This is what the historical trend of Bitcoin’s market value to realized value (MVRV) ratio suggests regarding whether the current bull run is over or not.

Bitcoin’s MVRV Ratio Could Indicate Where BTC Stands in the Current Cycle

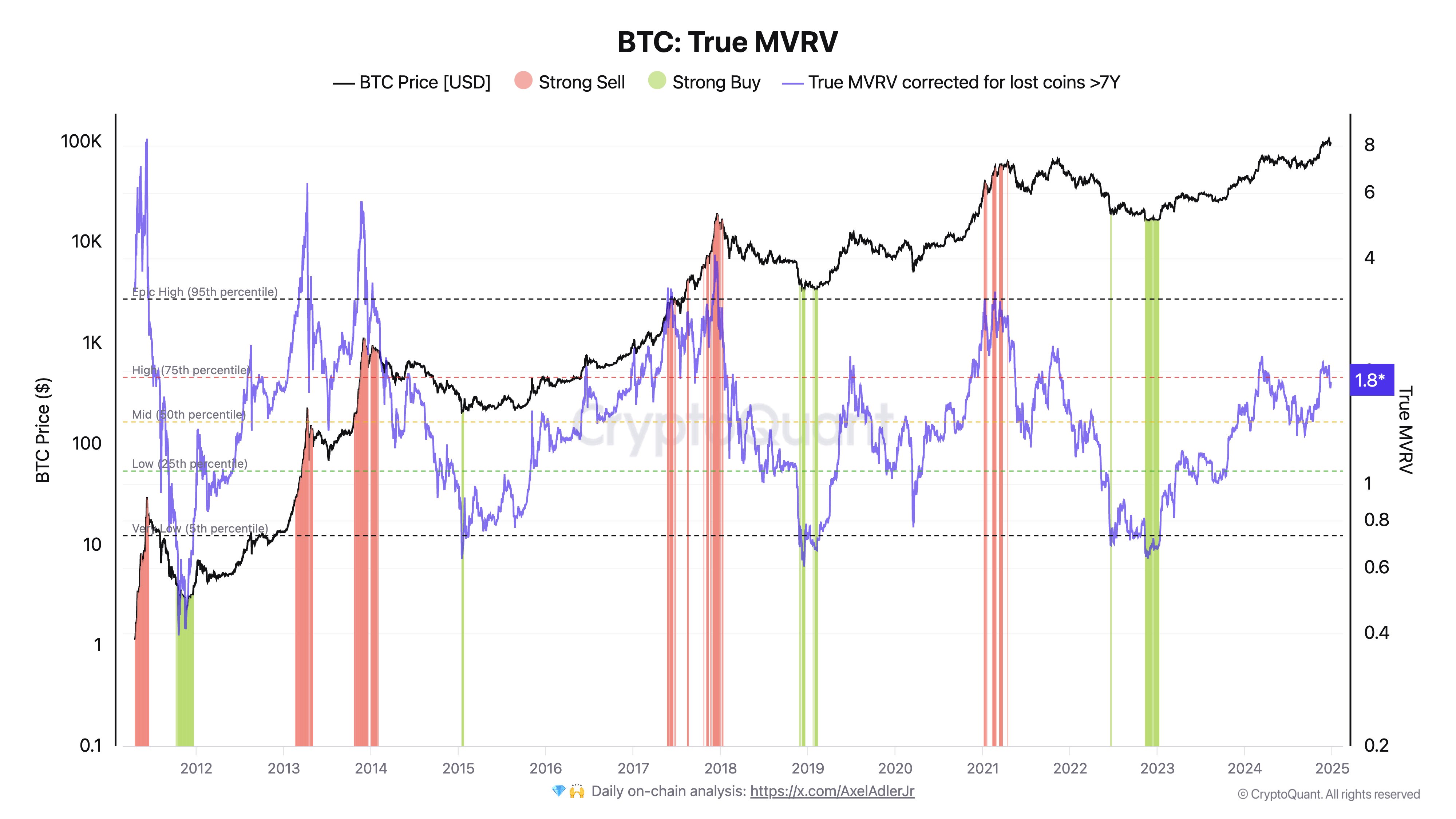

in a new mail On X, CryptoQuant Founder and CEO Ki Young Ju shared a chart showing the above pattern in Bitcoin’s MVRV ratio. He MVRV Ratio refers to a popular on-chain metric that, in short, tracks how the value BTC investors hold (i.e., the market capitalization) compares to the value they initially put into the asset (the made cap).

When the value of the ratio is greater than 1, it means that investors as a whole can be assumed to be in profit. On the other hand, it is below the mark, which implies a predominance of losses in the market.

The version of the MVRV Ratio published by Young Ju is not the normal one, but rather a modified form called “True MVRV”. This variation only takes into account data for coins that were involved in some type of transaction activity during the last seven years.

It can be assumed that coins that are more than seven years old are lost forever, either due to forgetfulness or due to losing the keys to the wallet. As such, the True MVRV, which excludes these coins that will likely never return to circulation, may provide a more accurate picture of the sector than the regular version of the metric.

Now, here is a chart showing the trend of this Bitcoin indicator throughout the history of the cryptocurrency:

As shown in the chart above, Bitcoin True MVRV has risen to relatively high levels during this bull run. This implies that the average investor obtains notable benefits.

Historically, the greater the profits of holders, the more likely they are to participate in a massive sale with the motive of obtaining profits. Therefore, whenever the MVRV ratio increases, BTC is likely to reach a high.

From the chart you can see that the highs of past cycles occurred when the indicator surpassed a specific line. So far, the metric has not come close to retesting this level in recent times.

According to the founder of CryptoQuant, the reason the market capitalization has not overheated relative to realized capitalization yet is that there is still $7 billion in capital inflows entering the Bitcoin market each week.

If the current cycle is going to show something similar to previous ones, then the fact that the true MVRV is high, but not extremely high, could suggest that there is room left for BTC in the current bull run.

BTC Price

Bitcoin has retraced its Christmas rally as its value has dropped back to $95,700.

Fountain: NewsBTC.com