Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

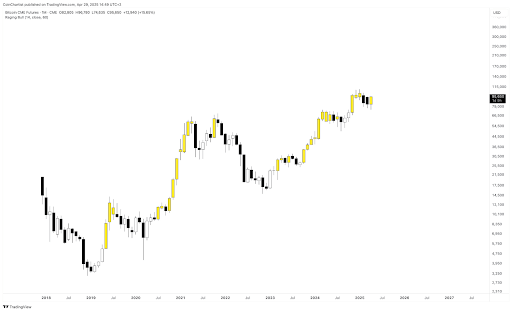

Bitcoin continues Show signs of resilience in the region of $ 95,000, pushing higher than recent minimums and trying to recover its upward structure after an April volatile. The monthly candlestick for April in the CME futures list currently presents a strong bullish wrapping formation, which, if it is kept at weekly closure, could provide the market impulse to close May with another bullish candle.

The potential of this upward closure is sufficient to Divide the feeling between The bearish defenders, according to cryptographic analyst Tony “The Bull” Severino.

The Raging Bull Flashs Signal tool in CME futures

Bitcoin price action In the last two weeks It has been positive and has seen an upward feeling slowly reducing back among cryptographic merchants. Interestingly, this price action has even seen Bitcoin’s net volume become positive for the first time in a time. Although the trend is still in its early stages, the renewed force is already beginning to soften some of the most bearish perspectives, especially when the key indicators begin to turn.

Related reading

Tony “The Bull” Severino, a well -called cryptographic analyst, Recently revealed in Social Network Platform X that his patented “Raging Bull” indicator has turned on again. However, this indicator has been turned on only in the Bitcoin CME futures table, not in the Spot BTC/USD table.

The divergence between CME futures and the spots table, with only the first one that shows this upward sign, has added complexity to the current Bitcoin perspectives. The Raging Bull tool, which uses weekly price data, is designed to identify the early stages of powerful ascending movements. According to Severino, the appearance of this signal, despite its bearish posture, suggests that it may be developing a significant change in the market structure. However, he hastened to add that a confirmed weekly closure is still necessary before firm conclusions can be drawn.

Breaking above this level is key

When examining the monthly table shared by the analyst, the bullish wrapping candlestick is clearly visible after a strong rebound of April minimums below $ 83,000. Bitcoin began the month of April in around $ 83,000, but a rapid recession In the first days He pushed the price down until he played playing around $ 75,000. However, the current candle of April not only erases the losses of March, but also indicates a greater interest in Bitcoin of institutional merchants on the CME platform.

Related reading

Even so, despite the candlebrosal encouraging formation, Bitcoin must break decisively above the region from $ 96,000 to $ 100,000, where they have stagnated. This level is acting as a roof that could determine whether the recent bullish impulse Continue or positions. A failure to close above this range, either within a weekly or monthly term, could invalidate the furious bull signal.

In addition, the furious bull indicator must return to the BTCUSD table to confirm a strong upward perspective. This can only be done if Bitcoin manages to break substantially above $ 96,000.

At the time of writing, Bitcoin is quoted at $ 94,934.

Outstanding image of Pixabay, TrainingView.com graphics