Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

Although Price setback And the recent market volatility, a cryptographic analyst has predicted that Bitcoin (BTC) can still have space for another parabolic rally. The analyst cited historically reliable main indicators that suggest that the market has not yet reached its upper part, even when the parabolic signals fail to activate an increase.

Without a sign of the upper part of the bitcoin cycle, still

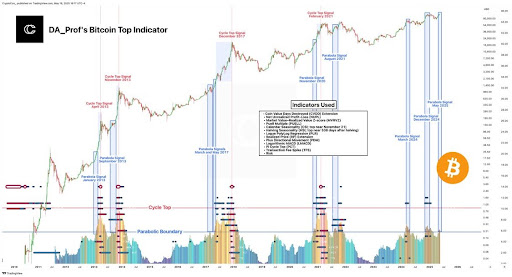

In a recent one mail In X (previously Twitter), the expert in the Crypto market with shared a comprehensive technical analysis rooted in the Bitcoin cycle indicators rather considered developed by DA_Prof. The accompanying table revealed that the current trajectory of the Bitcoin market has not yet reached the “Top cycle“Zone: a region that has constantly coincided with the main market peaks in the past.

Related reading

The technical indicator model of DA DA synthesizes ideas of thirteen market metrics in the chain and market. This multifactorial approach has successfully predicted the past cycles in 2013, 2017 and 2021, which makes it a valuable tool to potentially identify long -term market inflection points.

According to Crypto with, Current Bitcoin price action and technical readings suggest that the cryptocurrency may still be preparing for a Rally AH final. The analyst states that any potential cycle in 2025 will probably arise only when Bitcoin enters a critical area identified through the convergence of these thirteen advanced indicators.

The metrics used in the DA Prof indicator model include:

- Days of value of destroyed currencies (CVDD) extension

- Net depth of unrealized benefit (NUPL)

- Z-SCORE VALUE MARKET VALUE (MVRVZ)

- Seasonality of the calendar (CSI: above near November 21)

- Multiple Mull (Puelll)

- Reduction of seasonality in half (HSI: Top about 538 days after the event of half of half)

- Polyg Logue (PLR) regression

- Extension of the price made (RP)

- More directional movement (PDM)

- Logarithmic MacD (LMACD)

- Pi Cycle Top (PCT)

- Transaction rate spike (TFS)

- Risk

Crypto with pointed out that historically, when these indicators converged in the hot region, represented by the group of indicators in the lowest heat map section of the table, the price of Bitcoin experienced a dramatic peak followed by a significant accident.

However, in the current cycle, none of the DA PROF metric has entered the area. On the other hand, readings in the lower bands of the model remain relatively silenced, suggesting that the euphoria of the market has not yet reached ends of the last cycle.

Parable signs blink early, but there is no peak in sight

While the main Bitcoin indicators of Da Prof remain difficult, the parabola signals, another key characteristic of Crypto with, have not shown once but three times in this cycle. These signals are historically linked to the early stages of Bitcoin Explosive Price Rallies experienced during the previous Alcista markets.

Related reading

However, despite these alerts, Bitcoin has not been able to enter a true phase of parabolic rupture so far in 2025. Crypto with has indicated that the sign of the parable of May 2025 is especially notable, since the parabolic limit of the indicator coincides with the Bitcoin crossing.

This violation, paired with the absence of the PRI indicators, creates an unusual configuration. Emphasizing this anomaly, Crypto with raised a rhetorical question: “There is no superior cycle + parabola signal =?” “Insinuating that Bitcoin’s true clummax It can still be ahead.

Outstanding image of Adobe Stock, TrainingView.com box