Cryptocurrency investing is an art and a science, but simple strategies can help investors maximize their profits and mitigate their risks. Dollar cost averaging (DCA) is becoming a favorite investment strategy for many retail investors on crypto exchanges like binance. But is it the best strategy for risk versus reward?

What is dollar cost averaging?

DCA is a simple strategy that doesn’t require you to read the market like a financial mystic. You just need to follow the simple investment plan and watch your investment grow. Dollar-cost averaging is when fixed amounts are invested at regular intervals over time.

The goal of the Dollar-Cost Averaging investment strategy is that it balances the ups and downs of the notoriously volatile crypto market. Whether the price goes up or down at the time of investing each month, the cost is averaged over a sufficiently long period of time.

It is a relatively safe strategy and is not a jackpot-seeking technique that will generate huge short-term rewards. But it will set you up for the long run with a sensible and balanced entry point thanks to the law of averages.

How to implement dollar cost averaging?

Dollar-cost averaging involves purchasing a given value of tokens at regular intervals over weeks, months, or even years. It’s really that simple.

That can mean spending $100 every Friday at 10 pm on Dogecoin. Don’t deviate or change the plan unless a news story indicates that it is time to leave your position. Ideally, you should choose to invest in coins that you believe in for the long term, so that any immediate correction is just an opportunity to reduce the average price of your position.

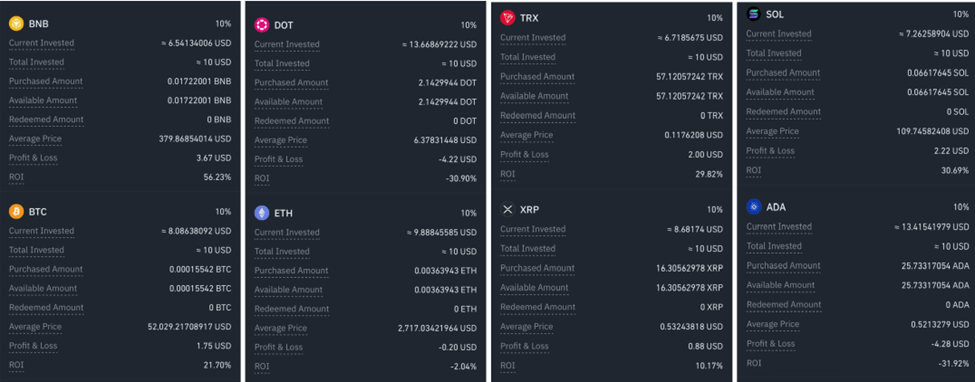

The Binance team recently conducted a dollar-cost averaging experiment to compare the rate of return of coins listed in the Binance CMC Equal-Weighted Top 10 Cryptocurrencies Index. The team funded $10 per month in each coin for a 3-month period as a test. The results were surprising: BNB outperformed all tokens with a gain of 56.23%, while other coins like DOT recorded a loss of -30.90%.

Rachel Conlan, Marketing Director, binanceemphasized the benefits of dollar cost averaging (DCA) for cryptocurrency investors, stating: “With dollar cost averaging, consistency becomes your superpower – it’s all about turning market ups and downs into long-term growth.” “.

Essentially, with this technique, you are guaranteed to buy the ups and downs. Over time, this averages out and you get a solid price per token without having to deal with a complicated crypto market.

While this strategy is easy to implement, it is advisable to only invest in coins that you believe will increase in value over time. If your dollar cost averages on an asset that only decreases in value, you will still end up with a loss on your P&L.

Benefits of Dollar Cost Averaging

DCA encourages a slow and steady approach to cryptocurrencies, which goes against glorified gambling strategies that often leave new investors poorer and disillusioned. This strategy comes with several built-in advantages compared to simply observing the market and picking winners. They include:

Protection against volatility

The cryptocurrency market is famous for brutal price swings that have made people millionaires and bankrupts in equal measure. By making smaller, more regular purchases, investors protect themselves against sudden crises. By design, the DCA strategy means buying the peaks and troughs to ensure a safe price for the tokens.

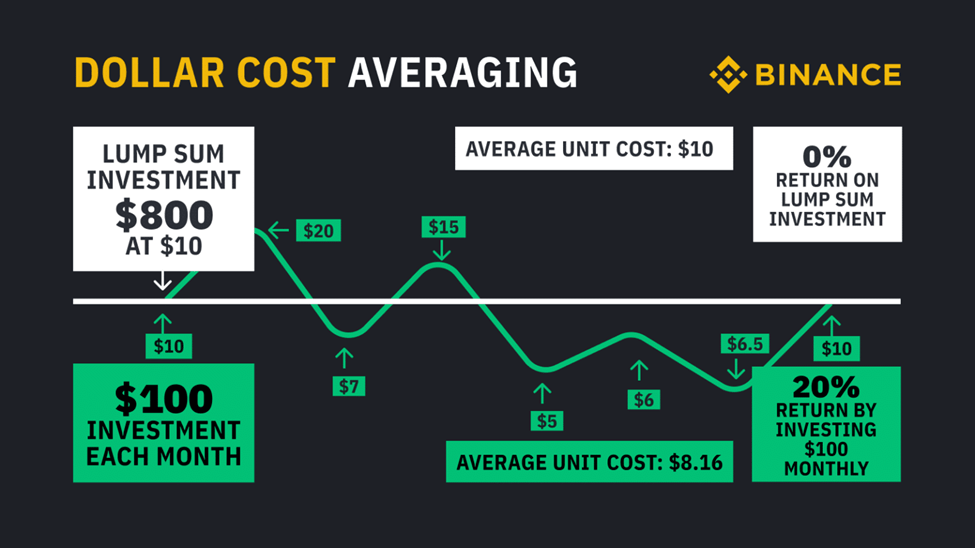

This diagram from Binance perfectly compares the “pick the market” strategy, where you invest a lump sum at the time you feel the coin is delivering value, versus the DCA strategy of investing small amounts frequently and consistently over time. over time. By continuing to buy as the price rises and falls, the average “unit cost” is lower, providing a consistently profitable position.

Take the excitement out of cryptocurrency investing

There are too many stories of people caught up in panic selling, FOMO buying, and chasing losses in the cryptocurrency market. Many of them end badly.. Fear and greed are dangerous emotions when large sums of money are involved, and the DCA strategy simply removes them from the equation.

Simple for new investors

Dollar-cost averaging is a great way for new investors to enter the cryptocurrency market. It is a low-risk strategy that does not require a large amount of money to get started. This is arguably the best way for a newcomer to build a portfolio without endlessly studying options and falling victim to analysis paralysis.

Disadvantages of Dollar Cost Averaging

Missed opportunities in bull markets

The goal of the dollar-cost averaging strategy is that it smooths out cryptocurrency market volatility, but that comes with the built-in cost of missed opportunities. If there is a prolonged bull market and constantly rising prices, investors get fewer and fewer tokens for the same dollar investment. .

Higher entry price

By its very nature, the DCA strategy does not allow you to obtain the best possible entry price. Again, a well-timed lump sum on a dip just before a big recovery will outperform you in terms of performance. But the chances of doing it consistently are very slim.

Not designed for short term boating

DCA is a long-term investment strategy targeting coins that should gain value. Investors attracted by big short-term gains should opt for other strategies. DCA aims to mitigate risk and set up a portfolio for the future. It is not a get rich quick scheme.

Alternatives to Dollar Cost Averaging

While DCA is increasingly popular, there are many other strategies for investing in cryptocurrencies that might be better suited for investors with a higher risk tolerance or more short-term ambitions.

Balloon investing, as the name suggests, means putting your entire investment into the market at once. The best time for this is when investors think the market is in a deep decline, but about to enter a bullish phase. Buy the right dip and the lump sum investment will give you better returns. If done wrong, it could be a painful experience.

Value averaging is a more advanced form of dollar cost averaging that takes into account the price of the currency. If the price goes down, the investor buys more. If it increases, they buy less. This can work as well as dollar-cost averaging, but it is more complex and investors must closely monitor the market for it to work.

So, is DCA the leading strategy?

For newcomers to the cryptocurrency market, the dollar-cost averaging method is arguably the best investment strategy. It is low risk, helps build a portfolio and if investors choose solid coins with growth potential, the chances of losing everything are slim.

It requires no knowledge of the market, and DCA eliminates the danger of emotional investing. DCA sacrifices short-term lottery wins for consistent growth, but that tends to be the best strategy.

Investors with deep knowledge might do better with lump sum investing, sometimes. But not always, and that’s the magic of dollar-cost averaging and why it’s largely considered the best cryptocurrency investment strategy today.