Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

According to a recent Cryptocharcan Quicktake position in the Borisvest chain, Ethereum (ETH) seems to be caught in a limbo state. While retail investors are increasingly ethy exchanges such as Binance, generally a sales pressure sign, large investors constantly withdraw ETH from these platforms, which indicates long -term accumulation and confidence.

Ethereum trapped in a strip and loosen

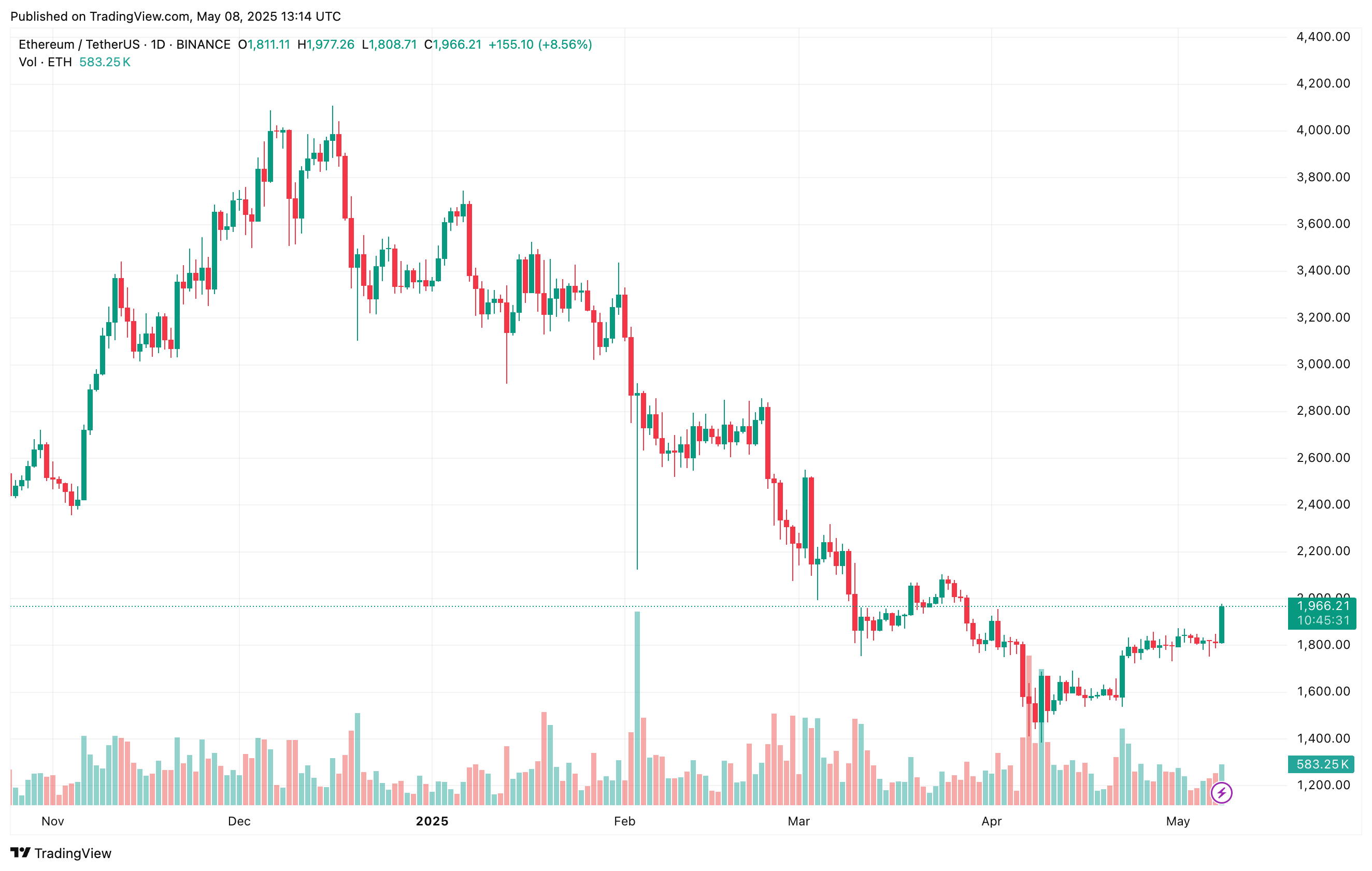

As ETH inch approaches the $ 2,000 mark for the first time since March 27, the feeling of the market seems to be changing. Optimism is being built around the potential for a reversal of trends, but the data in the chain continue to deliver mixed signals with respect to the direction in the short and medium term of Ethereum.

Related reading

In his analysis, Borisvest stressed that Binance Ethereum metrics are sending ‘mixed signals’. While short -term indicators reveal the underlying weakness and indecision of investors, longer -term metrics point to resilience and force.

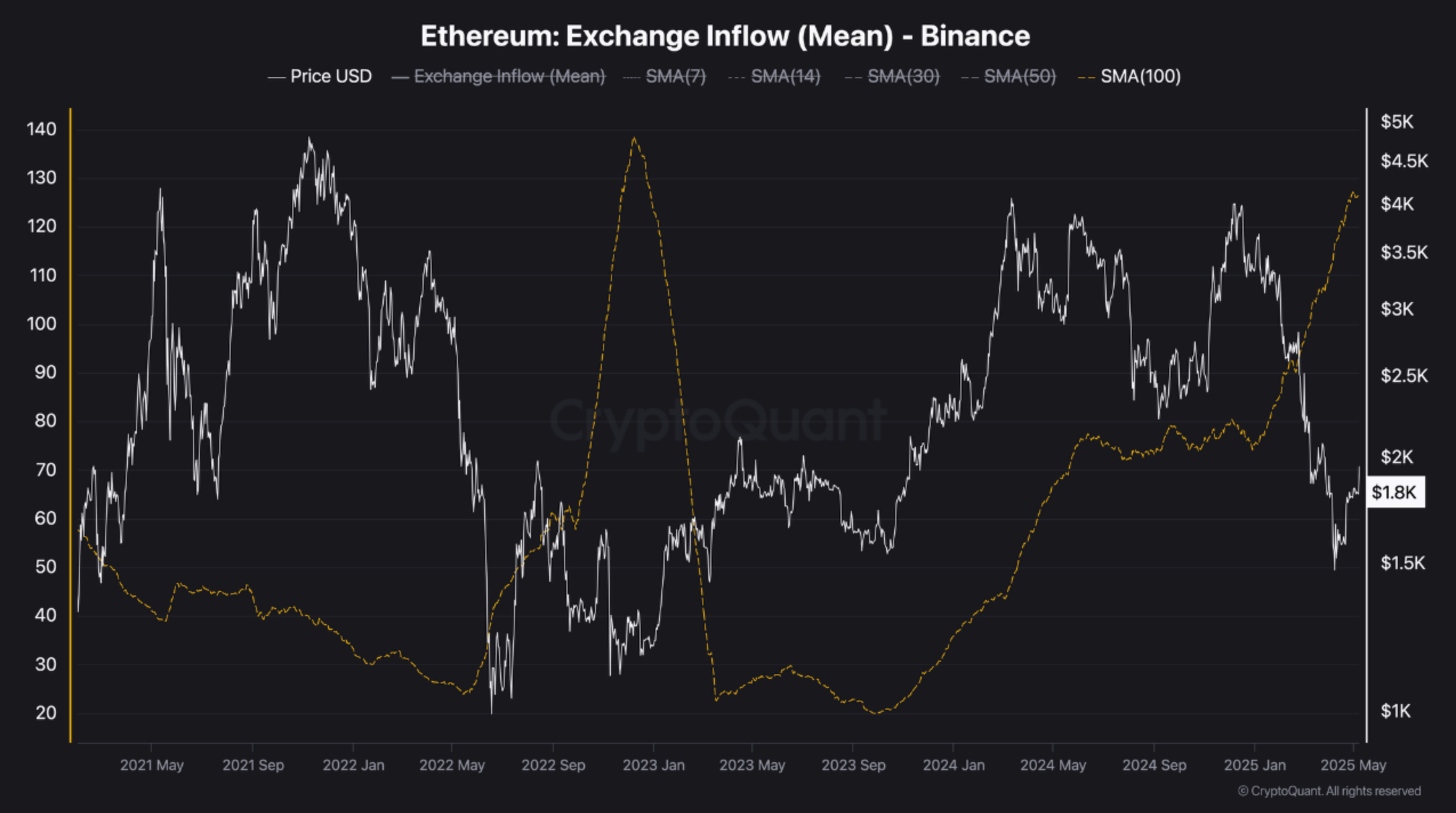

In particular, the average exchange inputs have increased significantly since the late 2024, which suggests a growing sales pressure of retail merchants. This pattern resembles the behavior observed for 2022-2023, when an increase in ETH deposits to exchanges preceded a strong price decrease.

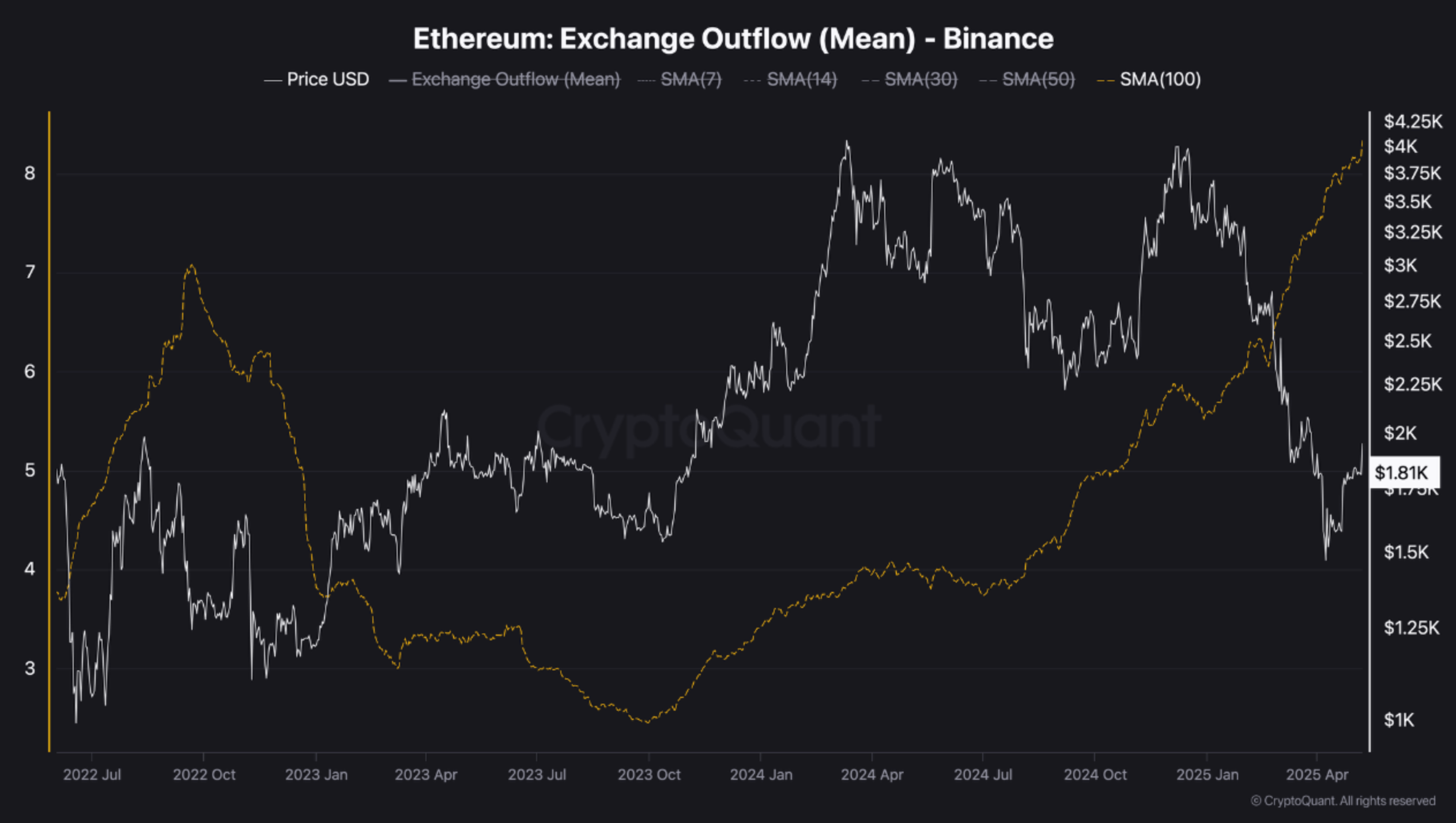

Similarly, the average exchanging exits have also constantly increased since October 2023. However, these output flows are largely linked to whaling wallets, directions that contain large amounts of ETH, which implies that people with high -level values are accumulation instead of selling. This divergence highlights a classic loosen between retail fear and institutional trust.

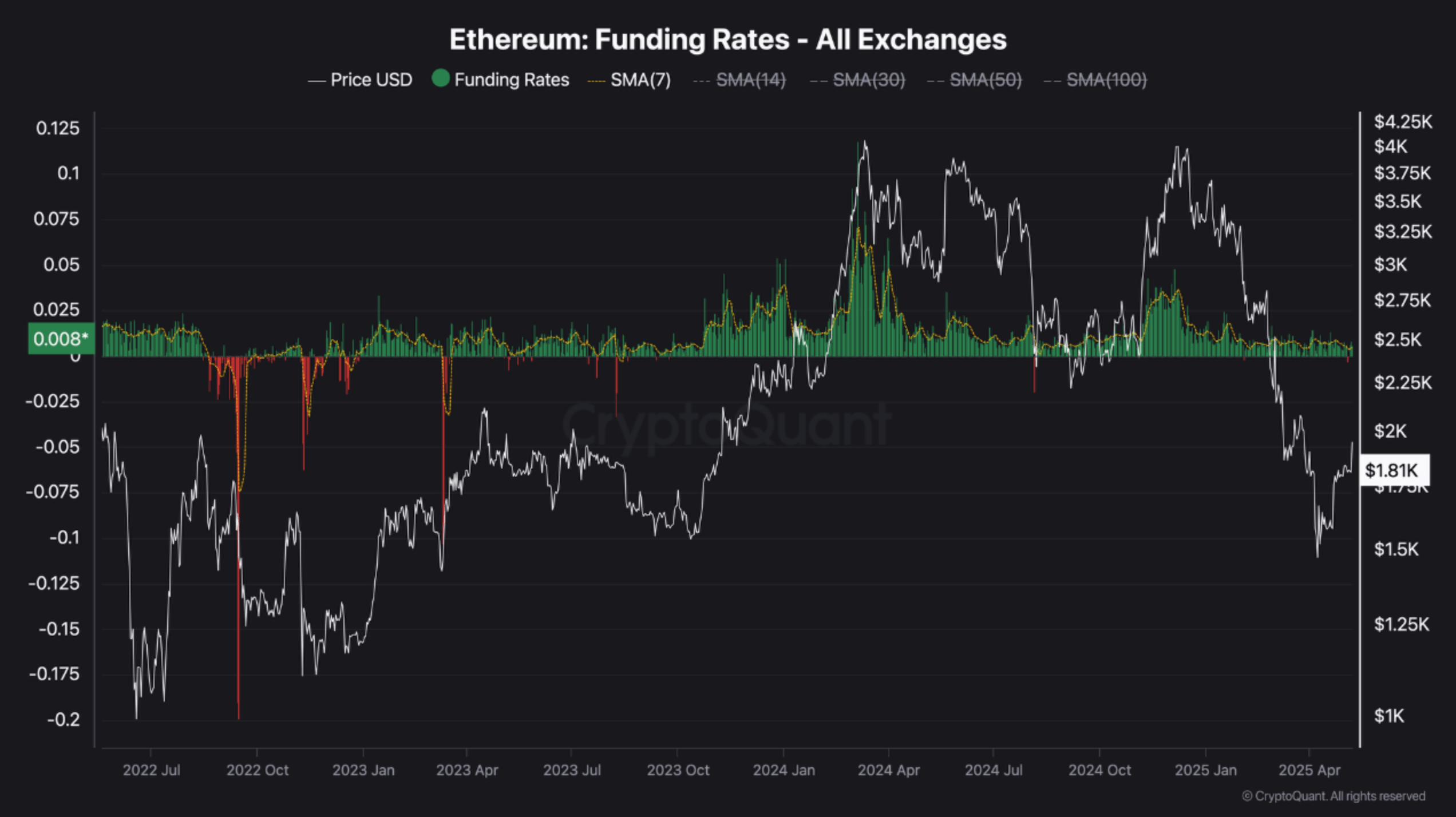

The analyst also pointed out the trends of the financing rate. He pointed out that during the ETH rally $ 4,000 in early 2025, the financing rates became too positive as the upward feeling was strengthened. This long positioning in excess of leverage resulted in a strong correction, which reduced the price of ETH to $ 1,400 in April.

At present, financing rates loom in neutral territory, indicating a lack of clear leverage bias. Borisvest said that if the short interest and financing rates increase below zero, a brief presentation could arise, potentially promoting the highest prices. However, this configuration has not yet been formed.

Meanwhile, the purchase/sale ratio of Taker, which tracks aggressive market orders, showed a strong sale pressure at the end of 2024 and early 2025, just before the strong decline of Ethereum. This relationship is now stabilized, suggesting that sellers can be exhausted and buyers are gradually recovering the force.

Change of fortune for ETH?

Although ETH has dropped 34.3% during the past year, several technical and chain indicators point to a possible investment of bullish trends for the second largest cryptocurrency for market capitalization.

Related reading

For example, Ethereum recently flicked A golden cross in the daily table, an upward indicator that generally leads to the main ascending movements. In addition, there are signs that cryptocurrency may have already touched this market cycle.

That said, uncertainty remains. Recently, Automatic Learning Algorithm Coincodex provided that ETH can witness another accident that can reduce its price to $ 1,500. At the time of publication, ETH is traded at $ 1,966, 7.8% more in the last 24 hours.

Outstanding image created with Unspash, Cryptoquant and TrainingView.com paintings