Although the details of the proposal of cryptography reserves of the president of the United States, Donald Trump, have not yet been revealed; Recently, XRP, Solana (Sol), Cardano (ADA), Bitcoin (BTC) and Ethereum (ETH) as part of a strategic crypto reserve of the United States planned. The announcement attracted several reactions of the community.

What is the strategic encryption reserve?

The strategic Crypto reserve is a national storage of digital assets aimed at strengthening the digital asset sector and reinforcing the leadership of the United States in financial innovation. As part of a broader effort to integrate cryptocurrencies into the financial infrastructure of the US, the initiative aims to raise the digital asset sector and support financial stability, inflation coverage and strengthen the position of the United States in the global encryption market.

Market response

After the ad

Trump’s announcement of a strategic Cryptography reserve of the USA. Uu. It led to an acute but temporary increase in cryptocurrency prices:

- Bitcoin (BTC): Increased 11% to $ 95,084

- Ethereum (ETH): It rose 14% to $ 2,541

- Solana (Sol): 26% shot at $ 180

- CARDANO (ADA): 71% shot at $ 1.15

- XRP (Ripple): increased 37% to $ 3

However, these prices were removed slightly as investors weighed the viability of the cryptographic reserve proposed by Trump.

Due to skepticism:

In an article by BloombergHe highlighted how skepticism about the proposal and concerns about imminent tariffs in the United States in Mexico and Canada led to market prices to come down again.

Investors questioned the inclusion of XRP, Sol and Ada in the reserve, which led to a wide sale that deleted most of Sunday’s profits. Bitcoin fell almost 9%, while Ether, XRP, Sol and Ada saw more pronounced decreases.

The uncertainty of the market was promoted by the lack of details about the implementation of the reservation and the fears of Trump’s commercial policies. Meanwhile, Trump’s ties with the key cryptography figures, including Brad Garlinghouse of Ripple and the Solana memecity ecosystem, raised concerns about the political influence on the reserve tokens selection.

Prices as of March 4, 2025, 1:00 pm (one day after the ad)

- Bitcoin (BTC): $ 83,537.23 (decreased by 10.0% in the last 24 hours)

- Ethereum (ETH): $ 2,083.34 (decreased by 14.8% in the last 24 hours)

- Solana (Sol): $ 136.93 (decreased by 19.3% in the last 24 hours)

- Cardano (ADA): $ 0.801 (decreased by 24.7% in the last 24 hours)

- XRP (Ripple): $ 2.30 (decreased by 17.6% in the last 24 hours)

In addition, the cryptographic market saw $ 1.07 billion in liquidations as Bitcoin fell below $ 87K, reversing the earnings of the announcement of the Trump cryptographic reserve, with high leverage, weakness of the stock market and the profits that feed the sale of the sale of the sale of the mass sale.

According to Carlos Tapang, CEO of Stable Rock, citing Anthony “Pomp” Pompliano, cryptographic projects and lobbyists co -opted for President Trump to frame his tone in a cryptographic reserve of “América First”, convince him to include tokens perceived as “made in the United States.” Pomp revealed that the experts who met with Trump confirmed this strategic attraction, which initially doubted would work, believing that Trump’s advisors understood Bitcoin’s geopolitical importance.

However, TaPang also acknowledged that these cryptographic projects overlooked traditional lobbying and took advantage of direct connections with Trump, their family and administration officials to ensure an exit liquidity opportunity backed by taxpayers for their ecosystems.

- Brian Armstrong, CEO, Coinbase

- It supports a Crypto of the United States. UU. Solo Bitcoin, arguing that BTC is the only digital asset comparable to gold as a reserve asset.

- It suggests an index weighted by market capitalization as an alternative.

- Tyler Winklevos, co -founder:

- Winklevos also supports a bitcoin only approach, recognizing the usefulness of other cryptocurrencies, but states that they do not meet the standard for a national reserve.

- Jason Calacanis, VC, Podcast “All-In”

- He dismissed the proposal as a “triumph bomb” and called it a “crazy jar” that benefited cryptography holders instead of the public.

- Joe Lonsdale, co -founder, Palantir

- While he was a Trump supporter, he firmly opposed the plan, describing him as “not the right and mainly the government.”

- He also criticized the potential financing of taxpayers for cryptographic investments.

- Molly White, cryptographic researcher

- She said the measure was more about pumping cryptography markets than to benefit Americans.

- He also suggested that tax money could be better spent elsewhere.

- Jeff Park, strategist, bitwise

- He warned that including multiple Altcoins was a great error of political calculation.

What should be included in cryptography reserves?

The local web community shared Its views on which cryptocurrencies should be included in the reserve, since the terms of the Crypto reserve of the United States are still ending.

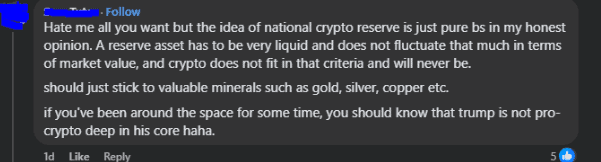

The comments have mixed reactions, with some that support the inclusion of XRP, Solana, Cardano and Hbar in a cryptography reserve of the United States, others that advocate only for Bitcoin, and the skeptics question the viability of a national cryptography reserve, while some discard Trump’s pro-Crypt position as a shit market expectation.

In January, after Trump signed an executive order that established a “National Reserve of Digital Assets” to promote digital assets, Bitpins compiled a list of US cryptocurrencies that could be included in the National Crypto Reserve of the United States.

- This includes Major Cryptocurrencies Such as XRP, Solana (Sol), Usdc, Cardano (Ada), Chainlink (Link), Avalanche (Avax), Hedera (Hbar), Stellar (XLM), sui (sui), Polkadot (dot), Litecoin (LTC), UNISWAP (UNISWAP (UNIS) (Near), Official Trump (Trump), and Aptos (Apt).

This article is published in bitpins: the industry reacts to the inclusion of Trump of Tokens no bitcoin to encryption reserve plans

What else is happening in Crypto Philippines and beyond?