Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

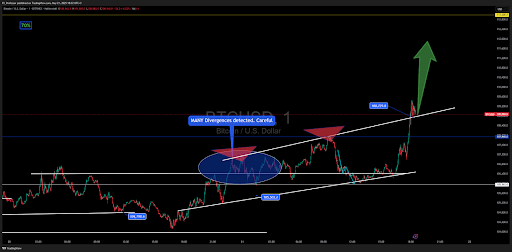

Bitcoin’s price action in the last 24 hours has been remarkable. After consolidating for several days in a hardening range, the market passed through the support zone of $ 105,503 converted into resistance to the beginning of the week and began an steep climb on the last negotiation day. This has allowed Bitcoin to push at new levels of all time, and shows no slowdown signs.

Interestingly, technical analysis shows that the rally appears An approach to a golden cross Among the mobile averages of 50 and 200 days, but FX_professor offered a different version of the very celebrated golden cross.

Analyst Golden Cross Hype Dispute as late signal

In a recent one Published analysis in TrainingViewFX_Professor discussed a different version of Golden Cross of Bitcoin. While most market commentators interpret this 50 -day simple mobile average crossing as a strong bullish confirmation, the analyst ruled out as a delayed indicator. The analyst described him as the back party where retail investors are late for the scene.

Related reading

Instead of waiting for gold Cruz A Flash GreenFX_Professor observed pre-indicator pressure zones as the real value signal. In the case of the action of the price of Bitcoin in recent months, the analyst indicated the region of $ 74,394 and $ 79,000 as the area of early accumulation and positioning, long before the Golden cross became visible. As such, by the time the cross appeared recently, Bitcoin’s price action had already increased significantly.

Operators often use the golden cross as a signal to enter a long position, since it suggests that the price of the asset is likely to continue increasing. However, this analysis follows a trend among experienced merchants who see the Golden Cross as a more delayed confirmation than a trigger for a rally.

The first entry and structure are more, the analyst says

According to FX_Professor, indicators such as EMA or SMA can be useful, but should never arrive before understanding the price structure, trend lines and real -time pressure areas. He shared a snapshot of his own Bitcoin pricing table that combines personalized EMA with a signature parallelogram method to detect where the price voltage begins to be built. Visible in the table inputs from April when Bitcoin bounced in the support of around $ 74,000long before the confirmation of the crossing.

Related reading

Now, with Bitcoin pushing Towards the following target zone Nearly $ 113,000, the analyst’s strategy continues to validate in real time. However, the confirmation of a Golden Cross remains optimistic for the action of Bitcoin’s price in the future, even if the price rally is already in the middle of its maximum level.

At the time of writing, Bitcoin is quoted at $ 110,734. This marks a slight setback from the new historical maximum of $ 111,544, which was recorded only three hours ago. Bitcoin’s price has still increased by 3.1% in the last 24 hours, and new maximums of all time before weekly closure are possible.

Getty Images’s prominent image, Record of TrainingView.com