The data show that Bitcoin’s feeling on social networks may be beginning to overheat, a sign that could end up being a threat to prices manifestation.

The feeling of Bitcoin’s social networks is currently more positive

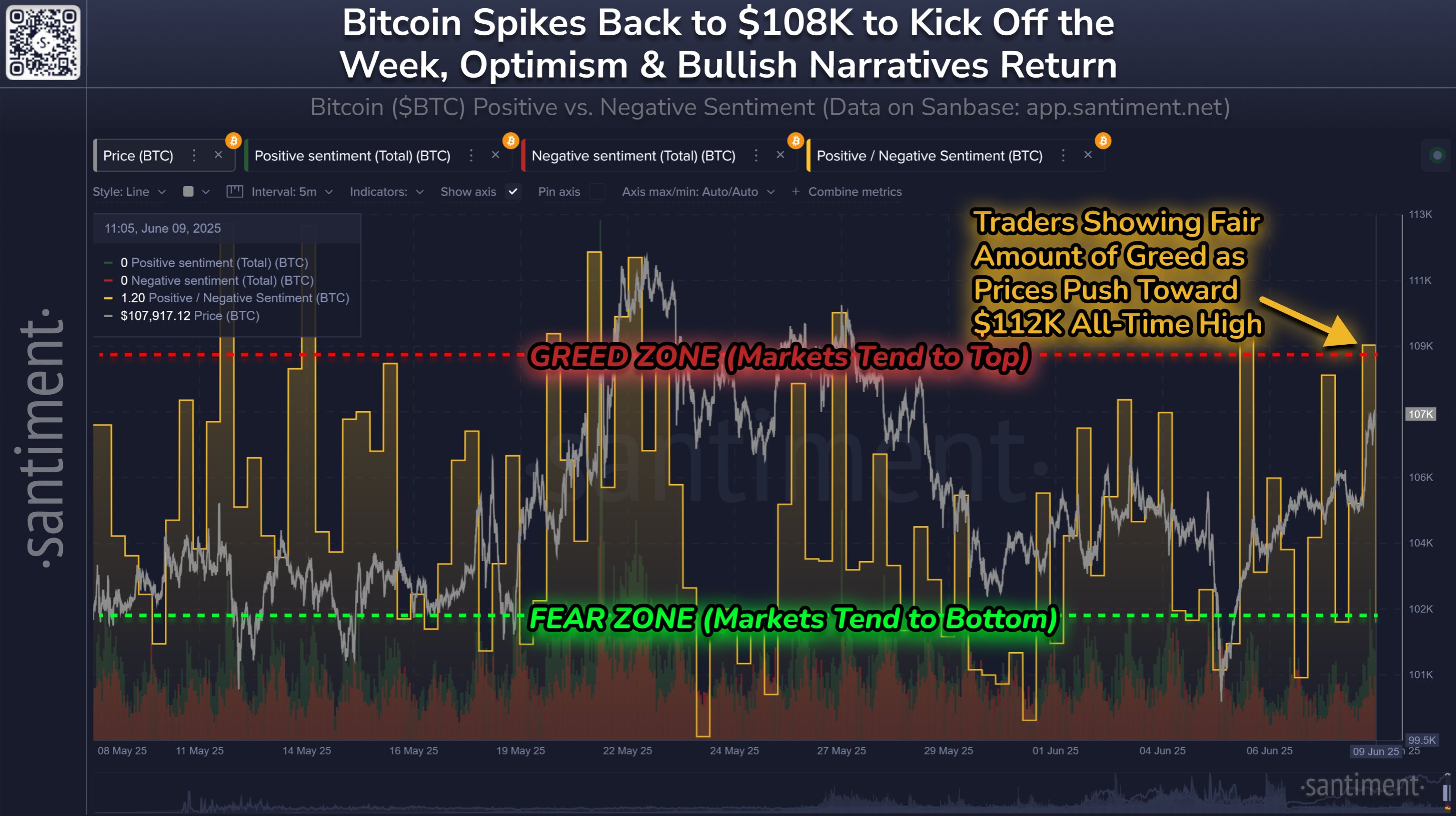

In a new one mail In X, the analysis firm Santiment has discussed how the feeling about Bitcoin has changed on the main social media platforms after the last recovery recovery.

The relevance indicator here is the “positive/negative feeling”, which compares the level of positive feeling with the negative feeling around a cryptocurrency given on social networks.

The metric works filtering publications/messages/threads containing assets and placing them through an automatic learning model that separates between positive and negative comments. The indicator tells the number of both types of publications and takes its proportion to provide a net representation of social networks.

Now, here is the Santiment shared box that shows the trend in the positive/negative feeling for Bitcoin during the past month:

The value of the metric appears to have spiked in recent days | Source: Santiment on X

As shown in the previous graph, Bitcoin’s positive/negative feeling has seen an increase in the area above the 1.0 brand, which suggests an avalanche of positive publications related to the asset has reached social media platforms. This turn towards a significant positive feeling has reached as the price of cryptocurrency has been going through an increase in recovery.

This is not a particularly unusual trend, since the emotion tends to increase among merchants every time there is an upward price action. In the context of the last increase, especially an elevation of feeling is not surprising, since it has approached the maximum price of all time (ATH).

While some exaggeration is expected, an excess can be something to take into account. The reason behind this is the fact that Bitcoin and other cryptocurrencies have historically tended to move in the direction that goes against the opinion of the crowd.

This means that an increase in market greed is something that can lead to a top for the price of the asset. In the same way, a cooling in feeling can imply a bullish investment.

From the painting, it is evident that the positive/negative feeling decreased to a relatively low level a few days ago when Bitcoin saw a reduction of $ 100,000. This fear among users of social networks may have helped the currency to reach a background.

After the last increase in the indicator, the situation is now the opposite, in fear of being lost (fomo) potentially developing among investors. Now it remains to be seen if this overexcitation would provide impedance to the price rally or not.

BTC price

Bitcoin broke briefly above $ 110,000 during the last day, but since then the asset has seen a small setback, since it has now returned to $ 109,500.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Outstanding image of Istock.com, Santiment.net, TrainingView.com graphics

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.