shows that Dogecoin attracts a remarkably bullish posture among merchants. According to a table shared by Ali Martínez (@ali_charts) in X, 72.13% of Binance users with open positions of Dogecoin are currently long, leaving only 27.87% on the short side. “72.13% of merchants in Binance with open positions of Dogecoin Doge are currently long!” Martínez wrote, underlining how biased it is the feeling towards an ascending price movement.

What does this mean to Dogecoin Price?

What does such a strong majority of the long ones mean to Dogecoin’s perspective? In many cases, a pronounced imbalance such as this suggests that the majority of market participants expect the price to continue rising, at least in the short term. When so many merchants bet on profits, it often reflects optimism, or even emotion, about the impulse of the file. Dogecoin has repeatedly demonstrated his ability to inspire fervor between retail investors and great speculators equally, so the peaks of bullish interest are not surprising.

Related reading

This type of data can be interpreted as a potential sign of force for Dogecoin. If the market aligns behind an upward narrative, the continuous purchase pressure can materialize and prices can increase. However, it is not always so simple. When a large part of the market leans to the side, it increases the risk that a sudden fall triggers a wave of forced liquidations between those long positions. If the broader cryptographic market, or if Dogecoin faces unexpected obstacles, traders who jumped to wait for a quick gain could end up running for the outputs, amplifying the movements down.

Even so, the figure “72.13%” is unequivocally high, which is enough to get the attention of anyone. A long/short relationship that Elevated does not guarantee a continuous rally; Instead, it paints an image of the current feeling between a specific subset of merchants. It is a snapshot over time, extracted from the activity of one of the most busy cryptographic exchanges in the world. Even so, it is a solid reminder that, at this time, a large number of Dogecoin merchants in Binance believe that the lower resistance path is upward.

Related reading

Of course, market conditions can change rapidly. Some merchants will closely monitor the general liquidity, Bitcoin’s behavior and any tariff news of the president of the United States, Donald Trump. Dogecoin is known by the abrupt price over -the -ups, stimulated by the buzzing of social networks or endorsements of influential figures, so even the data as decisive as this long/short relationship does not completely predict what comes next. But it gives us an internal vision of how Binance participants are positioning themselves and, in doing so, prepares the stage for the short -term intrigue of Dogecoin.

For now, the great domain of long positions seems to say: merchants remain optimistic and are willing to support that feeling with open contracts. It could be a sign of confidence in Dogecoin resilience, or it could be a configuration for unexpected volatility if the feeling turns. In any way that develops, Martínez’s list sheds a light on how the enthusiasm for this asset inspired by the Meme continues to rise in certain corners of the cryptography market.

At the time of the publication, Dogecoin was quoted just below his trend line of several years, after a rejection of the Fibonacci recoil level of 0.786 around $ 0.167. A renewed fall to the red support zone about $ 0.14 could be on the table if Doge closes below the trend line. On the other hand, the FIB 0.786 remains the most critical resistance level, followed by a potential channel test about $ 0.18.

Outstanding image created with Dall.E, Record of TrainingView.com