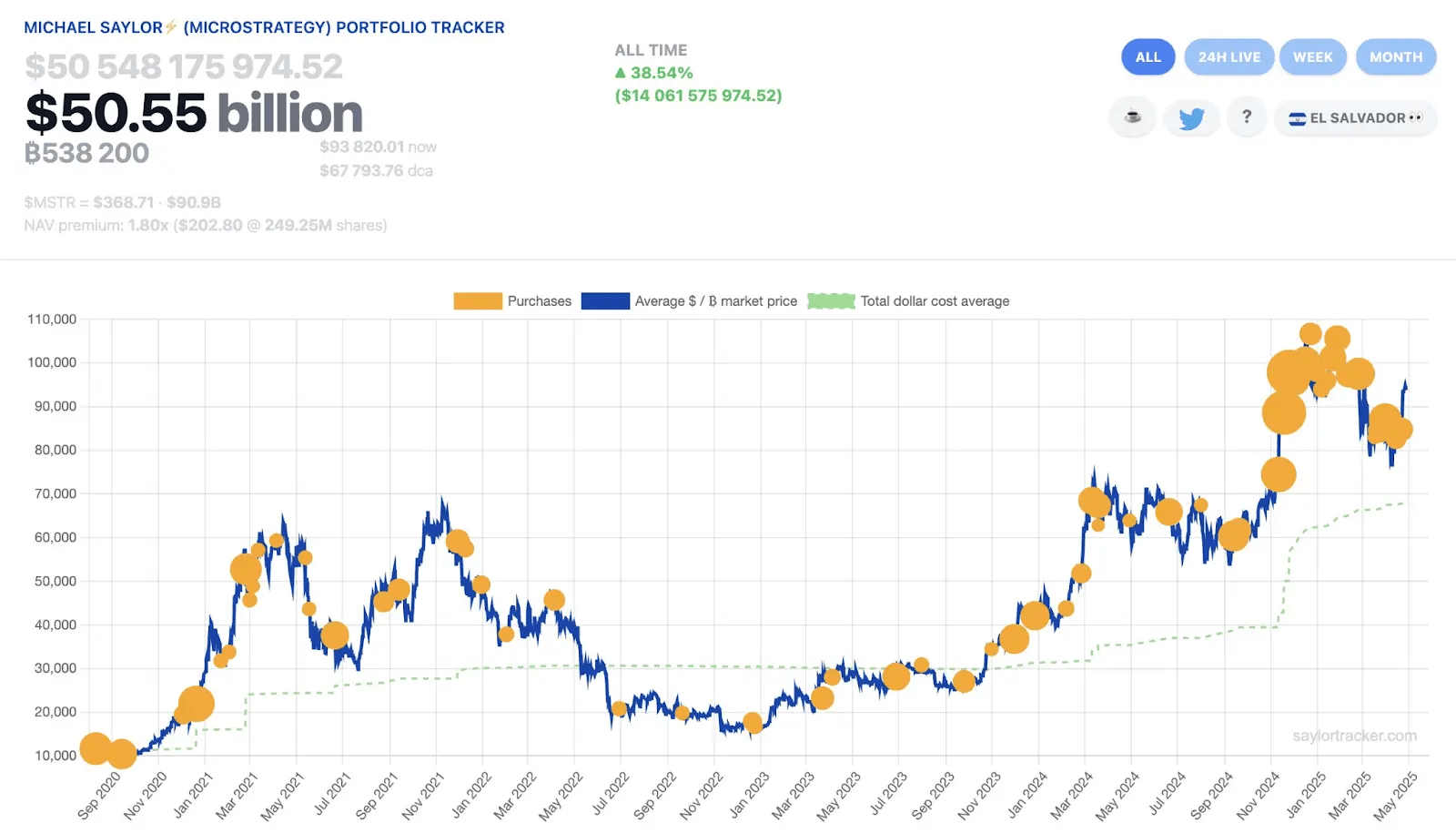

Executive President of the Strategy, Michael SaylorHe hinted at another Bitcoin shopping round by the company, which has become a reality.

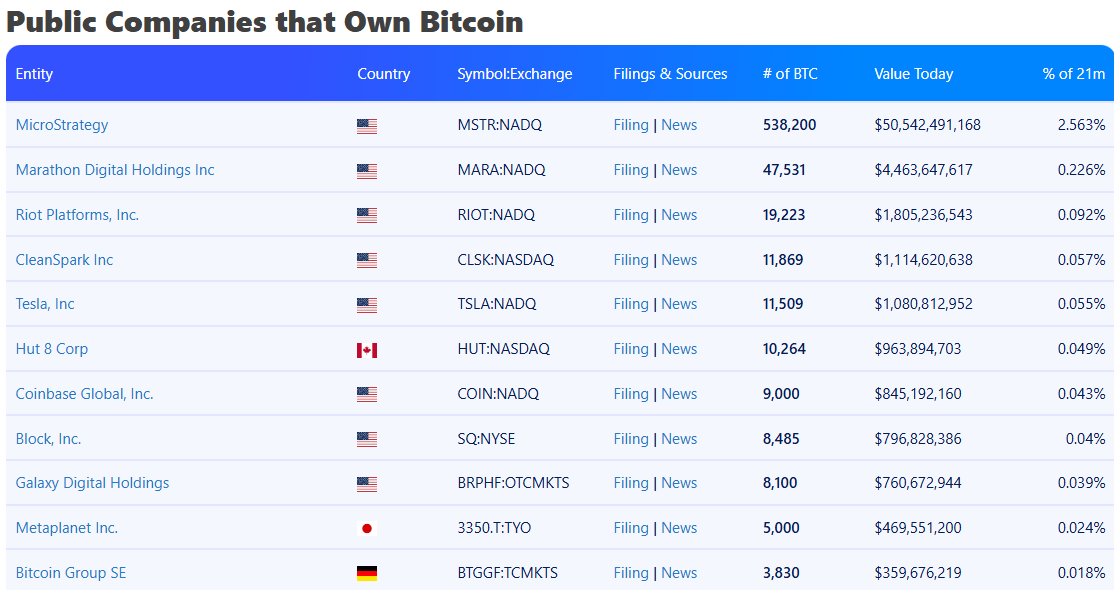

In general, Strategy It is the largest institutional holder of the leading cryptocurrency. Saylor’s track was very timely, since the main players are actively buying Bitcoin, further reducing the available currency supply

How many BTC has bought the strategy?

Michael Saylor hinted at another purchase of Bitcoin on Sunday, April 27, a week after the company bought $ 555 million in BTC at an average price of $ 84,785 per currency. The purchase was completed later and announced In X by Saylor.

The strategy remains the world’s largest owner in Bitcoin in the world. Today, the giant announced the acquisition of additional 15,355 bitcoins worth $ 1.42 billion.

Therefore, the company has a total of 553,555 BTC, in which 37.89 billion were invested. It turns out that the average price of each purchased currency is $ 68,459.

This company’s investment philosophy has inspired other companies to adopt cryptography. In particular, the Japanese investment firm Metaplenet has already acquired a combined total of more than 5,000 BTC in an effort to become a leader in the promotion of Bitcoin in Asia.

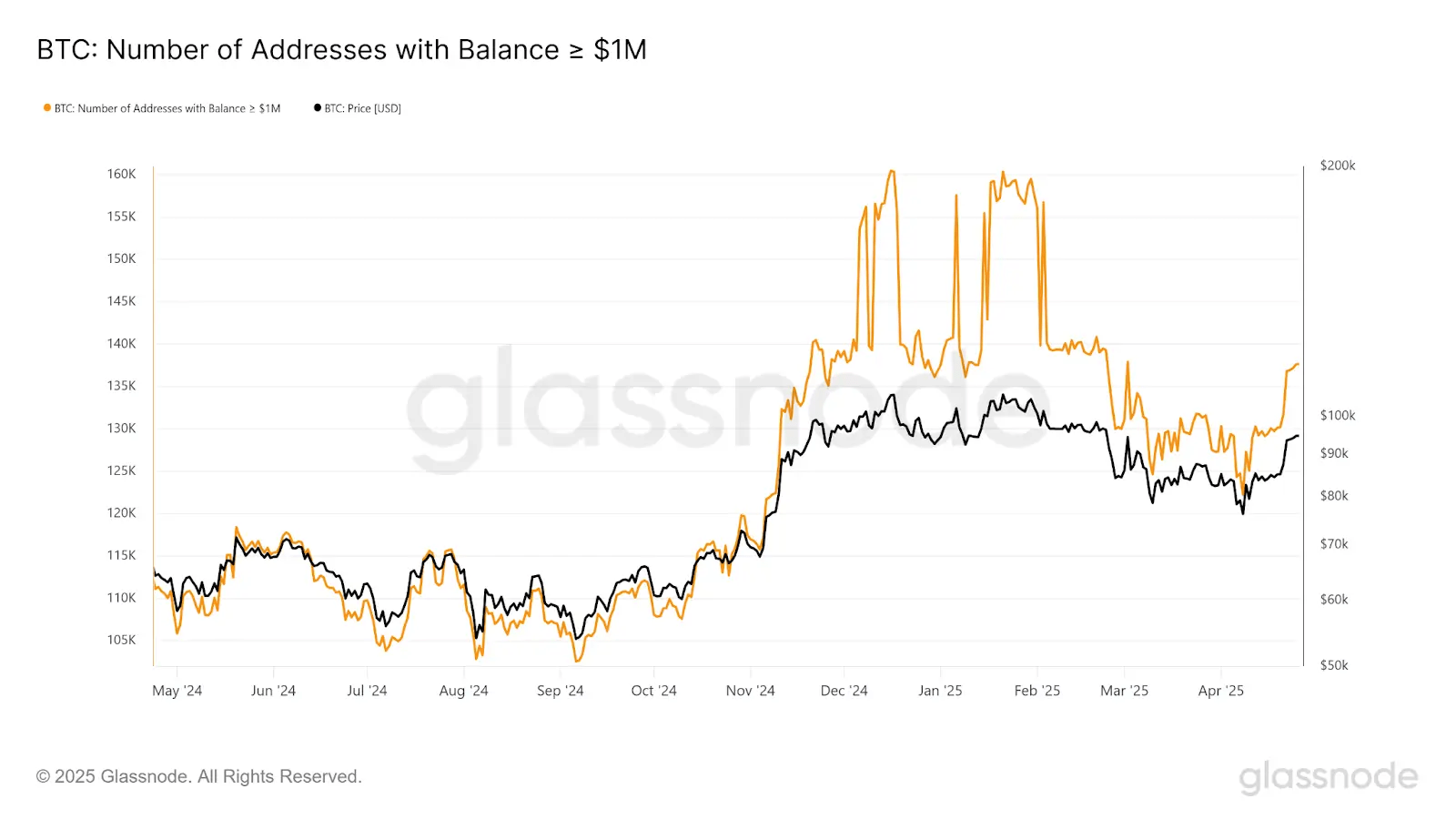

Large investors or so -called whales also continue to accumulate Bitcoin, while the main cryptocurrency is below the psychological brand of 100 thousand dollars.

Investor wallets, which have at least 1 million dollars in BTC, began actively recovering again from the beginning of April. During this period of time, its number grew from 124 thousand on April 7 to more than 137.6 thousand for April 26.

Beyond the acquisition of Bitcoins, the strategy is having a significant impact on the market, according to cryptographic analyst Adam Livingston. He pointed out that the company is “synthetically reducing the Bitcoin issuance” when buying half or more of the new supply of the miners every month.

The miners now extract around 450 BTC per day, or approximately 13,500 BTC per month, while the strategy has bought 395,155 BTC in the last six months. This is equivalent to buying more than 2,000 BTC per day, a figure that is much higher than the daily rate of new coins.

Here is an event of an analyst.

When Bitcoin becomes so scarce, accessing him will require paying a premium. Bitcoin loans will become more expensive. Bitcoin loans will become an elite business for states and corporate whales, and the strategy will control the sphere.

The Bitcoin supply shortage forecast suggests a sharp increase in BTC prices if the strategy can continue to increase its purchases amid the growing demand for digital asset among other large investors.

However, the strategy actions have their critics. They warn that the BuC Buy -based debt strategy could lead to the giant to the financial collapse in case of a prolonged bearish tendency in cryptography. It also increases systemic risks for BTC due to the high concentration of coins in the hands of a single player.

How does cryptography help you make money?

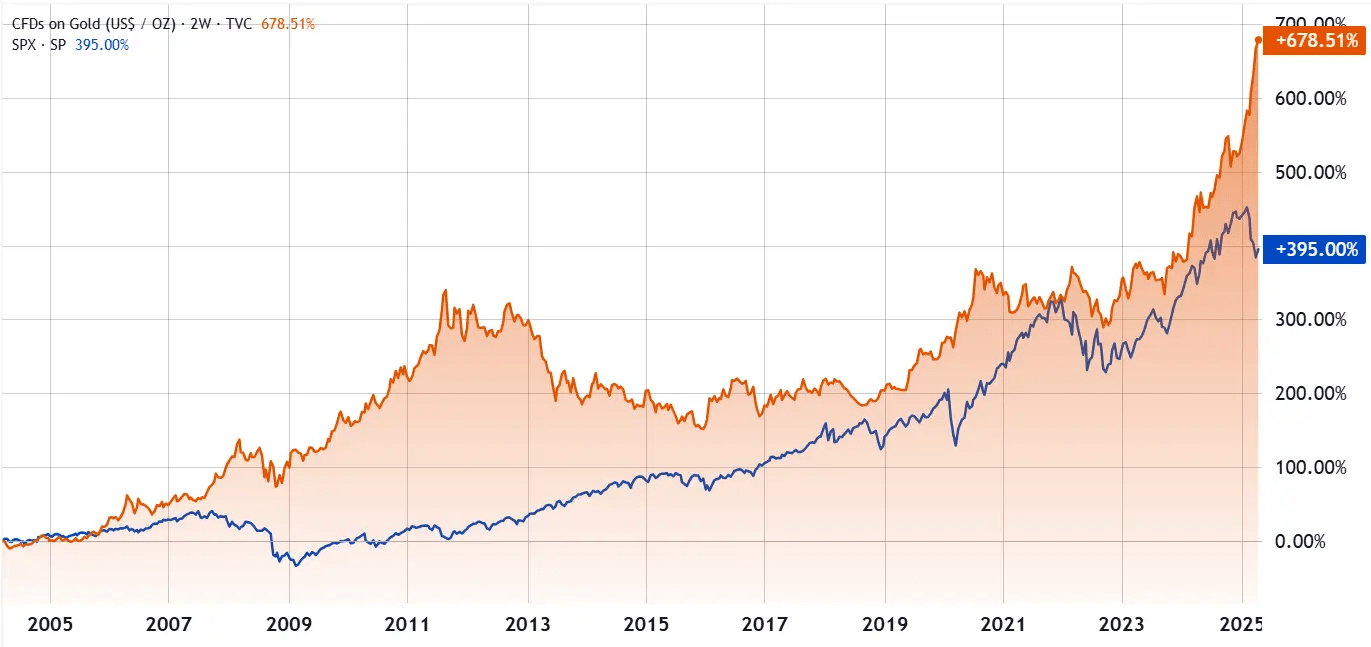

Meanwhile, the Central Bank of Norway (Norges Bank), which manages the sovereign fund of $ 1.7 billion from the country, reported a loss of $ 40 billion for the first quarter of 2025.

The main reason for such results is the fall in the prices of the actions of the technology companies that quote in the United States.

At the end of 2024, Norges Bank also indirectly owned 3.821 BTC through its capital investments. This creates a possible sale pressure on Bitcoin, especially in a context of socio -political instability and the risk of economic recession due to a global commercial war.

There is the possibility, although it is unlikely, that in such a situation Norges Bank can increase investments in companies related to cryptography or buy cryptocurrency ETF shares. In addition to the actions and bonds, Norges Bank invests in real estate, including retail, industrial, renewable energy and logistics centers around the world.

As a reminder, Norway sold his entire golden reserve of the Central Bank in early 2004, when the price of gold was less than $ 400 per ounce. Since then, Gold has surpassed the S&P 500 shares index by 280 percent.

The shares currently represent 71.4 percent of the total investments of the Fund, so they are possible serious losses if the commercial war continues. Although so far everything goes for the fact that difficult import tariffs by the United States government will soften at least significantly.

Norges Bank’s investments generated $ 222 billion in earnings in 2024, and their sharing portfolio fell only 1.6 percent in the first quarter of 2025. According to CEO Nicolai Tangen, the Norwegian sovereign fund “mostly remains indexes”, specifically the FTSE Global All Cap FTSE index.

Although this index includes more than 7,100 shares of developed and emerging markets, it is based on market capitalization, leaving 65 percent of the portfolio in North American companies.

However, according to Vice President CEO of Norges Bank, Trond Grande, there is some space for active investment. Well, the proportion of technology companies that quote in the United States have been below the reference point during the last 18 months.

Technically, it is unlikely that Norges Bank can invest in ETF of Bitcoin Spot without changing the mandate of the background. However, the increase in investment in companies with large Bitcoin holdings seems possible.

The strategy of actively accumulating Bitcoin is to exacerbate the shortage of coins in the market and establish a new trend for institutional investors. The more BTC ends in the hands of corporate giants, the greater the potential value of the asset. And although such purchases increase the concentration of risk, simultaneously they bring the cryptographic market to a new stage of maturity: the era of real scarcity and premium demand.