Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

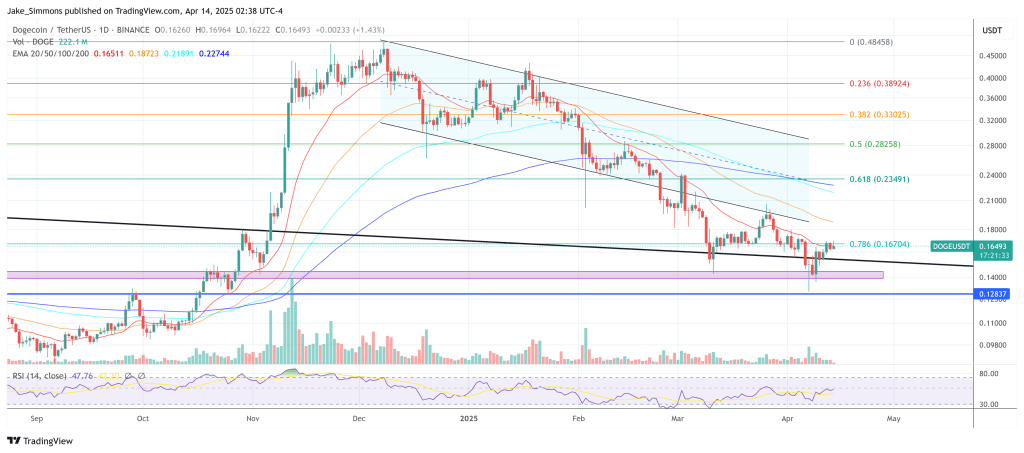

Dogecoin’s price action continues reaffirmed On Sunday that its strategic road map of March 22 remains intact. The weekly chart reveals an extended descending channel drawn with multiple lines of yellow trend that originated in 2021 and a restricted price action throughout 2022.

Within that formation, the most critical horizontal threshold seems to be $ 0.139, labeled in the table as the “last line in the sand” and described by Kevin as essential to preserve the bullish market structure. He points out that maintaining the durable weekly closures above this area is essential for more rise, while a decisive breakdown under $ 0.139 would cancel the upward thesis.

Dogecoin follows the plan

The maximum dogcoin setback about $ 0.45 earlier this year has been contained by a confluence of support channels and fibonacci setback levels. According to the Kevin table, primary FIB levels cover approximately $ 0.049 at the lower limit (0% FIB) to around $ 2,268 to the extension of 1,414.

Related reading

CLOSER INSPECTION SHOWS INTERMEDIATE FIBONACCI MARKERS at $ 0.090 (0.236), $ 0.138 (0.382), $ 0.190 (0.50), $ 0.262 (0.618), $ 0.413 (0.786), $ 0.542 (0.88), $ 0.738 (1.0), $ 0.934 (1.0866), and $ 1,543 (1,272). Since the price is around about $ 0.16– $ 0.17 at the time of publication, Dogecoin has remained above the 0.382 decline about $ 0.138, which reinforces Kevin’s argument that the risk-reompensses ratio at this level seems “absolutely phenomenal”.

The update of March 22, Kevin describes the confluence of several higher term indicators, including the weekly stochastic RSI, the 3 -day MACD and the 2 -week stochastic RSI, all of which sees nearly completely restarted. He cites the previous demand candle, which formed just above $ 0.139, as a key sign that buyers intervene to defend what he calls “the last line of support to the upward market.”

The weekly Stoch RSI in its graph is already located at low levels, while the 3 -day MACD and the 2 -week RSI appear approximately at one month in the background. According to Kevin, these technical remains should serve as a springboard for the next significant ascending movement of Dogecoin, provided that Bitcoin, which he thinks must have more than $ 70K on their stage, remains stable enough to support the broader force of the market.

Related reading

On Sunday, Kevin reminded his audience that this strategy, for the first time public on March 22, leaves “exactly according to the plan”, given the confirmed rebound of Dogecoin around the region of $ 0.139 and the continuous drift towards overall conditions in multiple impulse meters. He revealed that his Patreon Training portfolio has an average entry at $ 0.15 for this swing and pointed out that a quick rejection of the weekly closures of $ 0.139, together with the bullish position of the highest time indicators, corroborates its confidence in the potential of recovery of Dogecoin.

Although he acknowledges that the “much work” must still be done so that Dogecoin claims higher levels near the FIB 0.618 around $ 0.262 or even the FIB 0.786 to $ 0.413, Kevin argues that his initial thesis is as long as the account inspired by Meme retains his footwold above $ 0.139. For him, the risk of a breakdown is well defined if the fundamental support gives way, but if the level persists, sees the upward potential that extends far beyond the current range. From now on, the price of Dogecoin continues to cling to that important line in the sand, keeping Kevin’s plan very alive.

At the time of publication, Dege quoted at $ 0.16493.

Outstanding image created with Dall.E, Record of TrainingView.com