Bitcoin is emerging in 2025, lighting speculation about a historical Bitcoin supercycle. After a volatile beginning of the year, the renewed impulse, the recovery of the feeling and the bullish metrics have analysts who ask: Are we at the cusp of a repetition of Bitcoin Bull Run 2017? This Bitcoin pricing analysis explores cycle comparisons, the behavior of investors and the trends of the long -term holder to assess the probability of an explosive phase in this cryptocurrency market cycle.

How the 2025 Bitcoin cycle is compared with past bulls

The last Bitcoin price increase has restoration expectations. According to him BTC growth from the low cycle Graphic, Bitcoin’s path is closely aligned with the 2016–2017 and 2020-2021 cycles, despite the challenges and macro reduction.

Historically, Bitcoin market cycles reach their maximum point in about 1,100 days of their minimums. Approximately 900 days after the current cycle, you can stay several hundred days for possible explosive growth in Bitcoin prices. But the behaviors of investors and market mechanics admit a 2025 Bitcoin Supercycle?

Bitcoin inverter behavior: Ecos of the 2017 Toro race

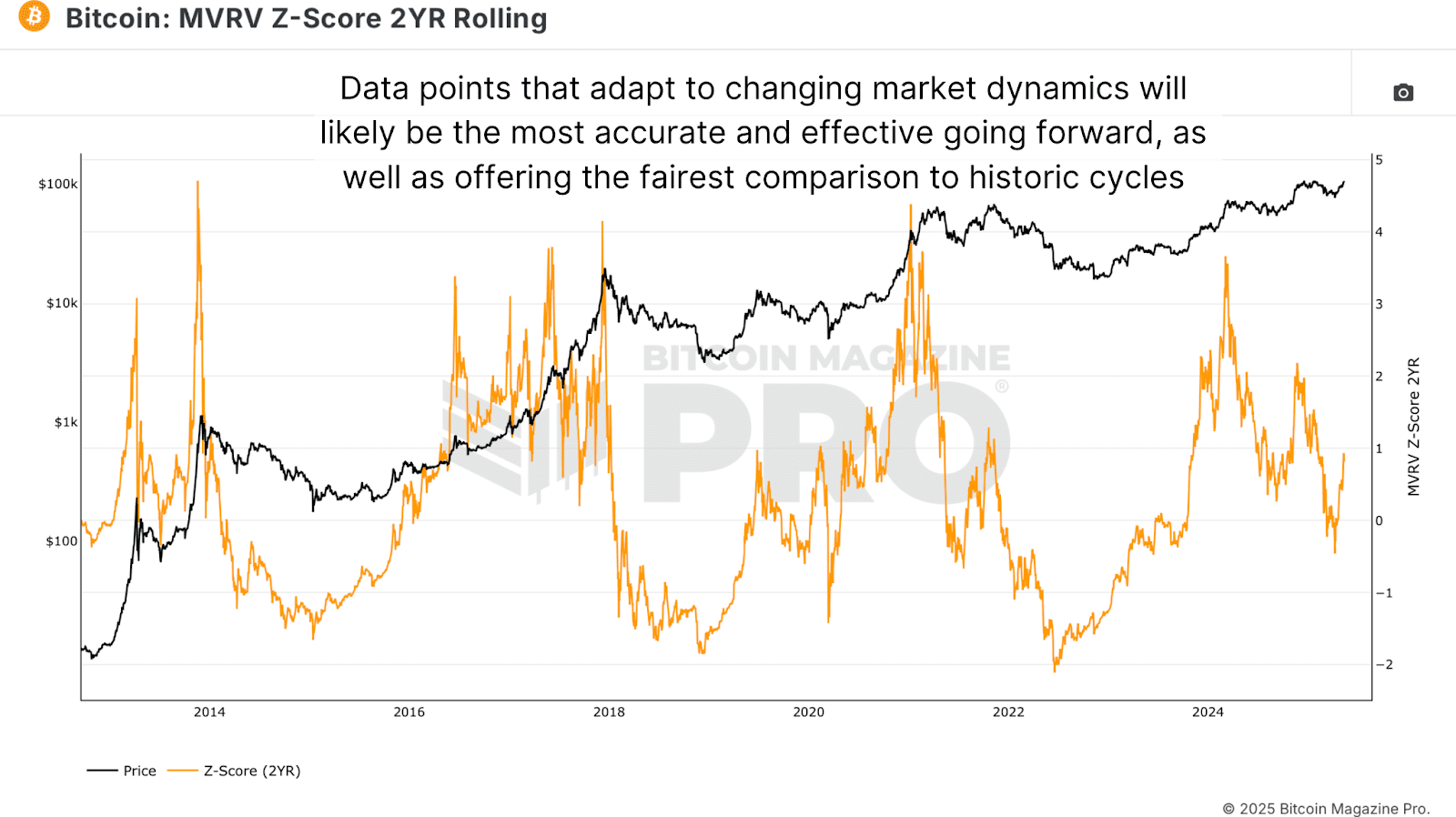

To measure the psychology of cryptocurrency investors, the 2-year score of Rolling MVRV-Z Provide critical ideas. This advanced metric explains the lost currencies, the illiquid supply, the growth of the ETF and the institutional holdings, and the change of long -term Bitcoin holders.

Last year, when Bitcoin Price reached ~ $ 73,000, the MVRV-Z score reached 3.39, a high level but not without precedents. The retractions followed, reflecting the consolidations of the middle of the cycle observed in 2017. In particular, the 2017 cycle presented multiple high score peaks before its last parabolic Rally of Bitcoin.

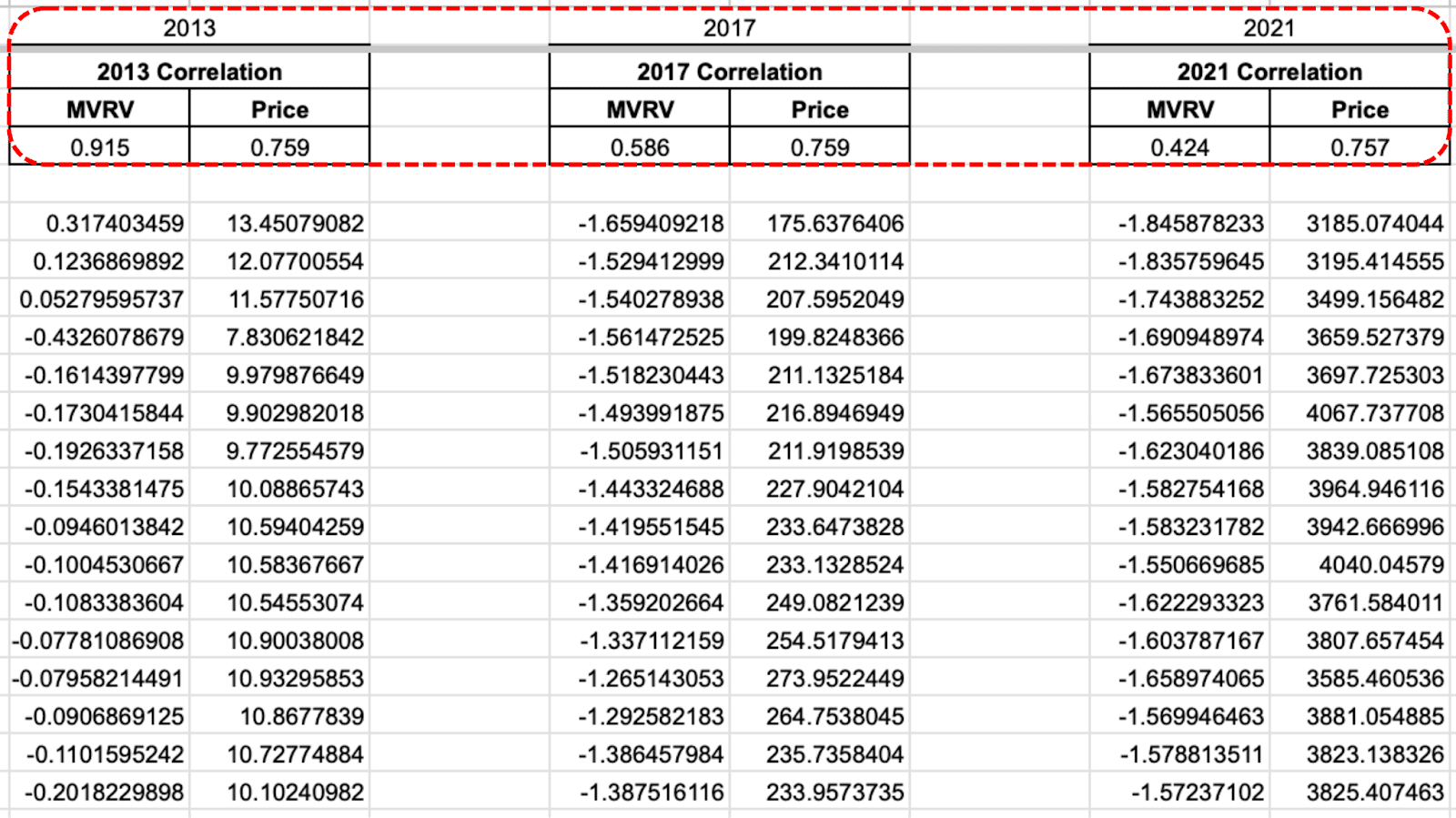

Using the Bitcoin Magazine Pro Api APIA cross-cycle Bitcoin analysis reveals a surprising behavioral correlation of 91.5% with the 2013 double peak cycle. With two main tops, one to pre-try ($ 74K) and another post-Ourves ($ 100K+), a third maximum of all time could mark the first triple peak of Bitcoin, a possible distinctive seal of a bitcoin superciclo.

The 2017 cycle shows a 58.6%behavioral correlation, while 2021 investors behavior is less similar, although its Bitcoin price action correlates at ~ 75%.

Long -term Bitcoin headlines indicate strong confidence

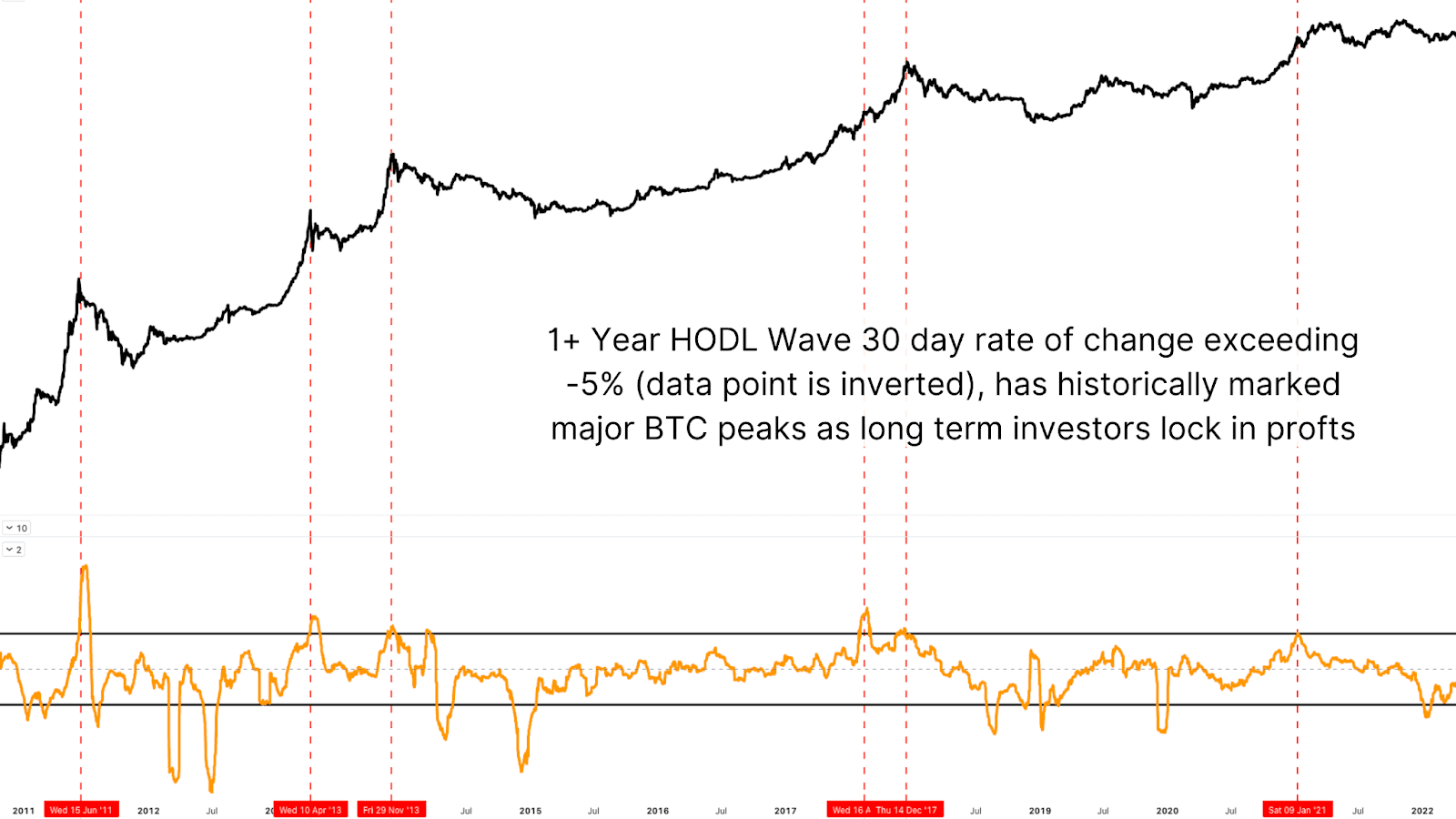

He 1+ years Hodl wave It shows that the percentage of motionless BTC for a year or more continues to increase, even as prices increase, a rare trend in the upward markets that reflects a strong conviction of long -term holders.

Historically, acute increase in the change rate of the HODL wave indicate the main funds, while the strong decreases in brands. Currently, the metric is at a neutral turning point, far from the maximum distribution, indicating that long -term Bitcoin investors expect significantly higher prices.

Bitcoin supercycle or more consolidation?

Could Bitcoin replicate the 2017 parabolic rally? It is possible, but this cycle can forge a unique path, combining historical patterns with the dynamics of the modern cryptocurrency market.

We can approach an important third peak within this cycle, first in the history of Bitcoin. If this triggers a complete melt of the Bitcoin superciclos remains uncertain, but the key metrics suggest that BTC is far from being finished. The offer is tight, the long -term holders remain firm, and the demand is increasing, driven by the growth of the stable, the institutional investment in Bitcoin and the ETF flows.

Conclusion: Is a $ 150K bitcoin rally in view?

Drawing direct parallels to 2017 or 2013 is tempting, but Bitcoin is no longer a marginal asset. As a positive and institutionalized market, its behavior evolves, but Bitcoin’s explosive growth potential persists.

The historical correlations of the Bitcoin cycle are still high, the behavior of investors is healthy and the technical indicators indicate that a space to work will be executed. Without important signs of capitulation, profits or macro exhaustion, the stage is established for the sustained expansion of Bitcoin prices. If this offers a rally or more than $ 150K, Bitcoin Bull 2025 career could be one for history books.

For deeper research, technical indicators, market alerts in real time and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Discharge of responsibility: This article is only for informative purposes and financial advice should not be considered. Always do your own research before making investment decisions.