This article is also available in Spanish.

Bitcoin has faced intense selling pressure since Tuesday, following a strong break above the $100,000 mark. The rally, which many investors expected to solidify Bitcoin’s bullish structure, quickly reversed, taking the price to a low of $92,500. The sudden drop has shaken market sentiment, leaving investors cautious about the immediate direction of the crypto market leader.

Related reading

Prominent analyst Axel Adler has shared crucial data on X, highlighting Bitcoin’s closest support levels. According to Adler, the key levels to watch are between $86,800 and $89,700, which represent the price realized by short-term holders. These metrics suggest that Bitcoin is approaching a significant demand zone, where accumulation could take place if selling pressure eases.

As Bitcoin consolidates near these levels, the market awaits signs of stabilization. It remains uncertain whether Bitcoin will be able to recover from this setback or extend its correction. However, the current support levels could serve as a turning point, offering a foundation for bulls to regain momentum.

Bitcoin consolidates between key levels

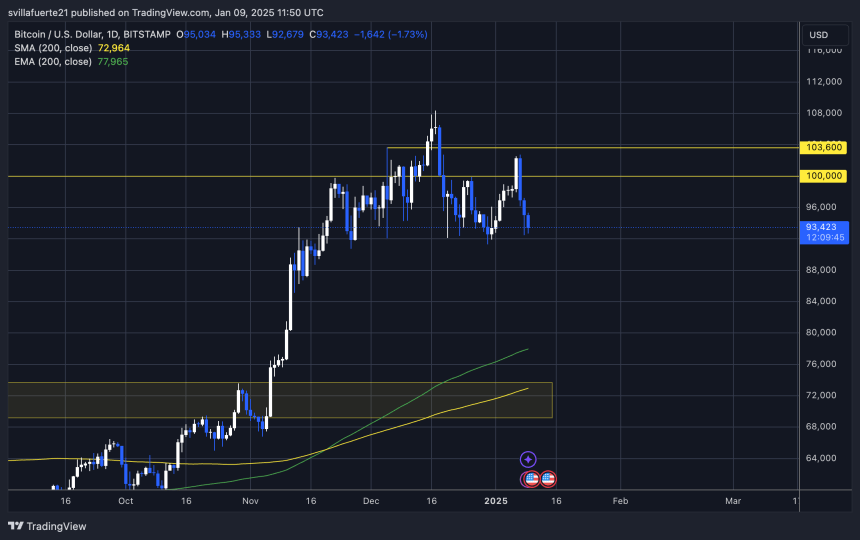

Bitcoin is going through a critical consolidation phase, with the price fluctuating between $100,000 and $92,000. While there have been brief deviations above the $100,000 mark, the market leader has struggled to maintain momentum, raising concerns about a possible drop to areas of lower demand. Investors and analysts alike are closely monitoring this range, with expectations that Bitcoin will find stronger footing below the $90,000 area.

Senior Analyst Axel Adler recently shared thoughts on Xshedding light on Bitcoin’s closest support levels. According to Adler, the Short-term holders Price realized 1M-3M is currently $89.7 thousand, while the widest Price realized by short-term holders It stands at 86.8 thousand dollars.

These levels represent key demand zones that could provide Bitcoin with the fuel needed for its next rally. A drop in these areas would likely attract buyers, setting the stage for a possible reversal.

Related reading

This period of consolidation is considered pivotal for Bitcoin as staying above or reclaiming key levels like $92,000 will determine its trajectory. While overall market sentiment remains cautious, a drop towards these lower support zones could offer a significant accumulation opportunity for long-term investors. The next few days will be crucial in deciding whether Bitcoin can stabilize and prepare for a new bullish momentum.

BTC faces critical test of support below $95,000

Bitcoin is trading at $93,400, navigating a precarious position as it faces increasing risk with each passing moment below the $95,000 mark. After a brief rise above $100,000 earlier this month, the bulls lost control and failed to hold support above this psychological level. This drop has left Bitcoin vulnerable to further declines, with investors closely watching key support levels.

For the bulls to regain momentum, reclaiming the $95,000 level is crucial. Beyond this, the $98,000 mark must also be retaken to confirm a bullish consolidation and a sign of strength in the market. Until then, uncertainty looms, and Bitcoin’s current range reflects a lack of decisive control by either party.

Related reading

The critical support level of $92,000 now acts as a short-term safety net. However, losing this level would expose Bitcoin to lower demand zones around $85,000, a key area that could attract buyers and stabilize the price. The next few days will be crucial as Bitcoin recovers or risks a deeper correction.

Featured image of Dall-E, TradingView chart