Bitcoin (BTC) has fallen 5.5% in the last 24 hours, falling below the $100,000 mark, despite a 38% increase in trading volume to $67 billion. The drop is due to bearish signals in key metrics, including the 7-day MVRV index and increased whale activity, both indicators of increasing selling pressure.

While BTC’s EMA lines maintain a bullish outlook, a rapid decline in the short-term EMAs suggests a possible bearish reversal if a death cross occurs. The next few days will be pivotal as BTC approaches critical support and resistance levels, which could shape its next directional move.

MVRV Ratio Shows BTC Could Continue Falling

The 7-day market value to realized value ratio (MVRV) for Bitcoin is currently at -2.63%, a significant drop from the 5.6% recorded two days ago. The MVRV index measures whether BTC holders have profits or losses by comparing the market value (current price) with the realized value (average purchase price).

Negative MVRV values, like the current one, indicate that, on average, BTC holders are in a losing position, which could indicate a period of market capitulation or undervaluation.

Historical trends suggest that BTC’s 7D MVRV ratio could decline further to levels around -5% or -6% before a recovery begins, as observed between December 20 and December 23.

If this pattern repeats, BTC could see additional selling pressure in the near term, potentially testing lower support levels.

Bitcoin whales are accumulating at a slow pace

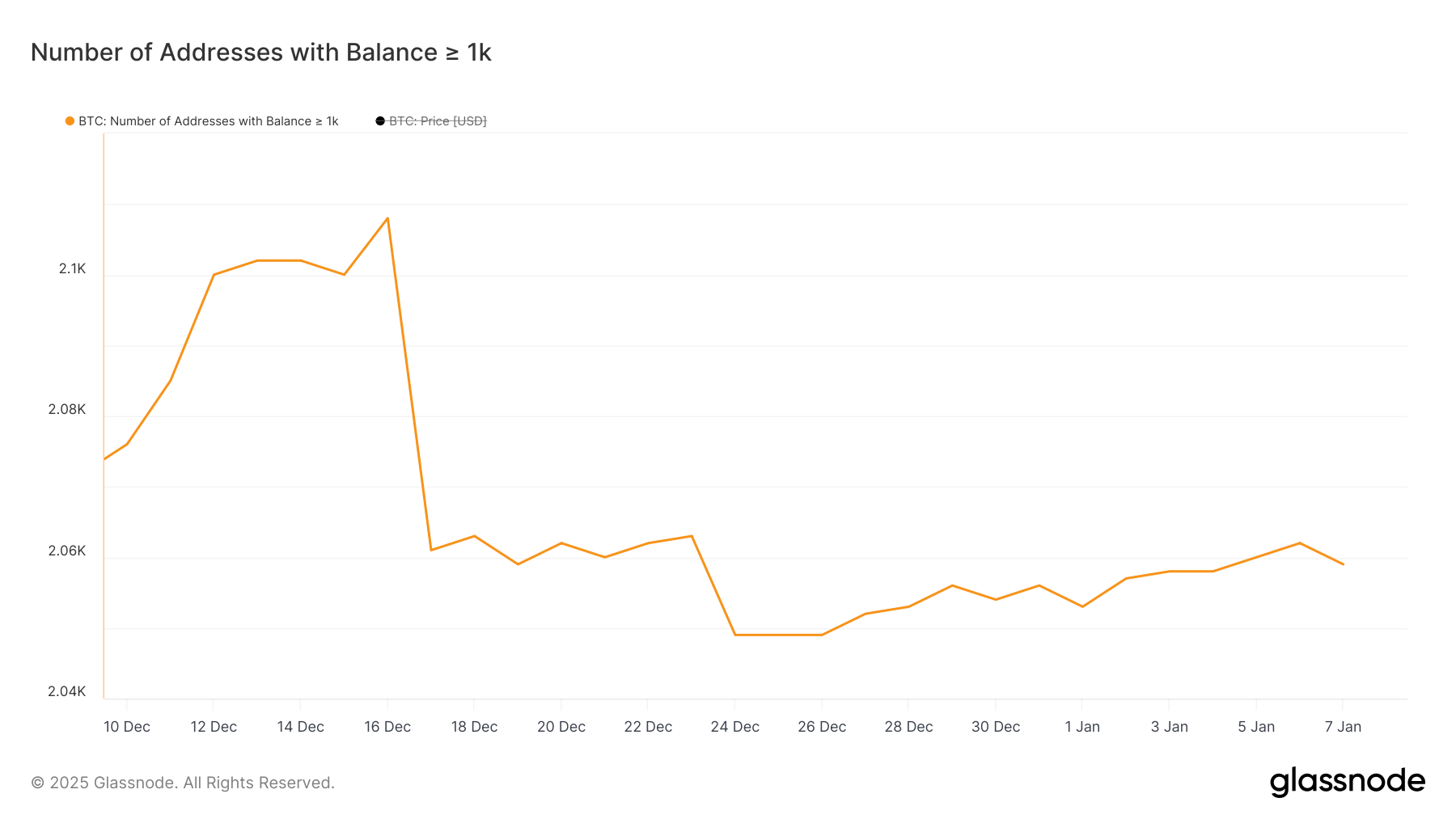

The number of Bitcoin whales holding at least 1,000 BTC reached a monthly high of 2,108 on December 16 before falling sharply to 2,061 just a day later. Monitoring whale activity is crucial because these large holders can have a significant impact on the market through their buying or selling behavior.

When the number of whales decreases, it often indicates profit taking or lower confidence, which can put downward pressure on prices. Conversely, an increase in whale activity generally reflects accumulation, signaling confidence and potentially supporting price stability or growth.

After reaching a monthly low of 2,049 between December 24 and 26, the number of Bitcoin whales has been steadily recovering, currently standing at 2,059 as of January 7. This gradual rise suggests renewed accumulation by large investors, a positive sign for market sentiment. .

The recovery from the lows could indicate that whales are regaining confidence in BTC’s upside potential, although they are not accumulating BTC at a rapid pace, which could suggest that they are still waiting to see where the BTC price goes.

BTC Price Prediction: Can It Return to $100,000 Soon?

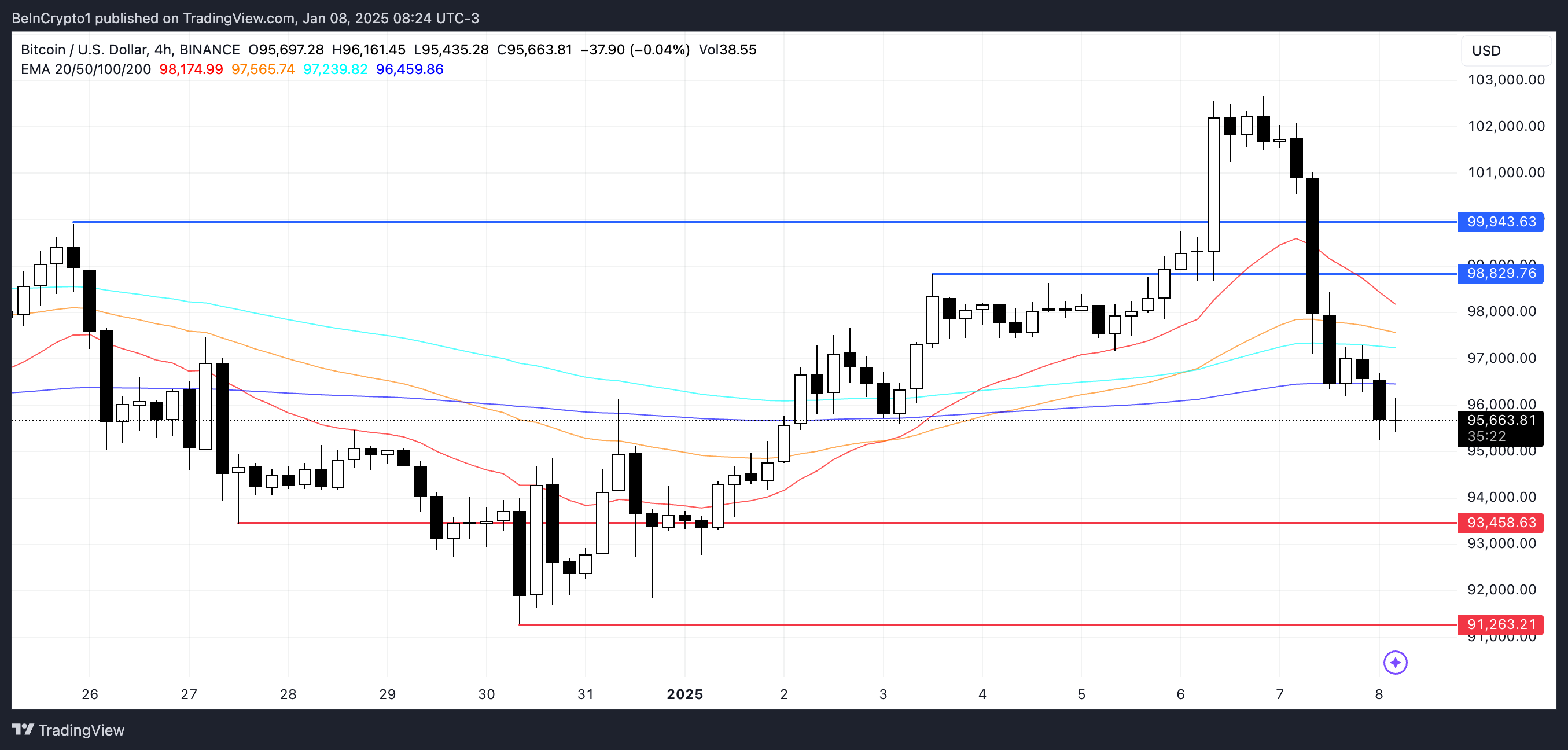

The BTC EMA lines show that the short-term EMAs are still above the long-term ones, maintaining a bullish structure. However, the short-term lines are falling rapidly, indicating weakening momentum.

If this trend persists and a death cross forms, where the short-term EMA crosses below the long-term EMA, it could indicate a bearish reversal. In this scenario, Bitcoin price could test the support at $93,400, and a break below this level could send the price further down to $91,200.

On the contrary, if the current downtrend stops and bullish momentum returns, BTC price could test the resistance at $98,800. A successful break above this level could pave the way for further gains, with $99,900 as the next target.

If this momentum persists, BTC could aim to retest levels around $102,000, indicating a possible recovery from its recent drop. The outcome largely depends on whether the buying pressure can counteract the emerging bearish signals from the EMA lines.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy and Disclaimers have been updated.