This article is also available in Spanish.

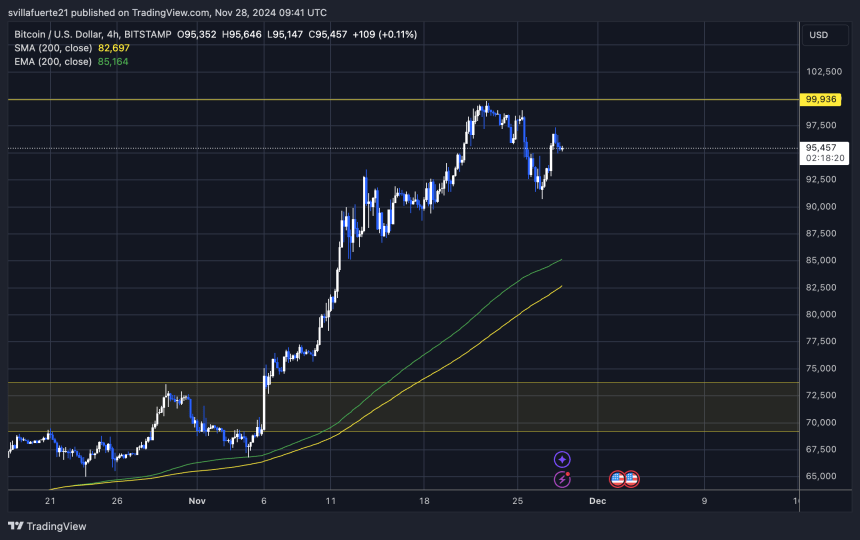

Bitcoin recently experienced a 9% retracement from its all-time high of $99,800, narrowly missing the psychological milestone of $100,000. The pullback saw BTC fall to a low of $90,700 on Tuesday, raising concerns among some investors.

However, the price has since recovered, showing resilience as it climbs back towards key resistance levels. Despite the volatility, Bitcoin’s long-term bullish structure remains intact, and market sentiment is leaning towards optimism.

Related reading

Prominent analyst Axel Adler has provided key on-chain insights that suggest strong demand for Bitcoin persists at current levels.

According to Adler, this buying activity indicates that investors view pullbacks as opportunities to accumulate, underscoring confidence in Bitcoin’s potential for further growth. However, it also highlighted strong support at lower price levels, which could come into play if the current recovery fails to sustain.

The next few days will be crucial as Bitcoin tests its ability to regain momentum and potentially break the $100,000 barrier. With demand remaining strong and market conditions lining up for a potential breakout, all eyes are on whether BTC can maintain its upward trajectory or if further consolidation is on the horizon. The stage is set for a decisive move in Bitcoin price action.

Bitcoin Data Reveals Investor Entry Prices

Bitcoin continues to show extremely bullish price action, driven by growing demand from institutional and retail investors. Key on-chain data from CryptoQuant analyst Axel Adler highlights critical price dynamics shaping today’s market.

According to Adler, Bitcoin price is currently consolidating within the average buying range of two key investor cohorts: 1D ($96.8K) and 1D-1W ($95.3K). These levels act as crucial support zones, reflecting strong buyer interest at current prices.

Additionally, the average buy level in the 1W-1M range, positioned at $84K, provides an additional layer of support in the event of a broader market pullback. This indicates that even in a more bearish scenario, Bitcoin will likely find stability around $84,000 before resuming its upward trajectory.

The data reinforces a widespread bullish outlook for Bitcoin among analysts and investors, many of whom believe the current cycle is still in its early stages. Strong demand and solid support levels suggest that Bitcoin is well positioned to maintain its bullish momentum in the coming weeks.

Related reading

Whether BTC stays above its current levels or experiences a temporary drop, the consensus remains optimistic about further gains, and this cycle could mark a historic run for the cryptocurrency.

BTC approaches $100K

Bitcoin is currently trading at $95,200, a pivotal level that could determine its next big move. This price serves as a crucial threshold, and if Bitcoin stays above it, the stage would be set for a possible test of the long-awaited $100,000 level.

Before reaching this psychological milestone, the next significant supply zone lies at $98,800. A break above this level would likely trigger a massive breakout, pushing BTC past its all-time high and into six-figure territory for the first time.

However, the stakes are high. Bitcoin could face a deeper correction if it fails to maintain its position above the $90,000 level. In such a scenario, the next strong support is at $85,500, a critical level that would need to hold to preserve Bitcoin’s bullish structure.

Related reading

Market participants are closely monitoring these key levels as Bitcoin’s trajectory will influence broader market sentiment. With strong demand and momentum, the next few days will be pivotal in determining whether BTC breaks above $100,000 or consolidates further before resuming its bull run. Since the market remains very dynamic, traders and investors are preparing for major moves in the future.

Featured image of Dall-E, TradingView chart