The markets at the end of May 2025 showed unexpected peaks and significant decreases along with disconcerting economic patterns. Market investors and observers have experienced an exceptionally dynamic period during this period. The total value of cryptocurrency markets grew by 6.9% reaching US $ 3.55 billion in the week ending at the end of May as reported by what was reported by Binance research While traditional markets experienced mixed results.

BTC and gold

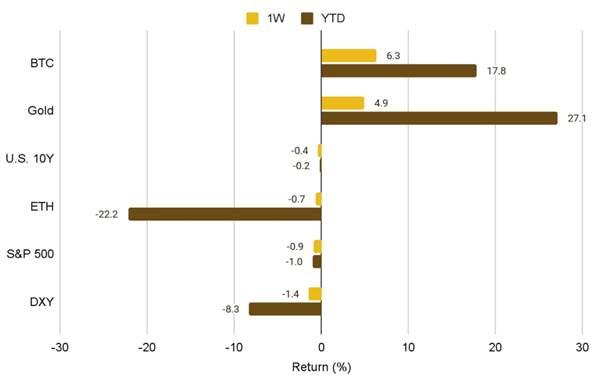

The best of maximum performance for the week were Bitcoin, which won 6.3% and gold, which increased by 4.9%. The recent Bitcoin increase occurred during a period of greater investment in ETF and a slightly weaker dollar, while gold benefited from safe demand and possibly additional concerns on the limit of the United States debt.

The S&P 500 and the powerful US dollar index (DXY) experienced decreases of –0.9% and –1.4%, respectively, while 10 -year -old and Ethereum treasures (ETHE (ETH) recorded slight decreases.

Year to date: Gold leaves cryptography in dust

Gold said the highest yield in 2025 with a gain of 27.1% in the year to date that exceeded the respectable Bitcoin yield of 17.8% YTD. Ethereum (ETH) has endured a terrible year with a significant decrease of –22.2%. The S&P 500 shows a minimum movement and remains slightly negative, while the DXY index has decreased substantially by 8.3%.

Ethereum Wild Week

Ethereum experienced its greatest weekly progress since 2021 when it increased more than 43% in seven days. That is not just impressive; It is legendary. ETH reached its previous weekly peak during the 2021 market frenzy when smart contracts became a common theme of conversation even in the barbershop. The recession of 2025 ETH reached a minimum of –55% YTD in mid -April before recovering at approximately –20% at the end of May.

Bitcoins ETF

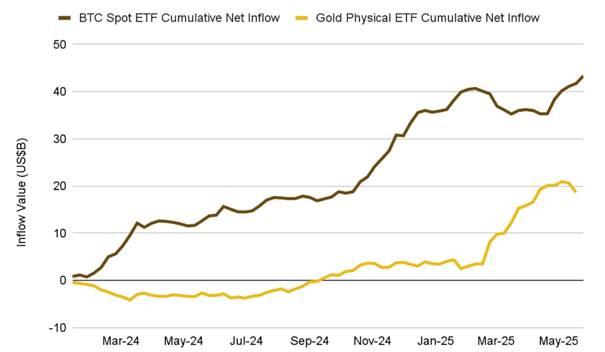

Bitcoin Spot ETF tickets reached $ 43 billion at the end of May while they shot. Cryptographic assets have moved beyond their status as a member of the Oddball family to become regular members of institutional investors portfolios.

Multiple asset yield: variable income, FX, basic products, bonds and volatility

If you thought Crypto was volatile, see the VIX (the “fear meter” for shares): VIX saw a 15% increase during the past week and increased almost 70% since the same period last year. The movement index that measures the volatility of the bond market shows an increase but remains less alarming compared.

The S&P 500 and NYFANG+ experienced moderate weekly decreases, but delivered annual yields respectable to NYFANG+ achieving an impressive 28.7%. Gold? Still dazzling, an increase of almost 38% year after year.

The bond market remains stagnant since the 10 -year Treasury bond values have been reduced in all maturities. WTI’s crude oil prices experienced a continuous decrease that reaches a 21% drop compared to last year.

Correlations: BTC and Eth

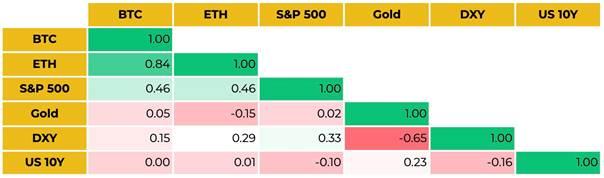

The 2 -month correlation matrix shows that BTC and ETH move closely along with a correlation of 0.84. The shares show moderate correlations with the S&P 500, while Gold maintains its independent rhythm, which often leads him to move away from the dollar index (DXY).

Credit sales

Multiple sectors experienced challenges during this week. Moody has lowered the sovereign credit rating of the United States to AA1, citing the increase in debt and interest charges. The qualification actions follow substantial adjustments of credit rating by S&P in 2011 and Fitch in 2023.

Every time these reductions of qualifications occurred, they created disturbances in the financial markets. The S&P 2011 reduction resulted in a 71% drop for BTC for 90 days, while gold experienced significant profits. In the first three days, BTC increased almost 3%, gold increased by 3.3%, but the S&P and the United States to 10 years showed decreases. We are experiencing a family situation, but this time the cryptographic market plays a more important role.

What follows? Key events to see

Next week it presents numerous potential catalysts beyond the analysis of price graphics. The next launch of the FOMC meeting of the USA.

The incorporation of macroeconomic indicators such as US services.

Final thoughts

The continuous force of Bitcoin and the attractiveness of gold stand out, but Ethereum’s difficulties show that the main market actors can face setbacks.

The Essential Council for Investors implies maintaining knowledge about market trends and dissemination of their investments in multiple assets. Cryptography enthusiasts and traditional investors must monitor both market segments because each one has valuable information. Stay ahead of the curve. Get exclusive market information and Binance trade.