People tend to celebrate periods of low feerates. It is time to clean the house, consolidate any utxes that you need, open or close any ray channel that has been waiting and register a stupid 8 -bit jpeg in the block chain. They are perceived as a positive moment.

They are not. We have seen an explosive appreciation of prices in recent months, finally reaching the reference point of 100k USD that everyone took as anticipated during the last market cycle. That is not normal.

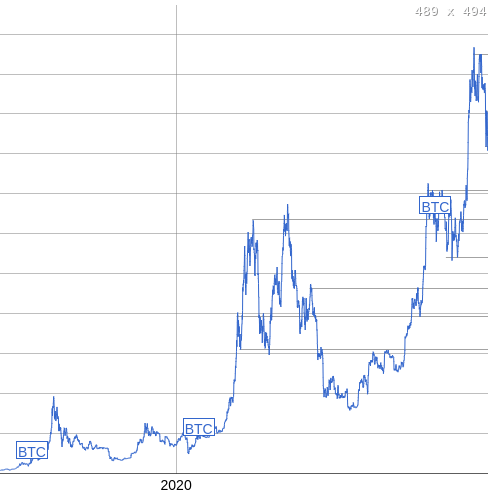

The image on the left is the average of Feerrate every day since 2017, the image to the right is the average price every day since 2017. When the price pumped, when it was very volatile, we have historically seen Feerates Spike accordingly. It usually coincides with growth and its maximum point when the price did. People who really buy and sell transactions in the chain, people took custody of their own coins when they bought them.

This last leg up to more than 100k does not seem to have had the same proportional effect on feeratos as even movements in this cycle have. Now, if you really looked both graphics, I am sure that many people go “What if this cycle is at the end?” It is possible, but let’s say it is not for a second.

What more could this indicate? That participants who drive the market are changing. A group of people who used to be dominated by individuals who self -written, who administered their risk of contrast by eliminating exchanges, who generated a time -sensitive chain activity, are becoming a group of people who simply go through ETF actions that do not need to establish anything in the chain.

That is not a good thing. Bitcoin’s very nature is defined by users who interact directly with the protocol. Those who have private keys to authorize transactions that generate income for miners. Those who receive funds and verify transactions against consensus rules with the software.

Both things that are eliminated from the hands of users and placed behind the veil of the custodians put at risk the stability of the nature of Bitcoin.

This is a serious existential problem that must be solved. All the stability of the consensus around a specific set of rules is based on the assumption that there are enough independent actors with separate interests that diverge, but are aligned in a value obtained when using that set of rules. The smaller the group of independent actors (and the bigger the group of people who “use” Bitcoin through these actors as intermediaries), the more practical it is for them to coordinate them to change them fundamentally, and the more likely it is that their interests as a group will be given in synchronization of the interests of the largest groups of secondary users.

If things continue to tend in that direction, Bitcoin could very well incorporate anything that those of us here today can. This problem is technical, in terms of climbing Bitcoin in a way that allows users to have independently the control of their funds in the chain, even if only through the worst resource, but it is also a problem of incentives and risk management.

The system should not only climb, but must be able to provide ways to mitigate the risks of self -commission to the degree to which people are accustomed to the traditional financial world. Many of them really need it.

This is not just a situation of “doing the same thing I do because it is the only correct way”, this is something that has implications for the fundamental properties of long -term bitcoin.

This article is a shot. The opinions expressed are completely from the author and do not necessarily reflect those of BTC INC or Bitcoin magazine.