Trust Editorial Content, reviewed by industry leaders and experienced editors. Disclosure of ads

Bitcoin has produced a recently range movement, with prices ranging between $ 83,000 and 86,000. Interestingly, the popular cryptographic analyst Burak Kesmeci has identified the important price levels for any short -term action.

Support to 82,800, resistance to 92,000, but where does Bitcoin go?

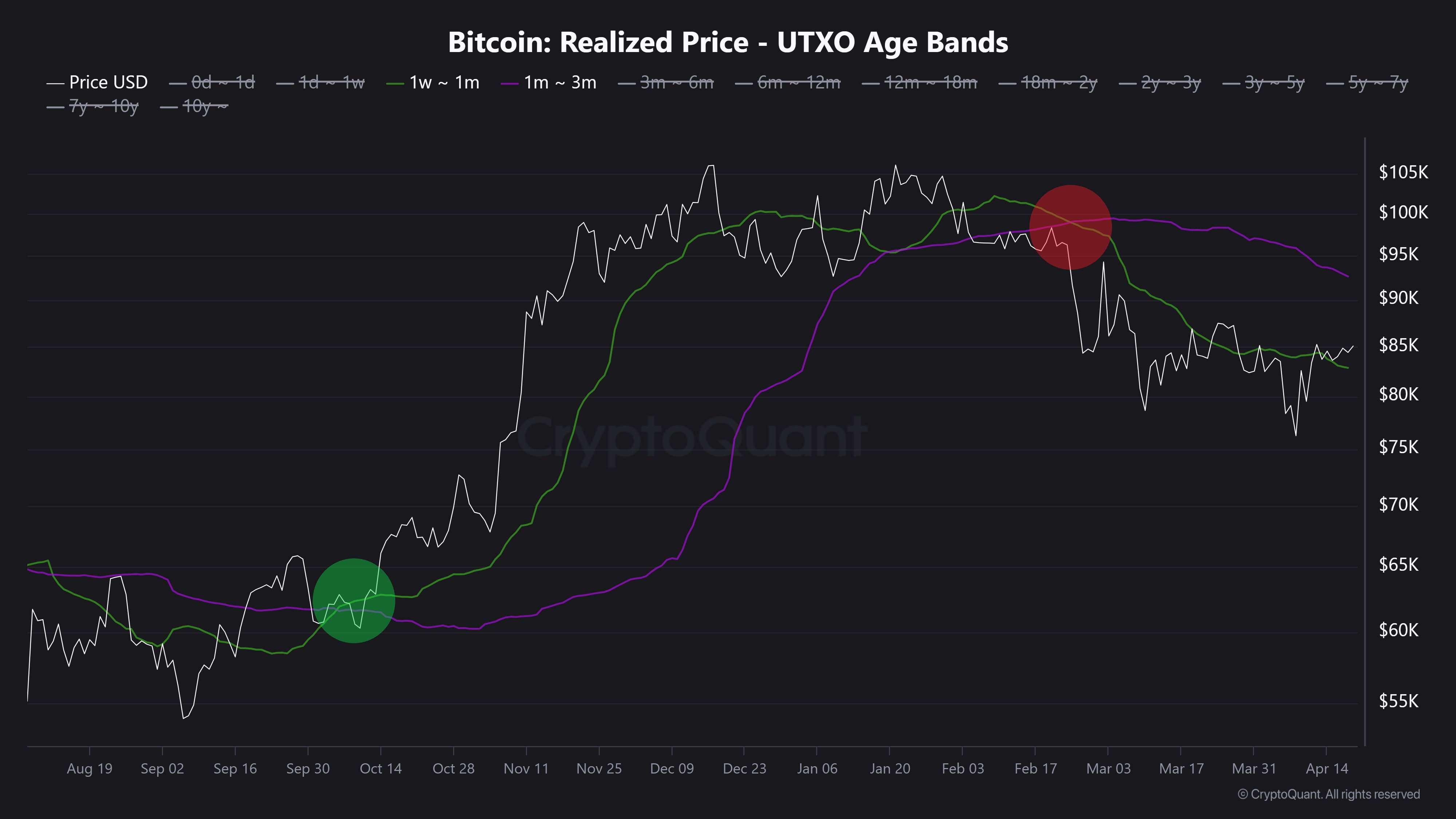

In a new publication about X, Kesmeci shared an interesting analysis in the Bitcoin market chain. Using the short -term investor cost base, the analyst identified two key price levels that could be critical for the next important Bitcoin movement.

First, Burak Kesmeci focuses on the average cost prices of new merchants in the last 1-4 weeks, which are probably the most reactive changes for prices. The price made for these merchants is currently $ 82,800, forming a short -term support that indicates that many recent buyers still have profits and can defend this level as a psychological floor.

Meanwhile, Kesmeci also highlights the price level of $ 92,000, which marks the average cost base for BTC holders for 1-3 months. This price has emerged as an important resistance zone, since investors are likely to leave the market once they reach the balance point. In addition, the price level of $ 92,000 is also marked by a confluence with several technical indicators.

The interaction between these two levels is significant. Historically, short -term bundle trends in BTC tend to begin when the most recent investor costs, from 1 to 4 weeks, crosses above that of 1–3 BTC holders. This change indicates that it increases the trust and the will to buy at higher levels, which often feeds broader manifestations.

However, that dynamic remains to be developed in the current market. From now on, Bitcoin quotes around 85,000, placing it above its support on the average of 1 to 4 weeks of $ 82,800 but still below the resistance of 1 to 3 months of $ 92,000. In addition, both cost levels have decreased in the last two months, which reflects the doubt or lack of aggressive purchases of new participants.

In particular, Kesmeci states that BTC must increase above $ 92,000 to confirm a strong bullish impulse for a price reversion.

Bitcoin 1.725 BTC ETFS download

In other news, Ali Martínez reports that Bitcoin ETFs have suffered withdrawals of 1,725 bitcoin, valued at $ 146.92 million, during the past week. This development illustrates a high level of negative feeling among institutional investors, which adds to the uncertainty of the market around the BTC market.

Meanwhile, Bitcoin quote $ 85,249 after a price change of 0.89% on the last day. The main cryptocurrency also reflects a loss of 0.58% in the weekly graph and a gain of 1.06% in a monthly graph.

Image of Adobe Stock features, TrainingView graphic

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.