Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

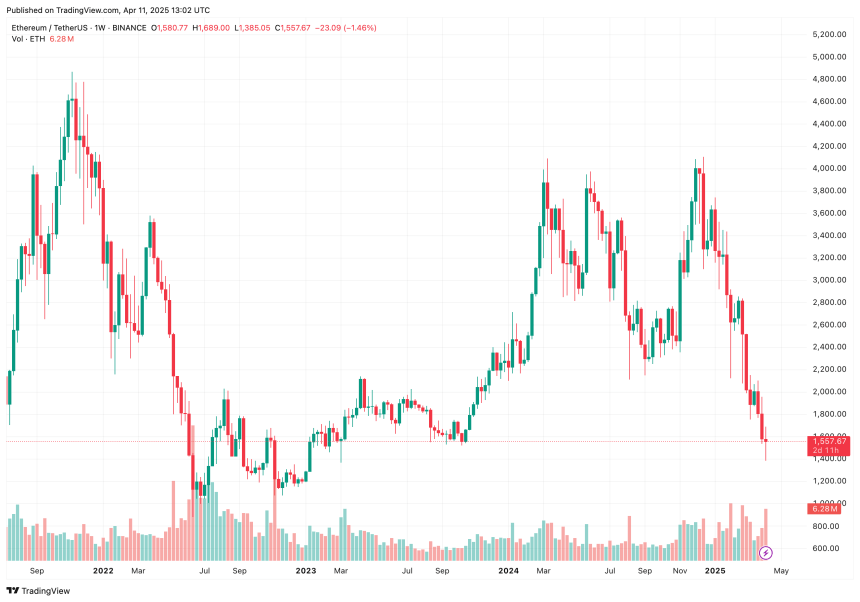

According to a recent X publication of the experienced cryptographic analyst Ali Martínez, Ethereum (ETH) may have already gone through its capitulation phase for this market cycle. In particular, the second largest cryptocurrency due to market capitalization has decreased more than 55% during the past year.

Is Ethereum capitulation ended?

Unlike Bitcoin (BTC) and Altcoins such as XRP, Solana (Sol) and Sui, Ethereum has suffered a challenge a two -year section. The cryptocurrency was quoted at $ 1,892 exactly two years ago, on April 11, 2023, and now has a price of around $ 1,560, more than 17% lower.

Related reading

In contrast, BTC has increased from approximately $ 41,000 two years ago to $ 82,127 at the time of writing, an increase of almost 100%. While Sol currently lies below its April 2023 price, unlike ETH, it managed to reach a new historical (ATH) of $ 293 earlier this year in January.

Understandably, the feeling towards ETH, among retail and institutional investors, is float Near minimums of all time. However, Martínez believes that “intelligent money” can accumulate at current levels, anticipating a short -term reversion.

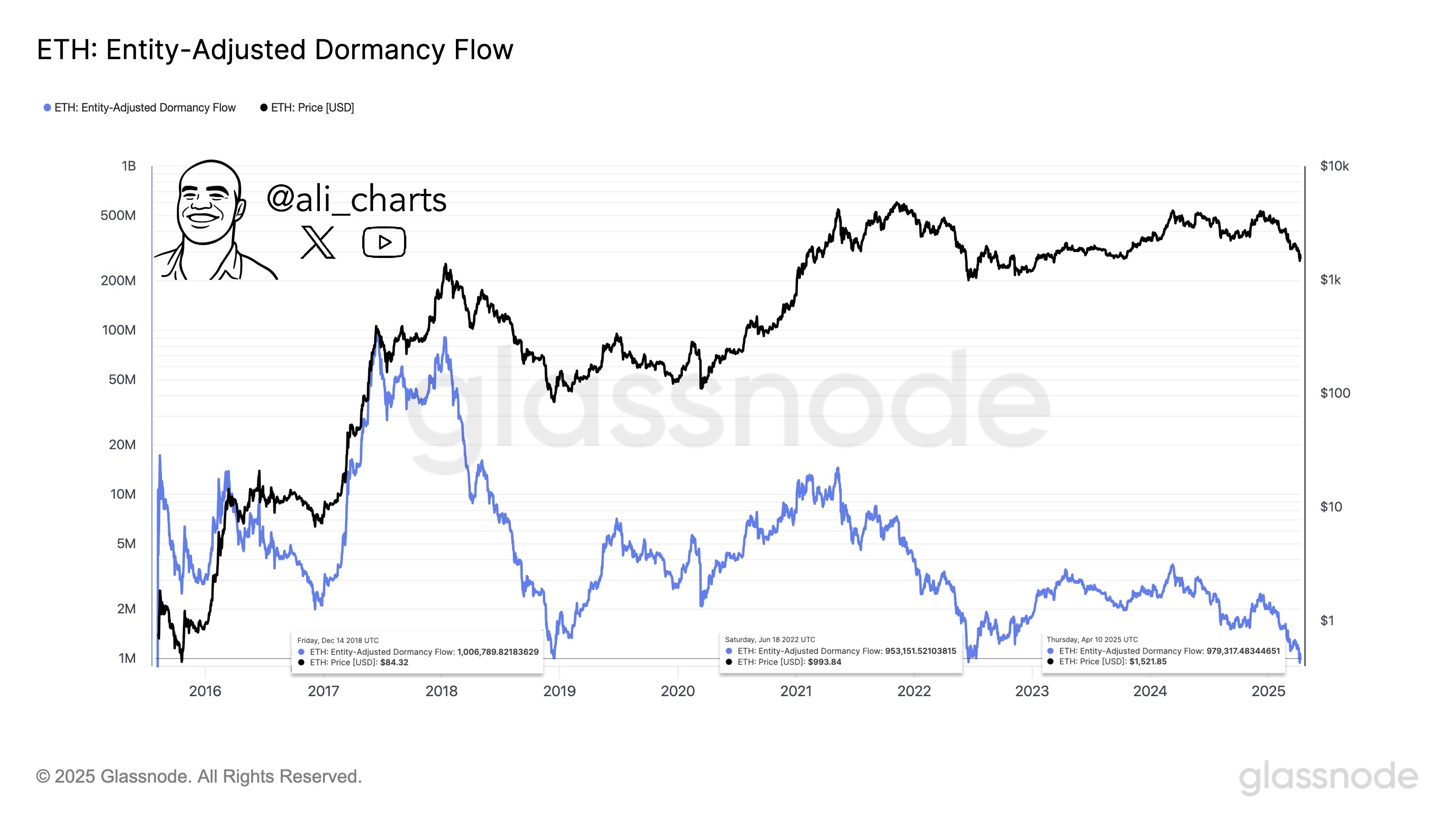

The analyst said that the latency flow adjusted to the Ethereum entity has recently fallen below one million. Martínez added:

This historically indicates a macro background area, which means that $ ETH could be undervalued and long -term holders are less inclined to sell. It also suggests: feeling is low, capitulation may have occurred, intelligent money could be accumulating.

For the uninitiated, the latency flow adjusted to the Ethereum entity is a metric in the chain that compares the market limit with latency, the average age of ETH that moves, adjusted by unique entities instead of raw directions. Metric helps identify whether the market is overheated or underestimated when tracking the behavior of long -term holders.

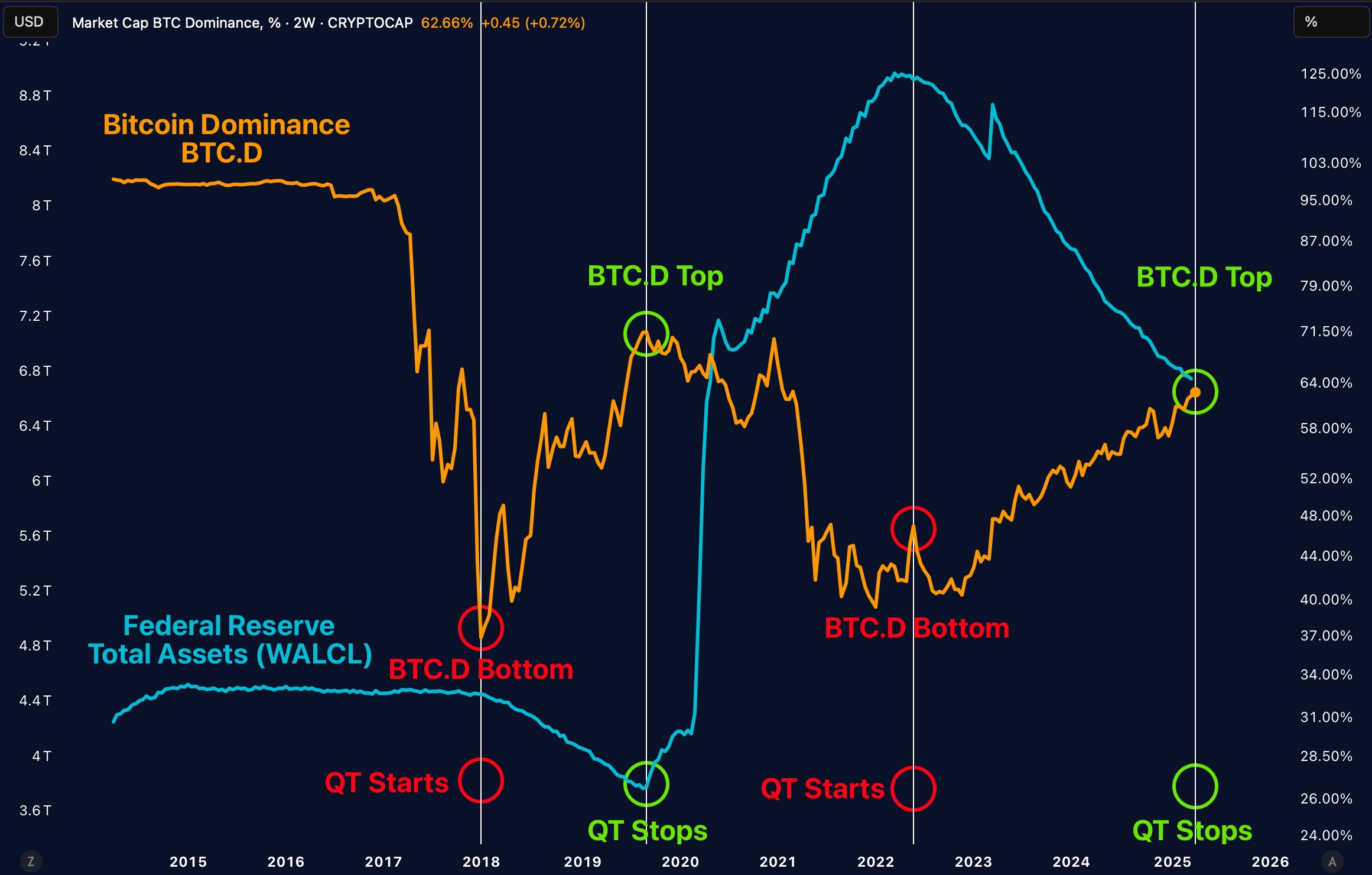

If ETH follows historical trends, you can approach an impulse investment. In a separate X post, the merchant of Merlijn crypto, the merchant, suggested that Bitcoin’s domain (BTC.D) is approaching a peak, which could change the capital to Altcoins and activate a short -term rally.

At the time of writing, BTC.D measures around 63.5%. A possible axis of the United States Federal Reserve towards quantitative flexibility (QE) could inject a new liquidity into the market, possibly causing an Altcoin Mini Rally.

ETH demands cautious optimism

While there are multiple signs that ETH may be close to touchingSome indicators suggest that there could be a continuous weakness for digital asset before any significant change of time.

Related reading

In a recent analysis, Martínez warned That ETH could fall as low as $ 1,200 if the sale of current sales continues. In addition, Capital ongoing Departures From funds quoted in the stock market (ETF) in Ethereum (ETF) based in the USA. UU. They are still a concern for the short -term perspective of the asset.

That said, the notwojak cryptographic analyst noted that ETH can be on the verge of a break, with a possible upward objective of $ 1,835. At the time of publication, ETH is quoted at $ 1,557, 2.3% less in the last 24 hours.

Outstanding image created with UNSPLASH, X and TrainingView.com graphics