Bitcoin is currently trapped within an adjusted price range, limited by the lower limit of the channel ascending to $ 78k and the 200 -day mobile average at $ 83K. A rupture of this range will probably determine the next significant market trend.

Technical analysis

By Shayan

The daily table

Bitcoin has maintained a bearish market structure, recently experiencing an increase in bearish impulse that pushed the price below the $ 80K critical brand.

This breakdown triggered the significant liquidity on the side of the sale under this crucial situation, which leads to a strong bullish rebound, probably because intelligent money executed large purchase orders.

In addition, the measure caused a long substantial settlement, effectively cooling the futures market. Despite the recovery, Bitcoin remains confined in a decisive price range, with $ 78K as a key support level and the 200 -day mobile average at $ 83K as crucial resistance. A rupture of this range will determine the following directional movement.

The 4 -hour table

Within the lower period, the search for liquidity below $ 80k is evident, since Bitcoin submerged in this liquidity zone before organizing a rapid bundle bounce. However, after breaking below the ascending channel, the price has been forming a descending wedge pattern, which suggests greater potential consolidation.

In the medium term short, Bitcoin is likely to continue moving inside this wedge while staying above the $ 78K support. A rupture of this pattern, either above the wedge or below the $ 78K mark, will probably result in a significant price movement in the direction of the break.

Chain analysis

By Shayan

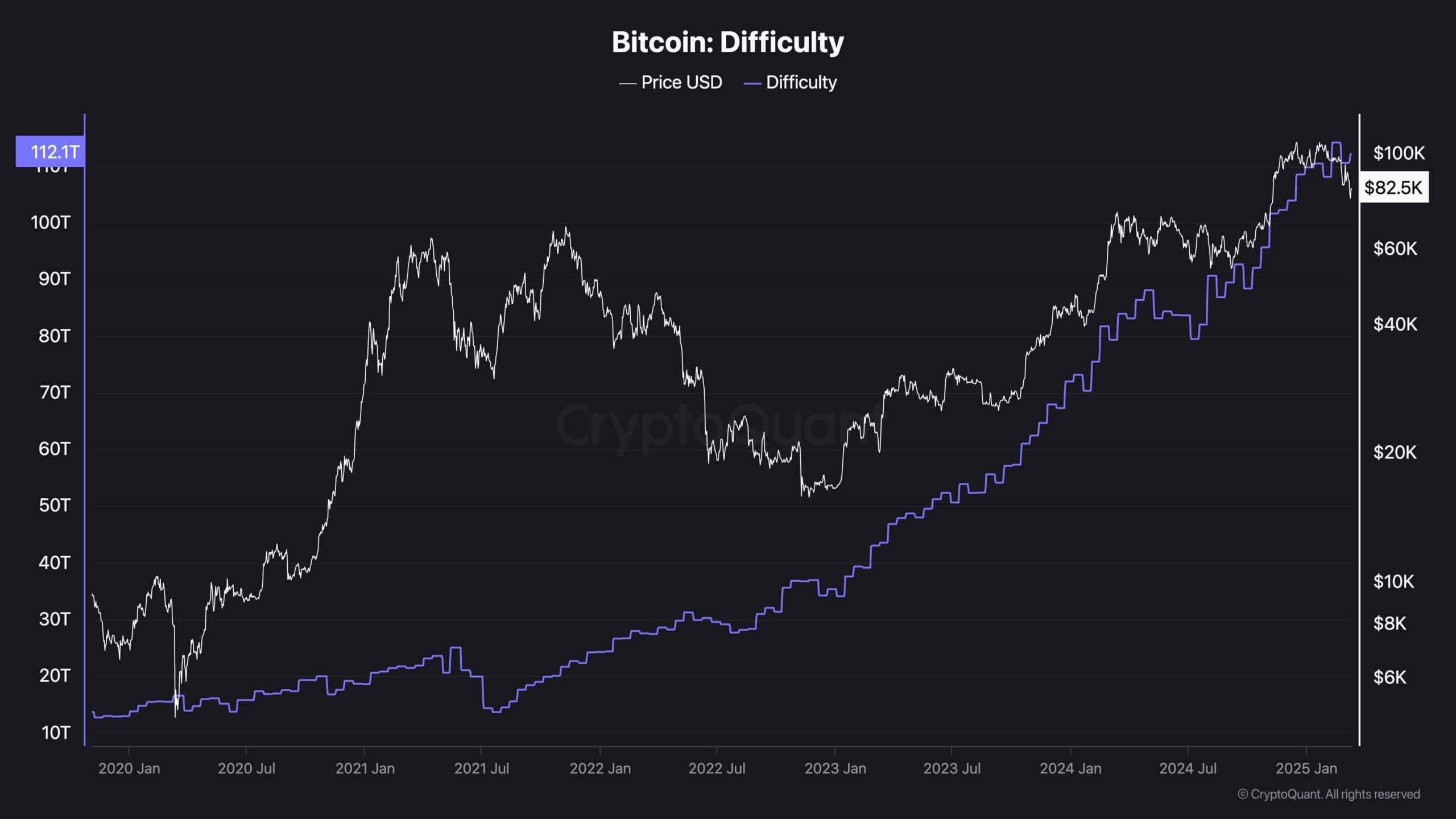

Bitcoin’s mining difficulty remains in a bullish trend despite the correction of the current market. During the extended correction phase that began in March 2024, the mining difficulty experienced a temporary fall. However, the price of Bitcoin recovered sharply, contradicting bearish predictions. Although the market is now experiencing a 30%correction, mining difficulty continues to increase.

A decrease in mining difficulty generally indicates the capitulation of the miner, where less efficient mining platforms are closed. So far, there are no signs of such behavior. However, if the correction extends even more, we could see the decrease in mining difficulty due to mining capitulation.

The miners seem to be maintaining a retention strategy, which suggests that the broader upward trend remains intact. This phase requires patience instead of premature conclusions as market dynamics continue to evolve.

Bitcoin after prices analysis: BTC can recover $ 90K this week? He appeared first in Cryptopotato.