Metaplanet Inc. widely recognized as the main Bitcoin Treasury company in Japan, has announced An important update of its Bitcoin accumulation strategy, revealing the “555 million plan” intended to acquire more than 210,000 BTC by the end of 2027, which is equivalent to 1% of Bitcoin’s total supply.

This new objective marks a dramatic increase with respect to the “21 million plan” plan “, which aimed only 21,000 BTC by 2026. Progress far exceeded expectations, with 8,888 BTC already insured as of June 2, which caused the strategic change.

To finance this growth, Metaplenet has launched the largest capital increase centered in Bitcoin in Asia, with the aim of ensuring ¥ 770.9 billion (approximately $ 5.4 billion) through the issuance of 555 million shares through a movement in motion in motion. This is the first structure of its kind in Japan, with a price of a market premium, which makes possible because of the high liquidity and volatility of the company’s company.

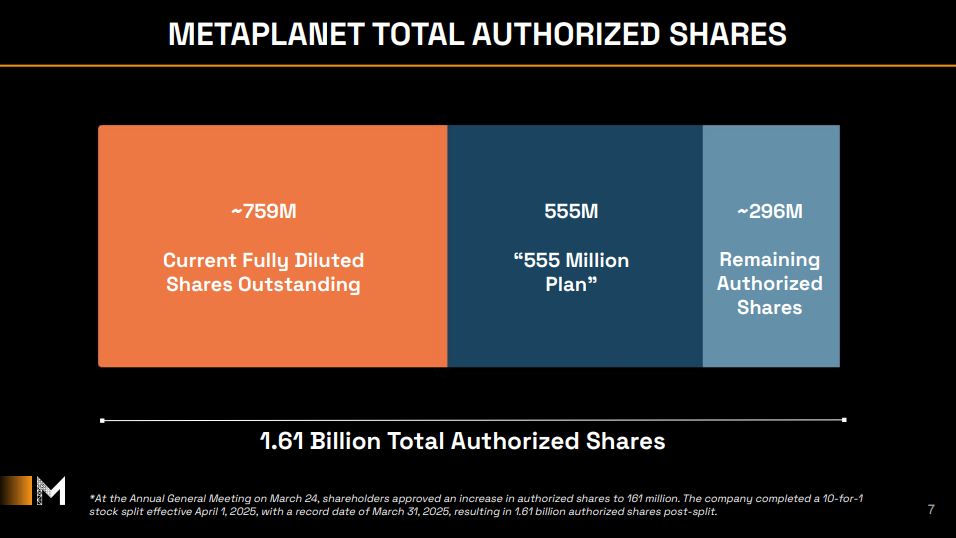

At the annual general meeting on March 24, shareholders approved an increase in authorized shares from 161 million to 1.61 billion, after a division of shares of 10 by 1 in force on April 1, 2025; Metaplenet has approximately 296 million remaining authorized actions. The 555 million shares that are issued under the new plan will bring the company’s completely diluted shares in circulation to around 759 million.

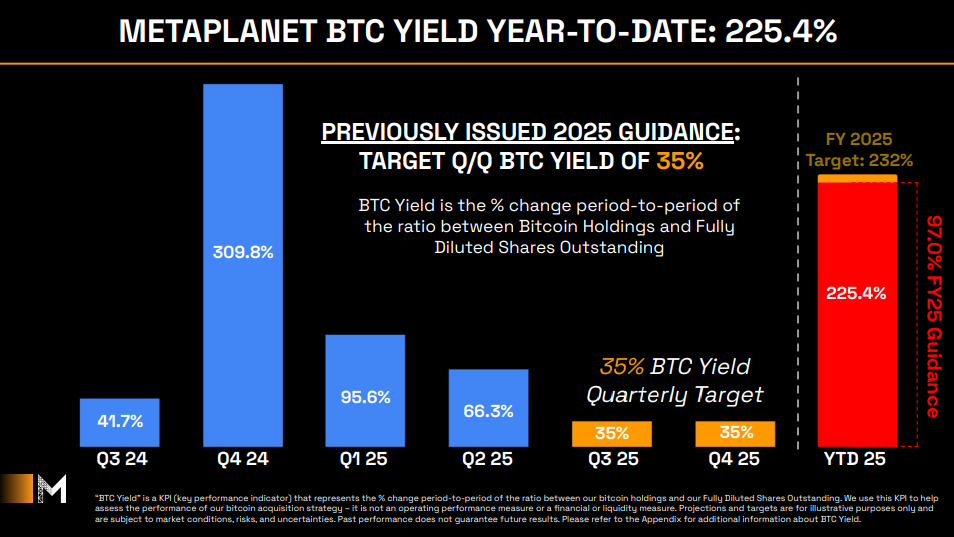

The Bitcoin Bitcoin’s performance objectives and performance for 2025 have shown a strong impulse, with quarterly BTC yields of 41.7% in the third quarter of 2024, 309.8% in the fourth quarter of 2024, 95.6% in the fourth quarter of 2025, 66.3% in the fourth quarter of control and the second year Q3 and Q4 2025. 225.4%, closure to the full -year objective of 232%.

Metaplanet too announced The issuance of validity 20 to 22 of the rights of acquiring shares through an allocation of third parties to the EVO fund, potentially adding 555 million new actions. The initial exercise price is established in JPY 1,388 and will be adjusted regularly based on shares prices, and some series include a premium to protect shareholders. The exercise period extends from June 24, 2025 to June 23, 2027, with the expected revenues of approximately JPY 767.4 billion. This financing supports the “555 million plan” and a greater accumulation of Bitcoin.

The Metaplenet CEO, Simon Gerovich, wrote in an X publication: “Thanks to all our shareholders,” he said. “We are honored to be on this trip with you. Metaplanet is accelerating to the future, driven by Bitcoin.”