The Bybit market share has seen A strong decrease after hack.

According to Kaiko data, the platform previously had almost 20% of the world cryptocurrency market for safety violation. Now, it’s just a single digit.

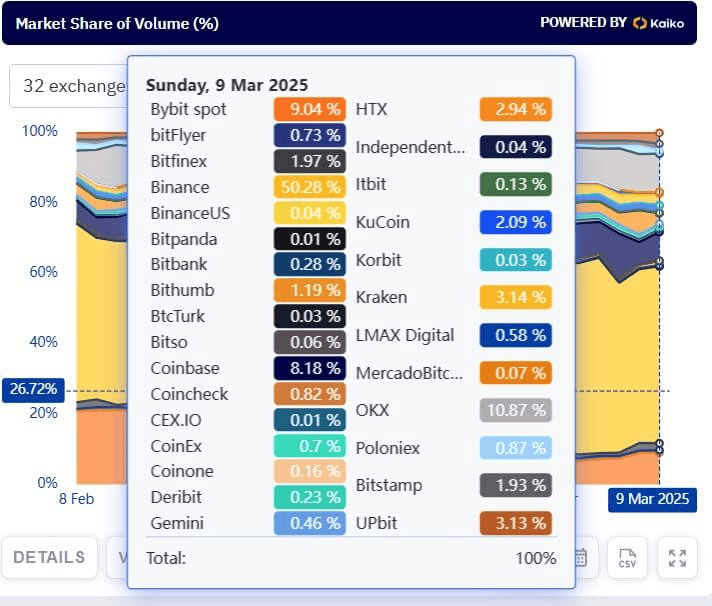

Bybit’s market share decreases

Immediately after Hack, the Bybit market share collapsed to only 5% for March 2, 2025, since users and merchants probably transferred their funds to safer exchanges due to security concerns.

During this period, Binance emerged as the largest beneficiary, and its market domain rose to 62% as merchants were looking for a safer and more liquid platform.

Other important exchanges, such as OKX and Coinbase, also saw small increases in market share, reflecting a broader redistribution of commercial activity.

Share recovery

Bybit has shown signs of recovery, with its market share recovering at 9.04% to March 9, 2025.

A key factor in Bybit’s survival was his rapid crisis response. Unlike many exchanges that suspend retreats during security violations, Bybit maintained its operational platform, allowing users to access their funds. This decision, together with consistent updates, helped maintain confidence and prevent mass retreats.

However, the exchange still faced significant reputational damage and persistent problems of trust, which raises doubts about whether it can completely recover its position prior to acceleration.

Fund recovery update

Despite these efforts, the recovery of stolen funds has proven to be a slow and complex process.

At the time this article was written, only $ 43.71 million have been frozen, 3% of the total stolen assets. Bybit, however, has honored its commitment to offer a reward of 10% on recovered funds, distributing $ 4.32 million to individuals and groups that helped freeze assets.

The Lázaro group of North Korea, the alleged perpetrators, has already washed at least $ 300 million, which hinders additional recovery.

Read bitpine coverage in bybit hack: Bybit hack update Timeline: the Lázaro Group of North Korea responsible for the largest cryptographic hack in history

Local opinions about Bybit’s trick

Paolo Diakino of Defi Philippines dismissed the idea of an Ethereum setback after the Bybit trick of $ 1.46 billion, explaining that the exploit led to the Bybit interface, not to Ethereum.

- He argued that the Ethereum network worked properly and that reversing transactions would not be practical, damage confidence and interrupt the ecosystem.

The Bayanichain CEO, Paul Soliman, described the Bybit trick as a classic social engineering attack in which the North Korean Lázaro group cheated the Bybit security team to sign a fraudulent transaction using a false user interface.

- He stressed that the block chain remained safe, but the human error was exploited.

This article is published in Bitpins: Bybit loses the market share after piracy as Binance Gan

What else is happening in Crypto Philippines and beyond?