This article is also available in Spanish.

In a remarkable show of resilience amid a largely weakened crypto market, XRP is up 6.7% in the last 24 hours. After a drop as low as $1.90 on December 10, the asset is trading back above $2.36, challenging the predominantly bearish sentiment that has gripped the altcoin sector.

While most altcoins posted losses or traded sideways over the same period, with Bitcoin posting only a modest 0.7% gain, XRP’s recent outperformance stands out as a clear anomaly. So why is XRP outperforming the cryptocurrency market?

#1 Imminent launch of Ripple’s RLUSD stablecoin

A key catalyst behind the XRP rally appears to be the impending launch of Ripple’s long-discussed stablecoin RLUSD. Yesterday, Ripple CEO Brad Garlinghouse confirmed through X that RLUSD had obtained critical regulatory approval. He said, “This just in… we have final approval from NYDFS for RLUSD! Exchange and partner listings will be available soon, and reminder: when RLUSD is active, you will hear from Ripple first.”

Related reading

RLUSD, currently in beta testing on both the Ethereum network and the XRP Ledger (XRPL), has sparked excitement within the XRP community. Members speculate that the introduction of the stablecoin could catalyze greater liquidity and utility for XRP, and anticipation may be contributing to a rise in speculative interest and so-called “FOMO” (fear of missing out).

#2 Strong XRP On-Chain Activity

Santiment’s on-chain analysis points to encouraging metrics for XRP. the signature noted that “the average dollar investment age is sending a bullish signal,” highlighting that younger currency age distributions often precede continued rallies.

According to Santiment, the average investment age for XRP is 865 days (22% younger in 14 weeks). Therefore, activity on the XRP network is increasing, and historically similar patterns do not reverse until these key indicators begin to reverse.

Related reading

“This is one of the key indicators throughout the history of each coin’s lifespan that helps validate that a bull market can and should continue. Similarly, the bull markets of 2017 and 2021 did not stop until average asset ages began to “rise” (age) again. Although price volatility can still be expected in the short term, consider it a very valuable omen of confidence if the optimistic attitude about market prices in the medium and long term is maintained,” says Santiment.

#3 Whales buy the dip amid bullish technical setup

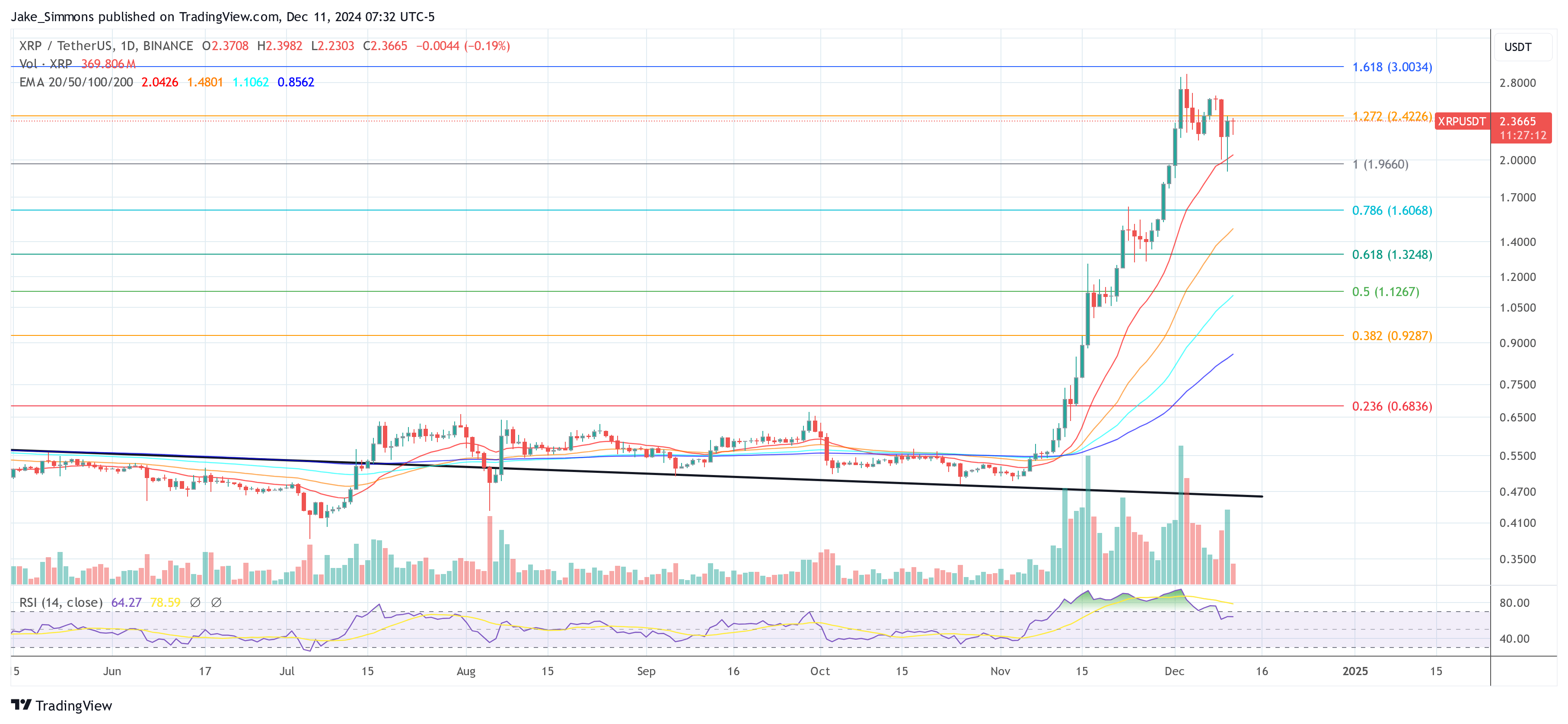

From a technical perspective, the XRP price structure remains extremely bullish on higher time frames. On the daily chart, XRP managed to hold support above the April 2021 high at $1.96, quickly bouncing towards the 1.272 Fib extension level near $2.42, where it currently holds. A sustained break above $2.42 could further reinforce the bullish narrative.

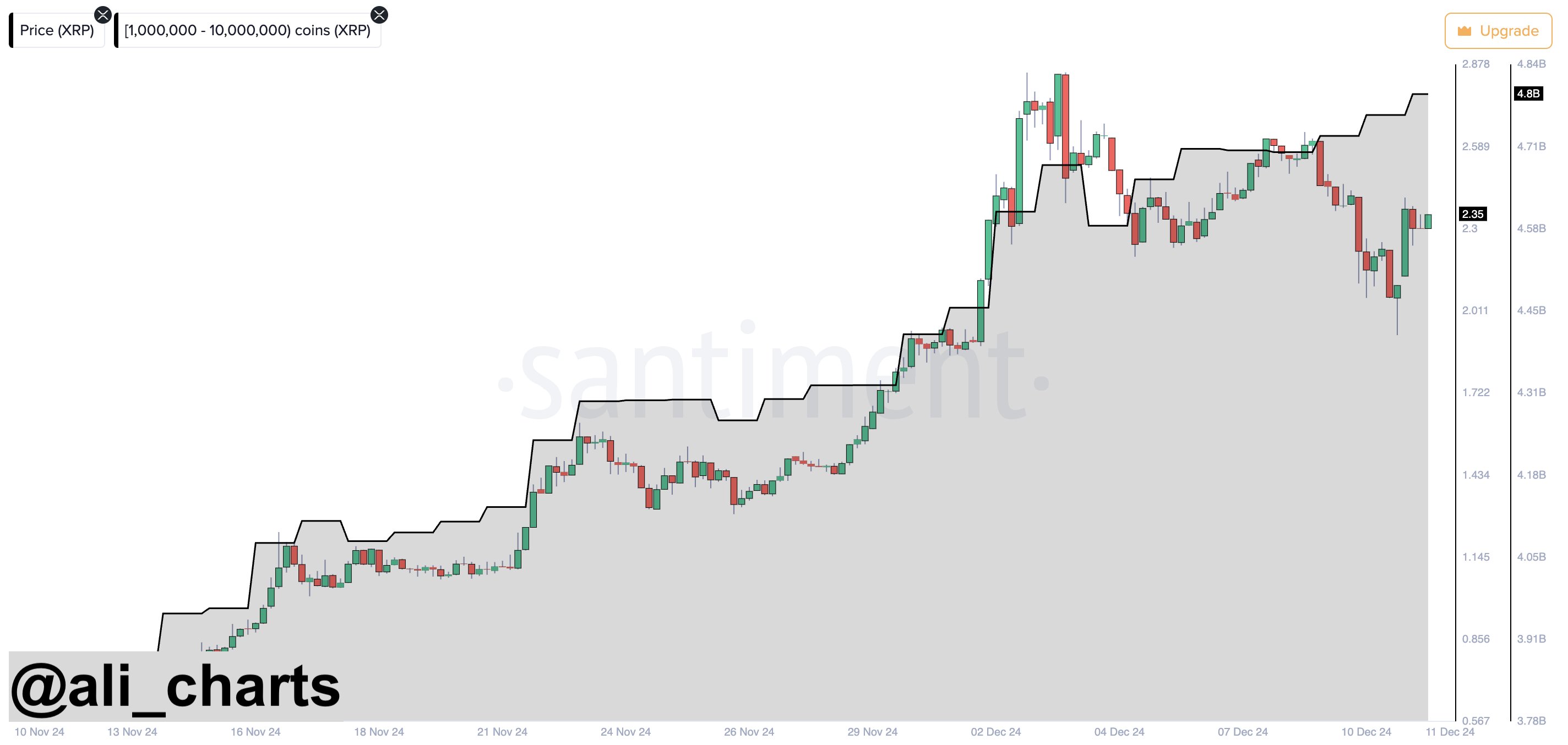

Notably, whales recognized the opportunity and bought the pullback. Cryptographic analyst Ali Martínez noted via X: “In the recent crash, whales bought over 100 million XRP!”

Featured image created with DALL.E, chart from TradingView.com