Discuss when and how to sell Bitcoin can be controversial, but if you plan to get profits in this cycle, it is essential to do so strategically. While maintaining bitcoin indefinitely is an option for some, many investors aim to capture profits, cover life expenses or reinvest at lower prices. Historical trends show that Bitcoin often experiences 70-80%reduction, providing opportunities to react in reduced assessments.

To see this topic in depth, see a recent YouTube video here: Proven strategy to sell Bitcoin Price peak

Why sell not always taboo

While some, such as Michael Saylor, defenders never sell Bitcoin, this position does not always adapt to individual investors. For those who do not manage billions, taking partial gains can offer flexibility and tranquility. If Bitcoin reaches its maximum point in, for example, $ 250,000 and faces a fairly conservative correction of 60%, it would visit $ 100,000 again, creating the opportunity to re -enter lower levels than we have already seen.

The objective is not to sell everything, but strategically climb outside positions, maximize yield and risk management. Achieving this requires data -based pragmatic decisions, not emotional reactions. But again, if you never want to sell, don’t do it! Do what works best for you.

Key time tools

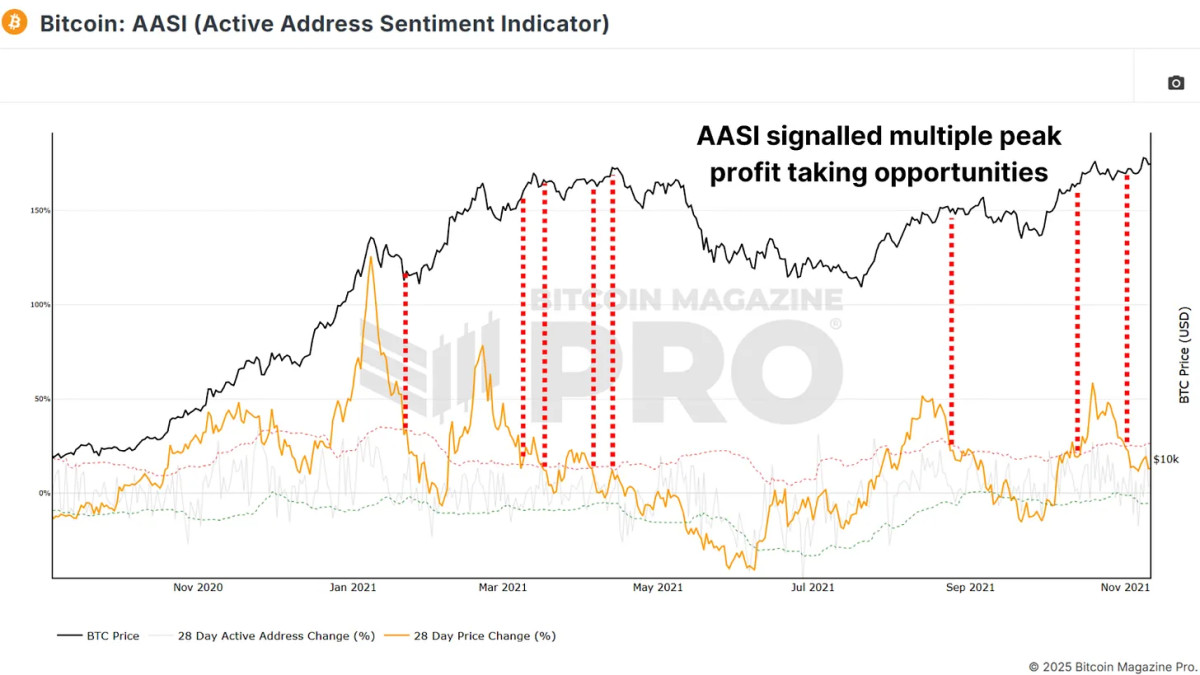

This Active address feeling indicator (AASI) Compare the changes in the network activity with the Bitcoin price movement. It measures the deviations between the price (orange line) and the network activity, shown by green and red deviation bands.

For example, during the 2021 Toro race, signals arose when the price change exceeded the red band. Sales signals appeared at $ 40,000, $ 52,000, $ 58,000 and $ 63,000. Each provided the opportunity to climb as the market overheated.

He Fear and greed index It is a simple but effective feeling tool that quantifies the euphoria of the market or panic. The values greater than 90 suggest extreme greed, often previous corrections, as in 2021, when Bitcoin recovered from $ 3,000 to $ 14,000, the index reached 95, pointing out a local peak.

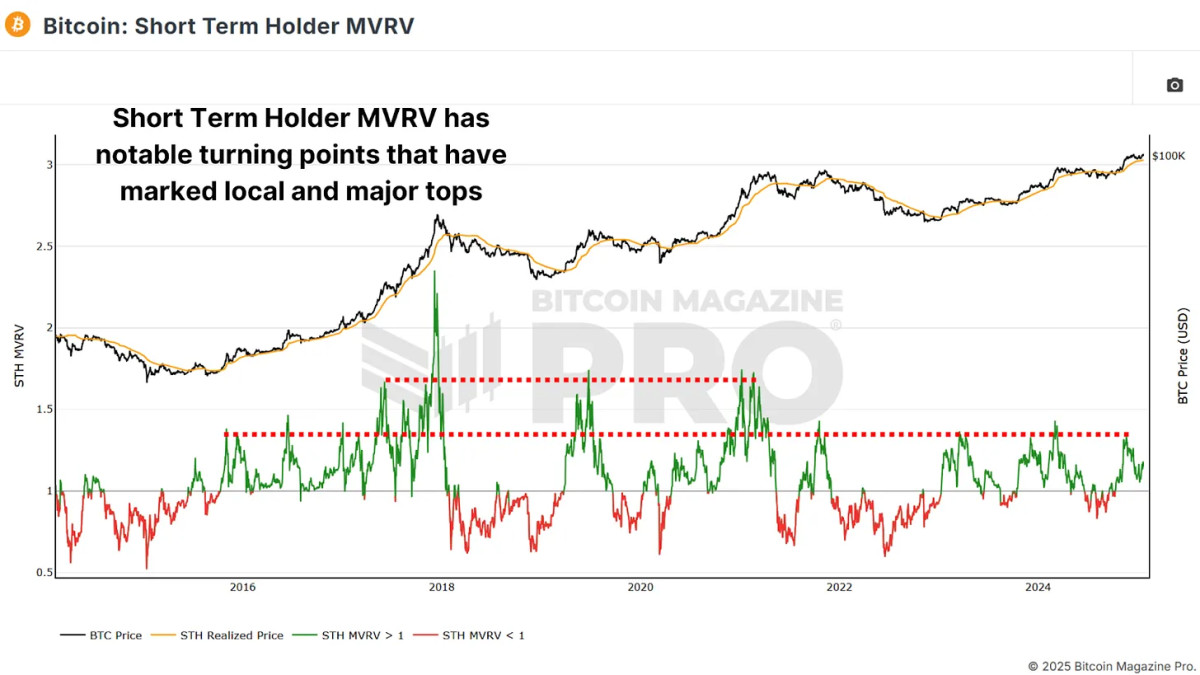

He MVRV short -term holder It measures the unrealized average gain or loss of the new market participants comparing their cost base with current prices. About 33% of the profits levels often mark the reversal and local intracicle peaks, and when the profits not made exceed around 66%, the markets are often overwritten and may be close to the important cycle peaks.

Related: Bitcoin diving data analysis and chain

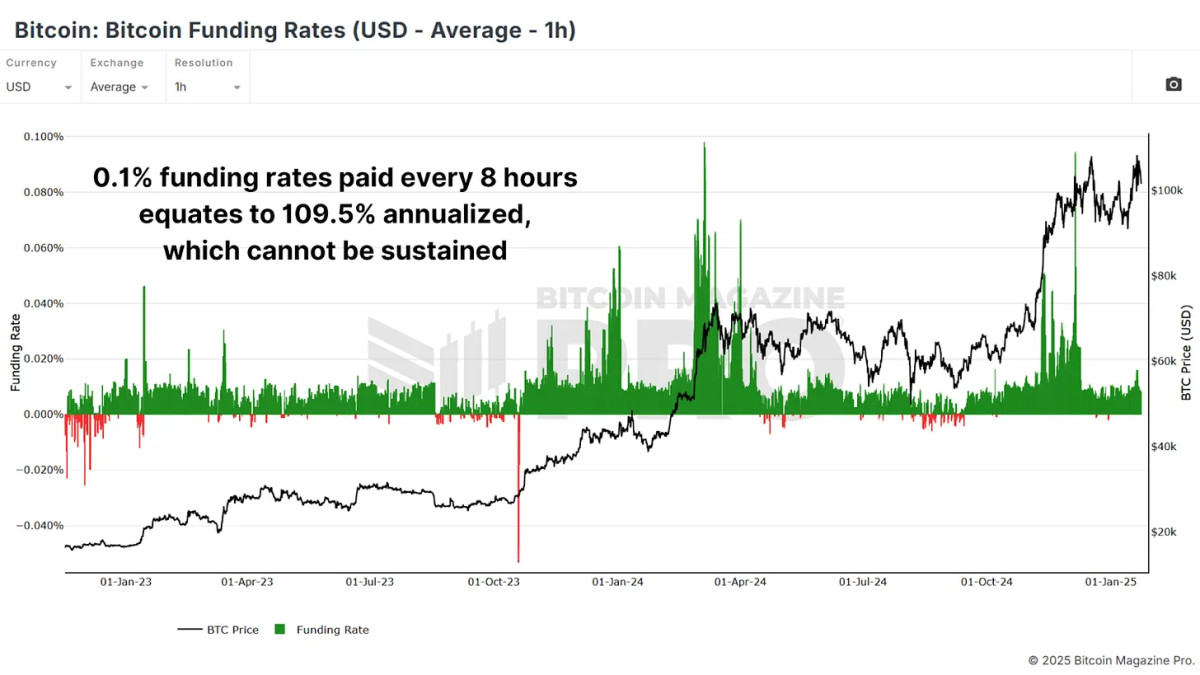

The Bitcoin Financing rates It reflects the premiums that operators pay to maintain leverage positions in futures markets. Extremely high financing rates suggest excessive optimism, often above corrections. Like most metrics, we can see that the hiring of a too euphoric majority generally provides an advantage.

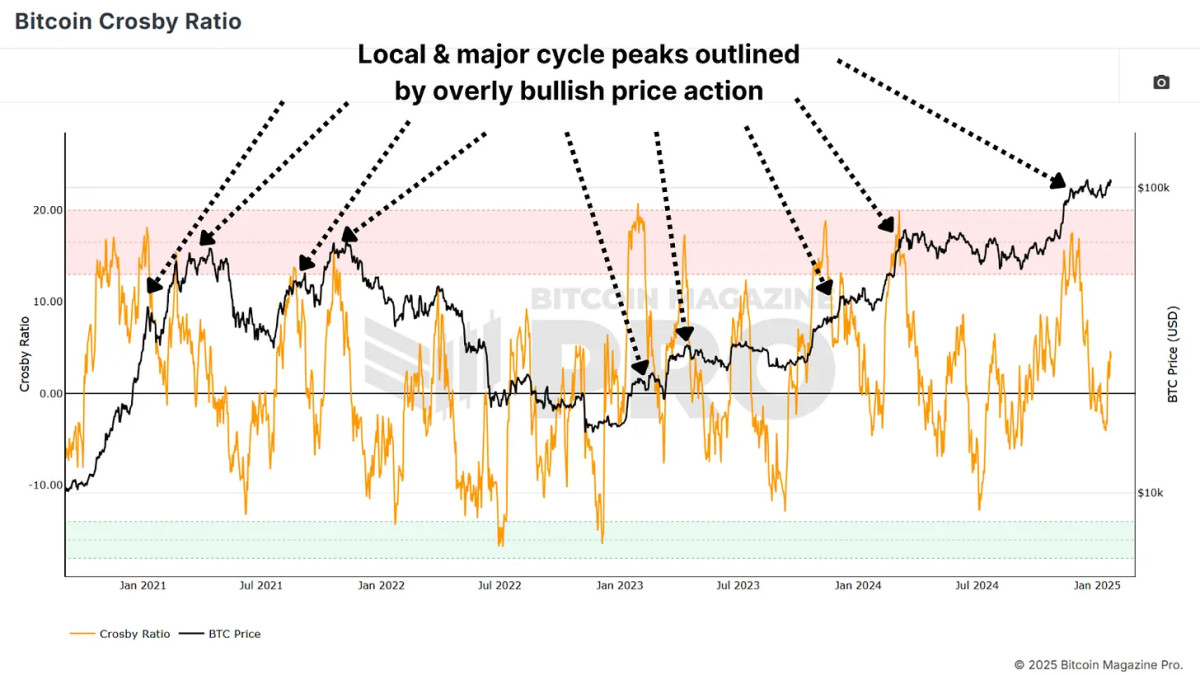

He Crosby ratio It is an indicator based on the moment that highlights overheated conditions. When the relationship enters the red zone in the daily table, or even the lowest deadlines if we use our tradingView version of the indicator, the market inflection points have generally occurred. When these signs occur in confluence with other higher marking metrics, it solidifies the probability of a larger -scale prediction.

Conclusion

The exact time is practically impossible, and no metric or strategy is infallible. Combine multiple indicators for confluence and avoid selling all your position at the same time. Instead, climb in increases as key indicators of the overheated signal of conditions and consider establishing subsequent stops linked to key levels or a percentage of the price movement to capture additional gains if the prices of the prices even higher.

For a more detailed Bitcoin analysis and to access advanced features such as live graphics, alerts of personalized indicators and in -depth industry reports, see Bitcoin Pro Magazine.

Discharge of responsibility: This article is only for informative purposes and financial advice should not be considered. Always do your own research before making investment decisions.