Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

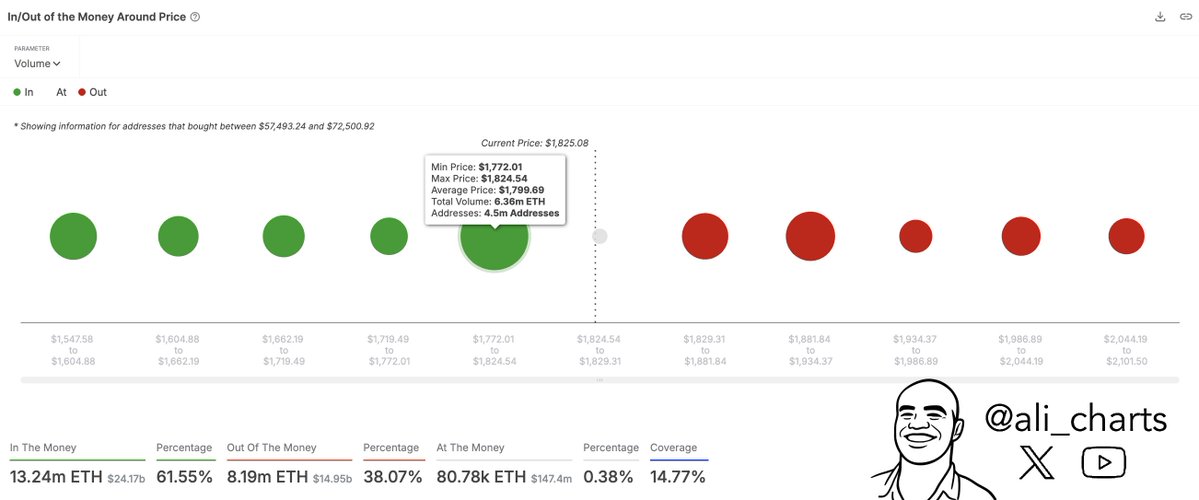

The rapid explosion of bullish impulse in the cryptographic market in the final weeks saw the price of Ethereum closing the month above $ 1,800. However, Altcoin could not finish the month in profits, which made April its fourth consecutive month with a negative performance. According to the latest data in the chain, the price of Ethereum seems to be above a crucial support level, which could determine Altcoin’s trajectory in the coming weeks.

ETH price at risk of falling to $ 1,772

In a May 3 publication on platform X, the outstanding cryptographic analyst Ali Martínez revealed that Ethereum’s price could be at a critical situation that could decide its future in the short term. According to the latest data in the chain, Altcoin runs the risk of falling to around $ 1,500 if you lose this support level in the next few days.

This evaluation in the Ethereum price chain revolves around the average cost bases of several Ethereum investors. In encryption trade, the cost analysis determines the capacity of a price level to serve as support or resistance based on the volume of currencies acquired for the last time by investors in the region.

Related reading

As shown in the previous graph, the size of the point (green and red) represents and corresponds directly to the number of ether tokens bought within a price region. The larger the circle, the greater the amount of tokens bought in the price zone and around, and the stronger the resistance or the support level.

According to Intotheblock data, more than 6.36 million ETH tokens were bought for 4.5 million addresses within the price range of $ 1,772 and $ 1,824 (at an average price of $ 1,799). As explained above, the high purchase activity within this price zone has led to the formation of an important support level just below the current price.

Ethereum’s price is expected to recover when it falls at this level. The reason behind this expectation is that when the ETH price returns to around $ 1,772, it is likely that investors with their cost bases at this level and their surroundings defend their positions by buying more tokens, helping the price to stay afloat of the support region.

However, the prominent table shows that price levels under the support level of $ 1,772 have a significantly less investor activity. This suggests that Ethereum’s price could fall to around $ 1,500 without taking a break if $ 1,772 are violated. On the other hand, the price of ETH could travel to $ 2,100 if this support level remains without providing, since there is no significant resistance ahead.

Ethereum price at a glance

At the time of writing this article, the Token ETH is valued at around $ 1,830, which reflects an increase of almost 1% in the last 24 hours.

Related reading

Istock’s prominent image, TrainingView graphics