This article is also available in Spanish.

In a market breakdown shared In X, the founder of Independent Commerce and Zero Complexity of Trade Korophhh Khaneghah points out a handful of critical cryptography graphics that he believes could dictate the next great market movement. Khaneghah, which has invested in more than 50 new companies, emphasizes that the graphics for BTC/USD, BTC domain (BTC.D), total2, ETH/BTC and SOL/BTC provide invaluable ideas about the current condition of the cryptographic market and the possible future changes.

BTC/USD: Definition of the encryption market

Khaneghah identifies BTC/USD as the criteria for measuring at which stage of the bull directs the market. According to your opinion:

“This decides in which stage of Toro’s career we are.

– Breaks above ATH summarizes The Bull Run

-Consolidation under ATH -> Altcoins enter accumulation zones

-The main structural parts -> Time to become bassist “

It suggests that merchants begin by determining in which of the three market environments is Bitcoin: a furious upward market, a consolidation phase or a structural recession. Currently, Khaneghah VE BTC/USD “that extends below the maximums of all time, leaving some important high trends”, which often presents a recovery scenario for Altcoins or a phase of prolonged accumulation ahead of the next attempt Bitcoin to break the maximum of all time.

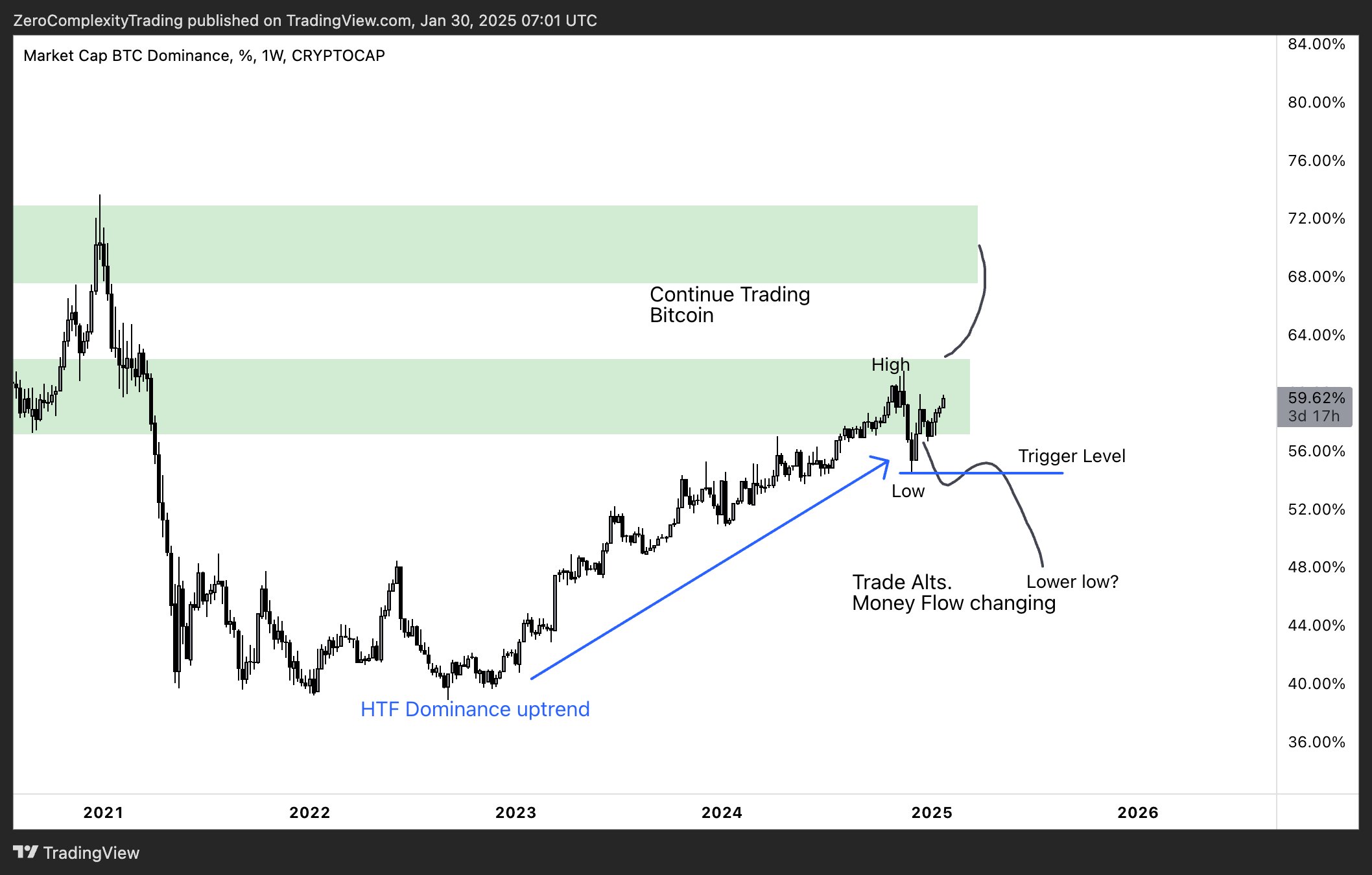

BTC domain (BTC.D)

To clarify if Altcoins is ready for a significant movement, Khaneghah resorts to BTC’s domain. As he explains: “Btc.d (Bitcoin domain) traces the participation of Bitcoin in the total capitalization of the cryptography market.” Increase domain = BTC exceeds and the latest altcoins (the same for the rise and the disadvantage). Domain decrease = BTC cools and money flows to Altcoins “.

The increase in domain generally means that Bitcoin is absorbing most of the liquidity of the market. Meanwhile, a fall in BTC.D often suggests that Altcoins is about to see higher capital entries.

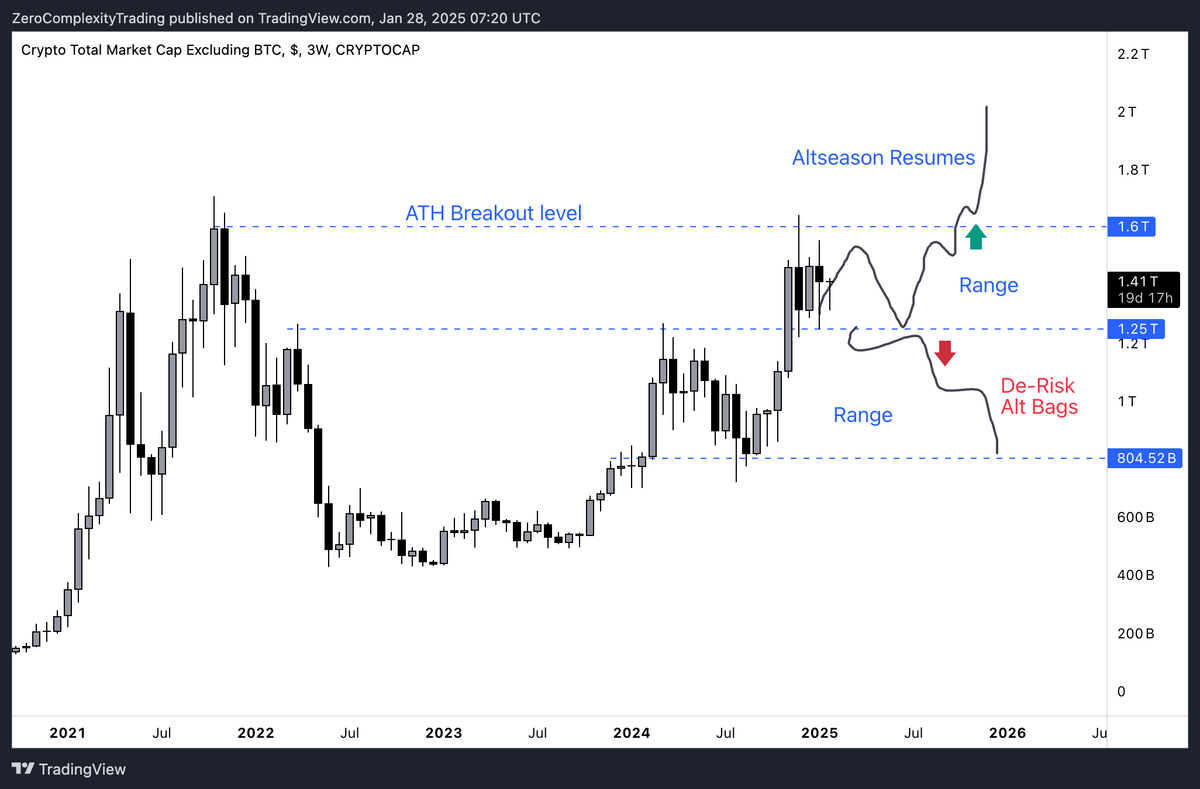

Crypto Market Captain, excluding Bitcoin (Total2)

The total chart2, which excludes bitcoin from the total capitalization of the market crypto, is key to analyze Altcoin’s behavior. Khaneghah advises: “When BTC.D falls, total2 increases because capital is turning Altcoins. When total2 explodes, look long in the strongest altcoins, turn out of Bitcoin and change the capital to Alts again. ”

He emphasizes that the most probability operations come from the moments of identification when the market revolves away from Bitcoin. In these cases, merchants can see stronger returns by entering Altcoin positions instead of remaining mainly in BTC.

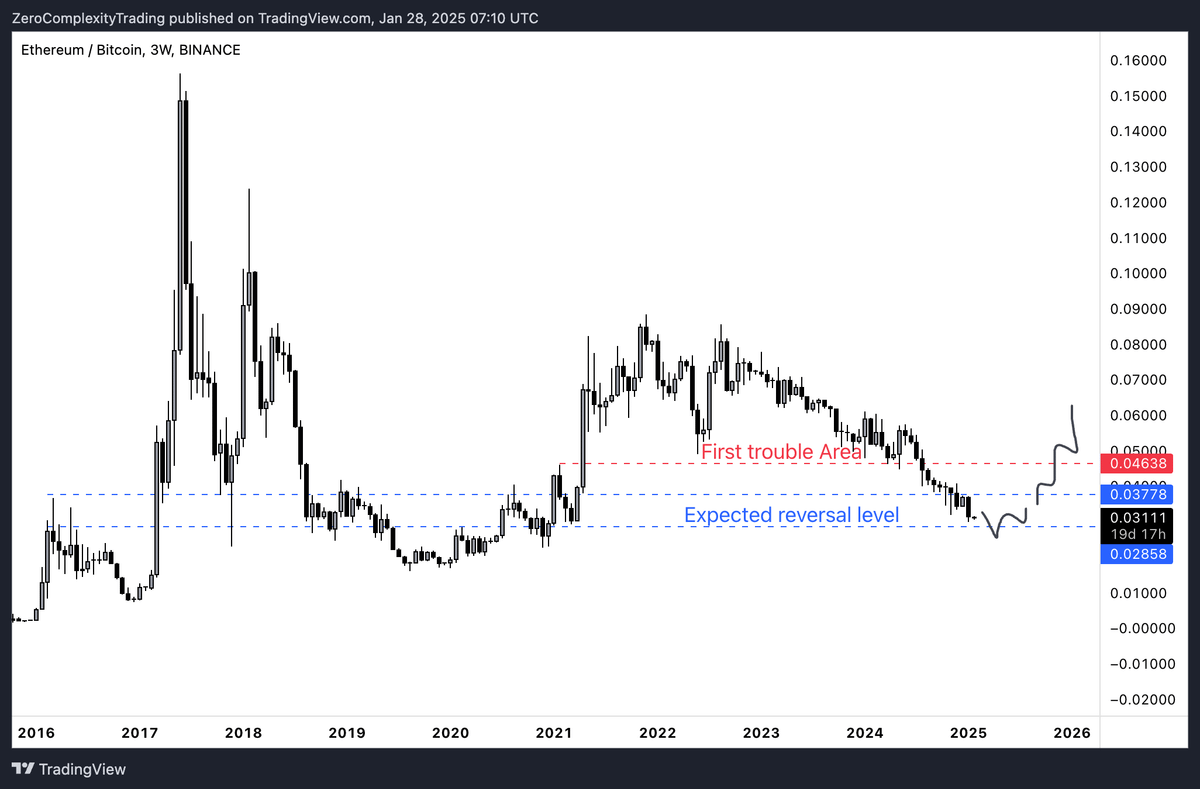

ETH/BTC

Khaneghah emphasizes that ETH/BTC is a useful barometer for a broader Altcoin feeling: “Altcoin’s best moves occur when ETH/BTC stops tending down because market confidence in Alts returns here.”

When Ethereum is surpassing Bitcoin or stabilizing against him, he generally causes the confidence that Altcoins could experience manifestations, often called “alternative season.”

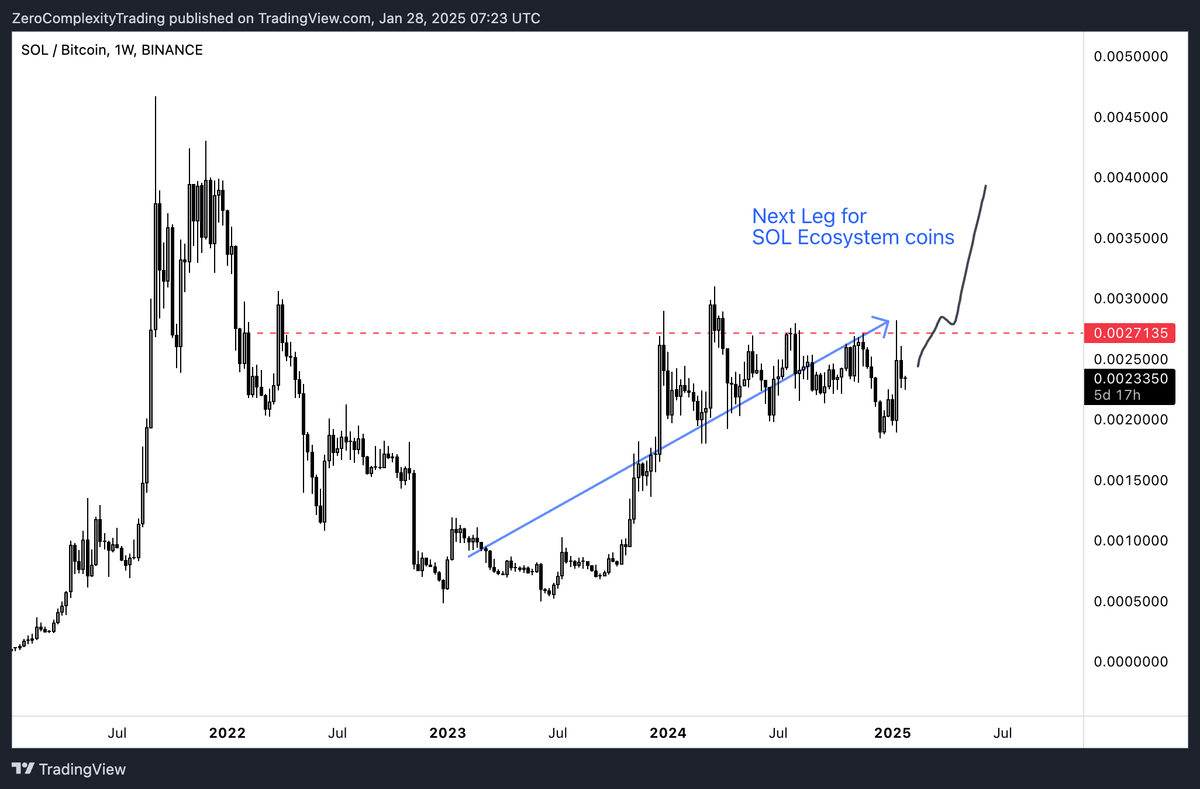

SOL/BTC

Khaneghah also shines in Sol/BTC, suggesting that Solana’s yield in relation to Bitcoin could remod Inside the SO ETH ecosystem. People will think that Sol has “pumped already”, but I like to buy coins with force, instead of buying coins that could capture an offer. “

While Solana has published significant profits, Khaneghah believes that his strong performance could continue. He points out that if Solana maintains a higher performance than Bitcoin, some capital could move away from ETH, potentially amplifying the activity throughout the sun ecosystem.

At the time of publication, BTC quoted at $ 105,026.

Outstanding image of Shuttersock, TrainingView.com graphics