The data shows that the Bitcoin HODLer balance has recorded a drop of around 9.8% in this bull run. This is what this figure looked like in previous cycles.

Bitcoin HODLers have seen their holdings drop recently

According to data from the market intelligence platform on the blockLong-term Bitcoin holders have been gradually reducing their total balance recently.

“Long-term holders” (LTH) here refer to BTC investors who have held onto their coins for at least a year, without transferring or selling them even once.

Statistically, the longer a holder holds their coins immobile, the less likely they are to sell the tokens at some point. As such, LTHs, which are maintained for significant periods, can be considered persistent entities. The side of the market with weak hands is known as the “short-term holders” (STH).

Now, here is the chart shared by IntoTheBlock showing the trend in combined Bitcoin LTH holdings over the last decade:

The value of the metric appears to have been on the decline in recent months | Source: IntoTheBlock on X

The chart above shows that Bitcoin LTHs have been reducing their supply this year. More specifically, the total balance of these HOLDERS has decreased by around 9.8% during this downtrend.

LTHs have decided to break their slumber every time this metric registers a decline. Generally this happens because they want to participate in a sale.

Something to keep in mind is that, while selling is something that can appear instantly on the indicator, the same is not true for buying. LTH supply has a 1 year lag in terms of this, as coins can only become part of the cohort after they have been held for at least a year.

As mentioned above, LTHs tend to be committed hands, so they don’t tend to sell too often. That said, even these investors are forced to sell when profits from a major Bitcoin bull run begin to arrive.

The analytics firm has highlighted on the chart what these sales looked like during previous cycles. It would appear that the degree of decline has been less in this cycle so far than in recent bull markets.

“Long-term holder balances have fallen 9.8% this cycle, compared to 15% in 2021 and 26% in 2017,” notes IntoTheBlock. Therefore, the HODLer distribution may have more room to continue before the Bitcoin rally ends.

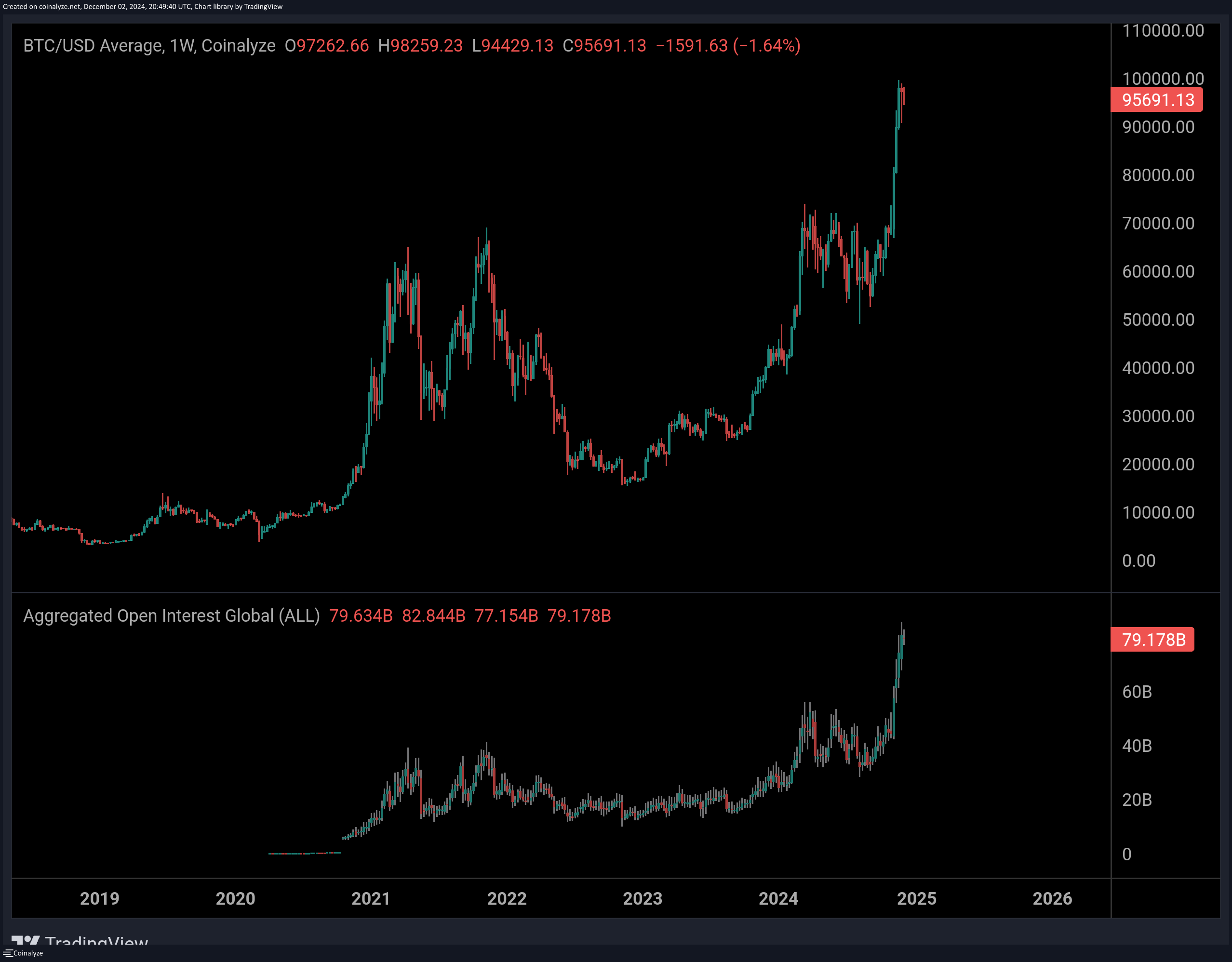

In some other news, as noted by CryptoQuant community analyst Maartunn in an mailTotal open interest for the cryptocurrency sector has skyrocketed to a new all-time high of $79.2 billion.

Looks like the value of the metric has observed a sharp surge recently | Source: @JA_Maartun on X

“Open interest” refers to a measure of the number of derivatives positions that users have opened across all centralized exchanges. An increase in this indicator generally corresponds to greater market volatility.

BTC Price

Bitcoin’s rally has cooled as its price has been consolidating sideways around the $95,800 mark recently.

The price of the coin has been stuck in sideways movement over the last few weeks | Source: BTCUSDT on TradingView

Dall-E Featured Image, IntoTheBlock.com, TradingView.com Chart