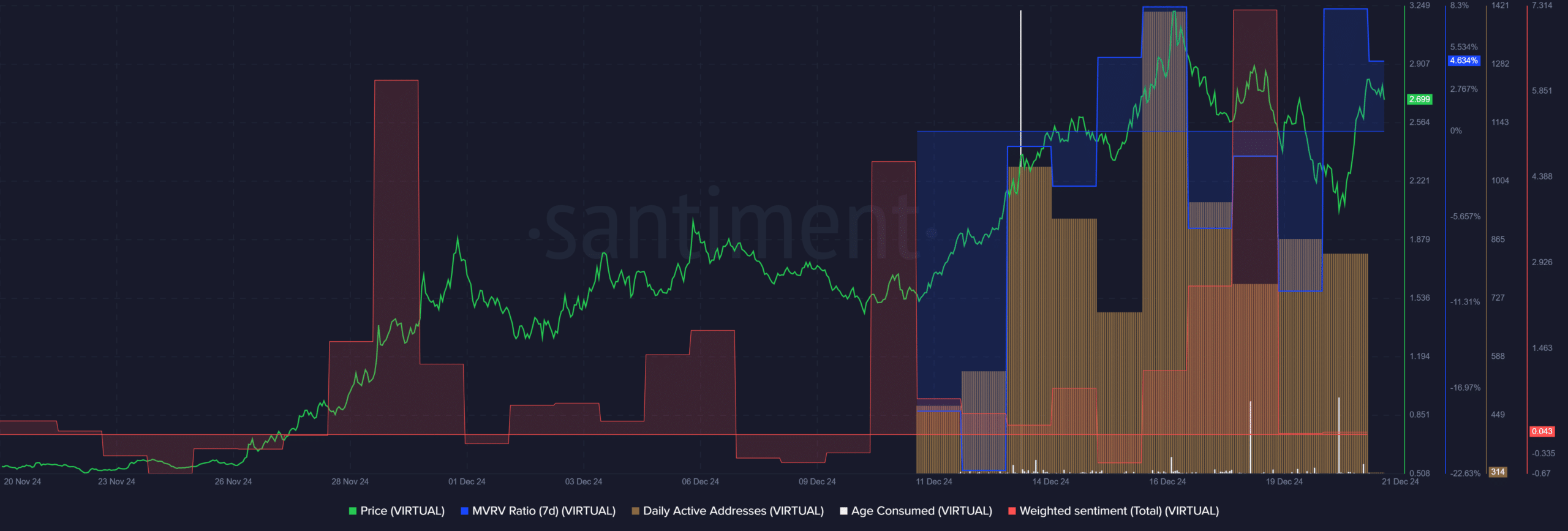

- Virtuals Protocol experienced two spikes in its consumed age metric during the pullback

- Quick recovery from local bottom gave bulls some hope

Virtual Protocol [VIRTUAL] has performed remarkably well over the past month. It recovered 33% from its recent lows, and the bulls were eager to rally again after the recent pullback.

However, it is worth noting that on-chain metrics showed relatively high participation and some profit-taking activity recently.

VIRTUAL ready to march higher

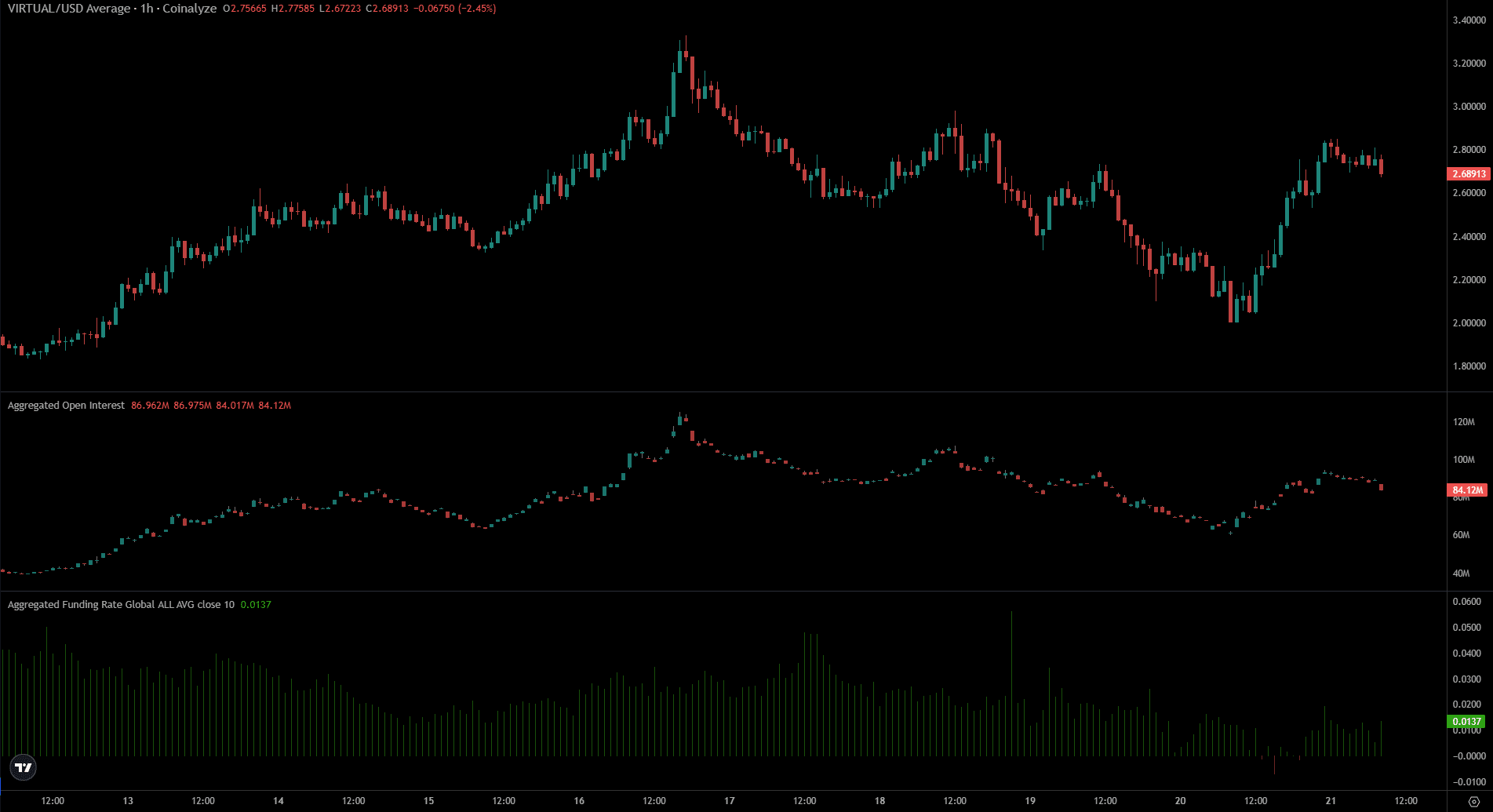

Source: VIRTUAL/USDT on TradingView

The market structure on the daily chart was bearish after the drop below the most recent December 15 low of $2.28. Fibonacci levels plotted based on the December move from $1.21 to $3.32 highlighted $2.02 and $1.66 as key retracement levels.

The Awesome Oscillator on the daily chart formed red bars over the past few days to suggest that bullish momentum has been weakening. However, a crossover below neutral zero has not yet occurred.

The CMF stood at -0.02, but did not indicate significant capital inflows or outflows from the market in recent days. Trading volume saw a spike in early December, but remained just above 1.1 million VIRTUAL trades each day.

On-chain metrics showed bullish sentiment has slowed

Source: Sentiment

Not only has the Awesome Oscillator fallen further, but the weighted sentiment has also fallen dramatically. On December 18, he was very optimistic, based on participation on social networks. However, it has since returned to the neutral level. Daily active addresses also saw a decline from a few days ago, but still remained above 800.

The age consumed metric saw two spikes in the past three days, but they were not as large as those seen earlier this month. That was when the Virtual Protocol token was in a strong uptrend. This can be interpreted as evidence of some selling pressure.

Source: Coinalyze

Finally, futures data also showed room for growth. Despite VIRTUAL’s rapid jump in the past few hours, the funding rate was not extremely high. This suggested that sentiment was bullish and that the difference in spot and perpetual prices was small.

Realistic or not, here is the market capitalization of VIRTUAL in terms of BTC

Open interest saw a 33% increase in the last 24 hours, while the price rose 27%. This also highlighted the bullish momentum and speculative enthusiasm. If the CMF rises above +0.05, it would be another sign of buying dominance.

Fountain: