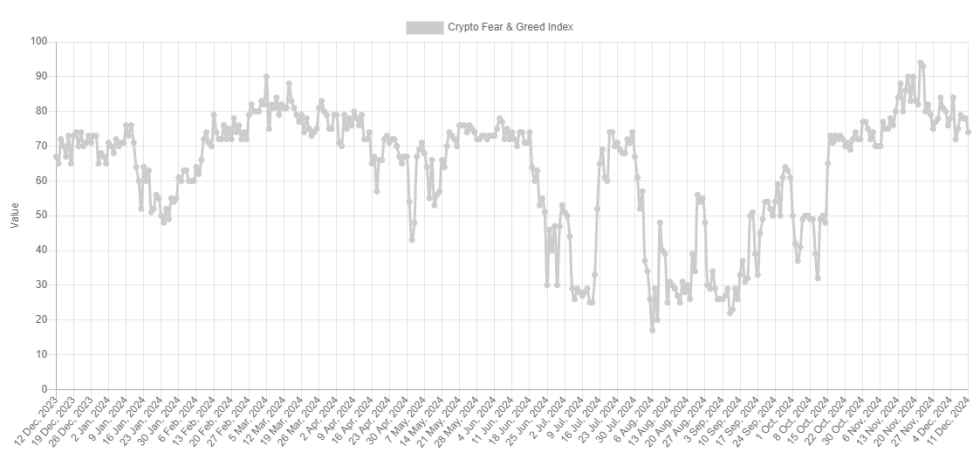

Data shows that Bitcoin sentiment has cooled due to extreme greed as bearish price action continues for BTC and other cryptocurrencies.

Bitcoin Fear and Greed Index Now Points to ‘Greed’

The “Fear and Greed Index” is an indicator created by Alternative That tells us about the average sentiment among investors in Bitcoin and the broader cryptocurrency markets.

This metric uses a numerical scale from zero to one hundred to represent sentiment. All values above 53 correspond to investors who have a feeling of greed, while those below 47 suggest fear in the market. The territory between the limits implies a clearly neutral mentality.

Now, here is what the Bitcoin Fear & Greed Index says regarding the current market sentiment:

The value of the index appears to be 74 at the moment | Source: Alternative

As seen above, the indicator has a value of 74, which means that investors are sharing a greedy sentiment at the moment. This current value is also quite deep in the region, so deep that it lies right on the edge of a special zone called extreme greed.

The market experiences extreme greed every time the index surpasses the 75 mark. There is also similar territory for the fear side, known as extreme fear, which occurs in those under 25 years of age.

Historically, extreme sentiments have been quite significant for Bitcoin and other cryptocurrencies, as major highs and lows have tended to occur in these regions.

The relationship between sentiment and price has been inverse, meaning that extreme greed has been the region of highs, while extreme fear is the region of lows.

During the last leg of the bull run, the index generally spent time within the extreme greed zone. The metric was in the region just yesterday.

Looks like the value of the metric has registered a cooldown in recent days | Source: Alternative

The change in sentiment came as BTC witnessed a pullback and the altcoin market suffered a drop. Given the historical pattern that Bitcoin typically observes, this latest cooldown in investor sentiment could prove positive and potentially allow the rally to continue.

In other news, the estimated leverage ratio for the BTC-USDT pair has seen a decline recently, as noted by CryptoQuant Founder and CEO Ki Young Ju in an X. mail.

The trend in the BTC-USDT Futures Leverage Ratio over the last couple of years | Source: @ki_young_ju

The estimated leverage ratio measures the average amount of leverage that futures market users opt for. The fact that this metric has recently recorded a decline could be constructive for Bitcoin as it means there is a lower risk of a chaotic mass liquidation event occurring.

BTC Price

Bitcoin had dropped to below $94,300 yesterday, but it appears that the coin has recovered quickly as its price has already returned to $98,500.

The price of the coin appears to have seen a pullback during the last few days | Source: BTCUSDT on TradingView

Featured image by Dall-E, CryptoQuant.com, Alternative.me, TradingView.com chart