Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

The executive president of Coinroutes, Dave Weisberger, detonated a new round of anxiety in the XRP market on Monday when he asked, in the Podcast of Scott Melker, if Ripple Labs could finance an acquisition of a circle “for $ 10 to $ 20 billion” without loading approximately $ 10 billion in XRP. “Who will buy the value of XRP worth $ 10 billion that would have to sell their treasure?” Weisberger sayingwarning that a sudden increase in supply could overwhelm order books and “hammer the price.”

Is it a massive sale of XRP conceivable?

In a matter of hours, the pro-XRP lawyer, Fred Rispoli, replied to X. “I love @daveweisberger1, but at this point it is very hard,” he wrote, invoking the reputation of Bloomberg’s strategist Mike McGlone for the bearish hyperbole. “Simply based on what they offer me for my domain actions in the secondary market, I don’t think Ripple has to sell an XRP to buy a circle.” Rispoli agreed that Ripple cannot raise $ 10 billion in pure cash, but insisted that the company could “easily allow acquisition for a combination of cash and debt” and great capital success.

Related reading

When Weisberger replied that the Circle Board would probably demand hard dollars unless he accepted the heritage of Ripple or XRP “without a haircut,” Rispoli cavó. “There is no way to obtain $ 10b in cash, and $ 10b is too high anyway,” he wrote, citing the valuations of the private investigation of 2024 that placed Ripple for $ 15 billion that exclude its 36 billion XRP. If the circle price label fell to $ 7–9 billion, he said, Ripple could close with “$ 1–3 billion cash at hand, a heavy stock exchange and debt”, especially with “all that money from the CCG that slides around the cryptographic world at this time.” Rispoli admitted it that it would be “a scope” but “feasible without selling significantly XRP”.

Weisberger acknowledged mathematics: “That is a reasonable analysis,” he wrote, warned that any price at the upper end of Rispoli’s range “could be a short -term pain for XRP holders of us.”

The Ripple offer offer repurchase in January 2024 valued the company at $ 11.3 billion, revealing more than $ 1 billion in cash and approximately $ 25 billion in digital assets, mostly XRP, in its books. The company still controls approximately 52 billion XRP (approximately 40 percent of the offer), although 36 billion are found in the tank -warehouse liberations in guarantee, which limits immediate access. At the spot price of $ 2.20 today, the gas portion is worth a little less than $ 35 billion, but even moving a fraction would quickly collide with the depth of the thin place, a point of Weisberger Hammered Home.

Related reading

Ripple’s cash battery was also reduced after purchase of $ 1.25 billion of Prime Broker Hidden Road in April, an agreement resolved with a mixture of cash, capital and Rlusd Stablecoins. This acquisition suggests that the company prefers hybrid structures, reinforcing Rispoli’s statement that the XRP Treasury does not need to flood the market.

Is Circle even for sale?

The debate can be academic. Circle, a USDC issuer, has repeatedly declared it “not for sale” while marching towards a list of New York values that is now aimed at an assessment of $ 7.2 billion. Ripple’s rumored approach at the beginning of this spring exceeded $ 5 billion, well below the Weisberger stress case and within the “feasible” band of Rispoli, but Circle rejected the conversations and updated its S-1 two weeks later, expanding the float instead of looking for a buyer.

Strategically, Ripple already walks his own RLUSD in dollars, launched in January and positioned by President Mónica a lot as “complementary to XRP, not a competitor.” The absorption of the USDC emitter would be triggered instantly towards the size of the belt.

Even under Rispoli’s optimistic structure, Ripple may still need to liquidate the XRP of several hundred millions of dollars for working capital and closing costs. In current volumes, download only 500 million XRP (≈ $ 1.1 billion) would be equivalent to half a week of global billing, enough to distort the price unless it is executed as private blocks.

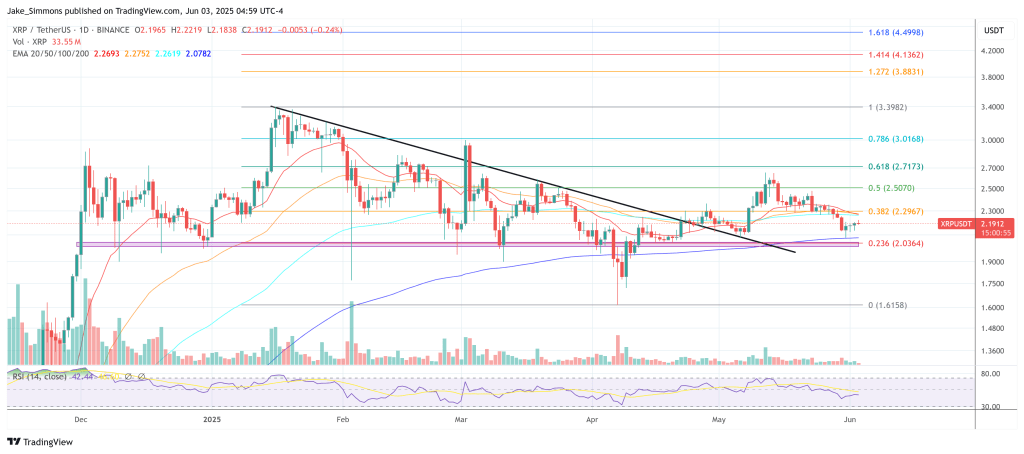

At the time of publication, XRP quoted at $ 2.19.

Outstanding image created with Dall.E, Record of TrainingView.com