Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

Bitcoin has increased dramatically in the last 10 years against gold, with an increase of an incredible 13,693%, according to financial statistics shared by the Crypto businessman TED.

The figures demonstrate the alarming divergence between the two assets of April 2015 and April 2025. In particular, this surprising rise of Bitcoin He has drawn the attention of extended investors throughout the world.

Related reading

Bitcoin vs. Gold: Equal conditions to a massive gap

Ten years ago, Gold and Bitcoin were at similar prices. In April 2015, Bitcoin moved between $ 200 and $ 250, while gold It was varied around $ 1,200 to $ 1,300 per ounce.

The fortune of these investments has become totally different. Bitcoin has triggered around $ 84,000 per currency, an increase of 33,500% in the ten -year period. The cryptocurrency briefly reached almost $ 109,000 during the deadline.

If someone tries to tell him that gold is better than Bitcoin …

Just show them this:

In 2015, 1 BTC = 1 ounce of gold.

Today? That same Bitcoin has increased by 13,693% in 10 years.

Let the numbers speak. pic.twitter.com/8jiph5isnr

– Ted (@Tedpillows) April 17, 2025

Gold, on the other hand, has preserved its image of reliability on volatility, instead of offering spectacular profits. The precious metal increased by only 156% during the same period. From the market spectators, the value of Gold’s proposal is still anchored in his behavior consisting of inflation proof that covers the very long time scales.

Historical context demonstrates divergent growth patterns

Returning even further shows greater disparity in growth rates. According to a market analyst on the social media platform X, the price of gold was only $ 20.67 per ounce in 1933. As for 2025, the price has increased a bit to around $ 3,330 per ounce, which is in fact a strong increase but a gradual increase for a period of almost a century.

Ted's analysis on X.

Bitcoin has had a completely different story. From a price of $ 1 in 2011, it reached $ 84,000 by 2025. With such rapid appreciation rates, financial analysts who discuss both the value of such growth have generated emotion and skepticism.

Pure disparity in size

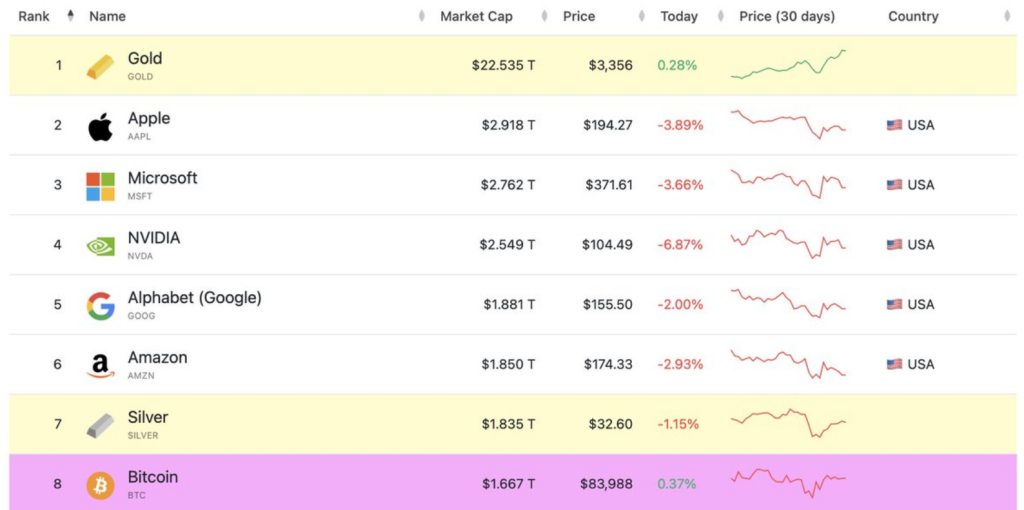

According to analyst Belle, a marked contrast in behavior is due to the big difference in the size of his market. Gold has approximately a market capitalization of just over $ 22 billion. Due to this large size, gold provides an element of stability, which makes the market less sensitive to individual transactions or short -term investment flows.

Gold added $ 1 billion to its market capitalization in one day.

That is almost all the value of #Bitcoin right now.This shows how massive the traditional markets are and how early we are with Bitcoin.

Even a small change in $ BTC I could send it flying. pic.twitter.com/ysjsgozkjx– Beautiful (@bitt_belle) April 17, 2025

Bitcoin Market capitalization It is at approximately $ 1,667 billion, in general but still only a golden fraction. This reduced size makes Bitcoin more sensitive to capital flows. Gold recently saw an impressive increase of $ 1 billion in market capitalization for a day, but this was a much lower percentage movement than the same dollar flow would trigger in the value of Bitcoin.

Related reading

Same dollar flow, different price impact

Meanwhile, mathematics in terms of market capitalization generate intriguing price movement scenarios. According to the informed calculations, if Bitcoin obtained an impulse of $ 1 billion in the market capitalization, comparable to the recent increase of one day in gold, its price per unit could increase from $ 84,000 to $ 135,000.

Outstanding image of the Ledn Blog, TrainingView Graphic