This article is also available in Spanish.

After briefly retreating to $90,000 earlier in the week, Bitcoin has recovered strongly, surpassing the price of $95,000.

Bitcoin, currently trading at $95,224, has posted a 7% gain over the past two weeks, indicating renewed bullish momentum.

Related reading

Key indicators highlight the best buying opportunities

As Bitcoin continues its recovery, CryptoQuant, a prominent on-chain analytics platform, has shared perspectives into key metrics that could help potential investors determine optimal entry points.

Drawing on historical data and market behavior, CryptoQuant highlights patterns of price corrections, short-term holder strategies, speculative bets, and trading volume indicators to guide investors in navigating Bitcoin’s ongoing bull run.

According to CryptoQuant, historical bull markets have shown that price declines are inevitable, even during periods of sustained growth.

For example, the 2017 bull market saw corrections of up to 22%, while the 2021 rally saw declines of 10% and 30%. The 2024 bull run has already seen price pullbacks of 15% and 20%, suggesting that periodic corrections may offer strategic buying opportunities.

The platform also emphasizes the importance of the short-term holder realized price metric, which reflects the average cost basis of recent investors. This metric often serves as a critical support level during bull markets as short-term holders are more likely to buy at its equilibrium price, reinforcing price stability.

Buy at the average cost of short-term holders

The price realized by the short-term holder can be seen as the dip buy level during bull markets.

Investors tend to buy at their breakeven price, making this indicator a visualization of price support. pic.twitter.com/mTDpuhaK8Y

– CryptoQuant.com (@cryptoquant_com) November 27, 2024

Additionally, CryptoQuant notes “open interest flow,” a phenomenon where speculative positions are liquidated during periods of intense price action. This process can create favorable entry points for investors looking to capitalize on temporary market resets.

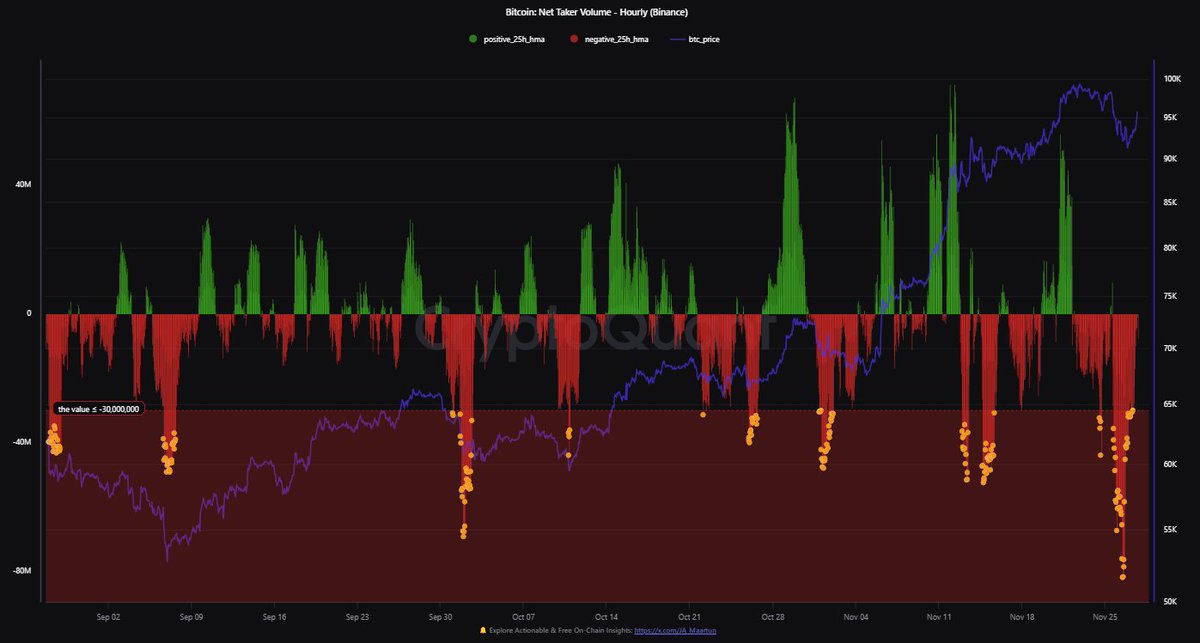

Finally, the Net Taker Volume indicator, which measures the balance between buying and selling pressure, suggests that peak selling activity may indicate opportunities for future price growth.

A reading below -$30,000,000 according to CryptoQuant, as seen recently, may indicate that sellers are on the verge of exhaustion, paving the way for potential upside.

Key Support Levels for Bitcoin

While Bitcoin’s current momentum hints at another possible rally, analysts caution on the importance of holding critical support levels. Cryptoanalyst Ali recently identified the $93,580 price zone as the key demand level, where approximately 667,000 addresses collectively acquired nearly 504,000 BTC.

Related reading

According to the analyst, staying above this level is crucial to avoid a possible liquidation by holders at this price.

A key demand area for #Bitcoin look is $93,580, where 667,000 addresses bought almost 504,000 $BTC. Staying above this support level is a must to prevent these holders from selling off! pic.twitter.com/UdXTZOYzGH

—Ali (@ali_charts) November 28, 2024

Featured image created with DALL-E, TradingView chart